To investors,

Will Clemente breaks down the volatility from this week using on-chain metrics to separate the signal from the noise. You can follow Will on Twitter or sign up for his email by clicking here. Here is Will’s analysis:

Key takeaways for this week:

BTC is still rangebound between 32K-40K

Exchange flows have plateaued, no real directional trend

Stablecoins are waiting on the sideline

The perp traders that didn’t get wrecked over the last few weeks are waiting on the sideline (futures open interest and number of futures contracts is flat)

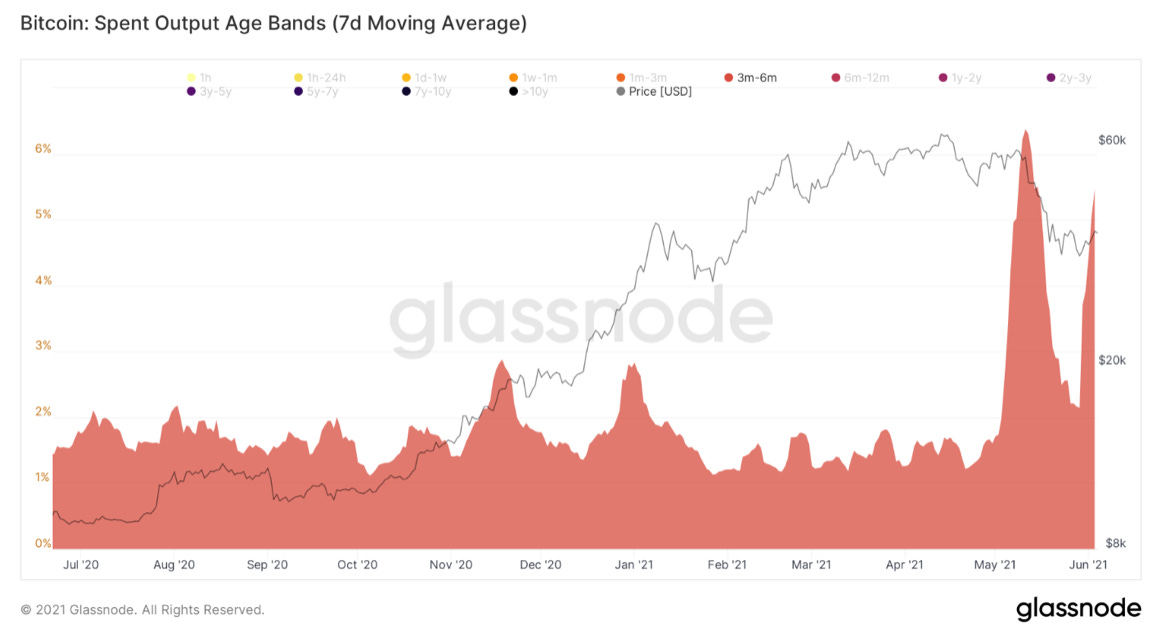

Selling is still mostly being done by younger coins

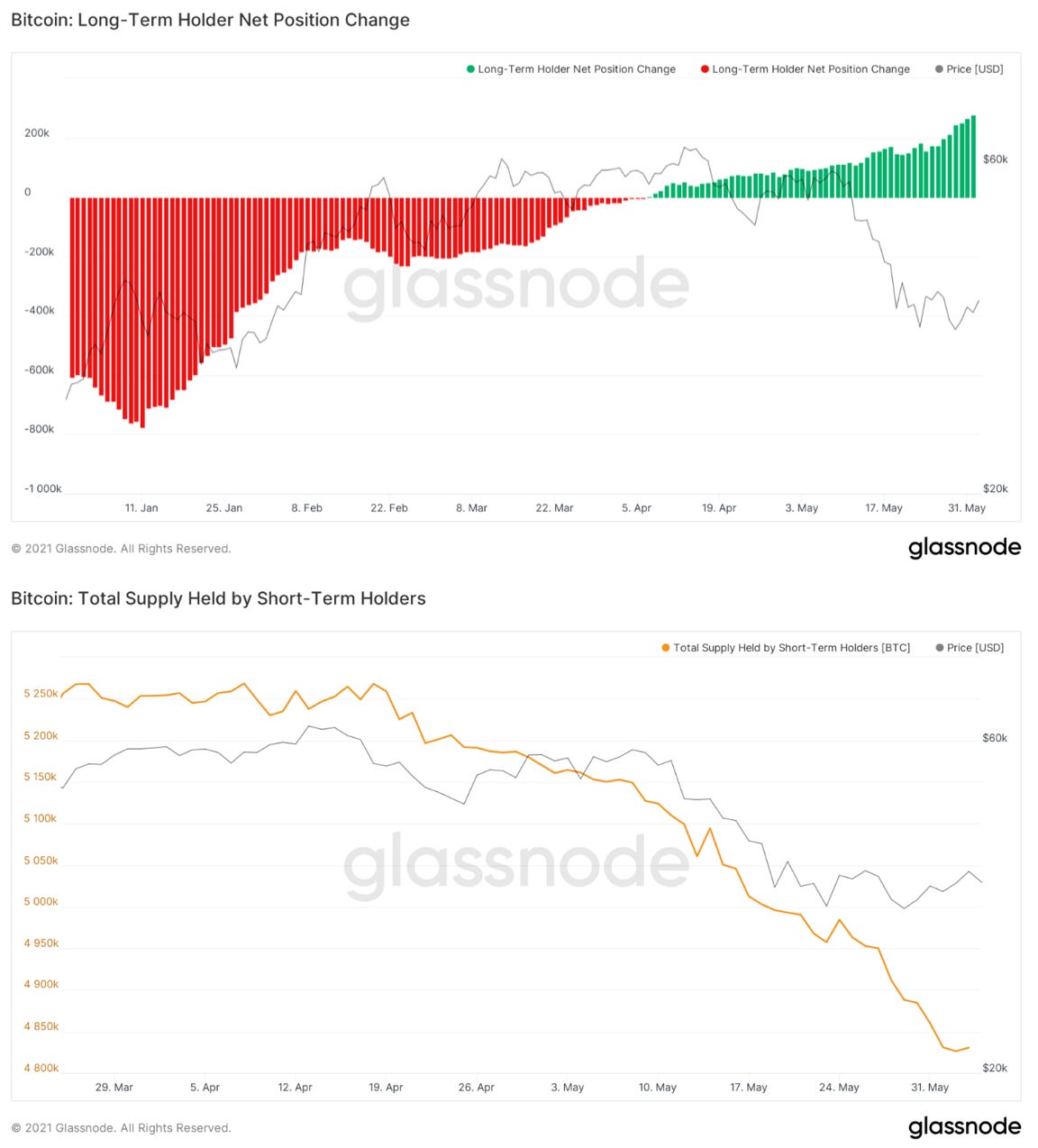

Long term holders still adding, offsetting selling from short-term holders over the last week

Retail buying heavily (possibly attracted by lower prices)

Bitcoin remains undervalued compared to the capital flows on-chain

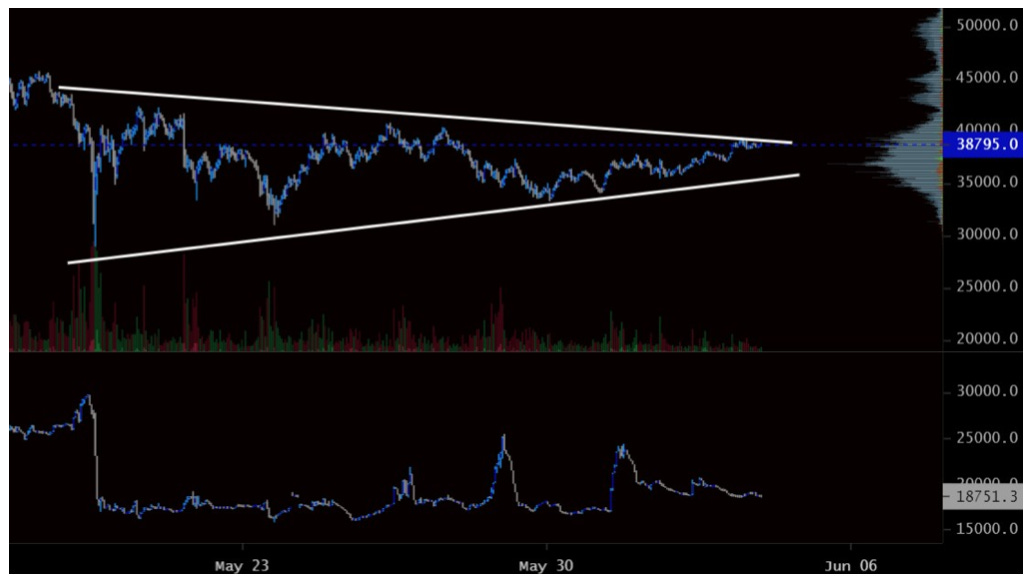

Hope all is well. At the time of writing, Bitcoin is still consolidating in the upper bound of a range between $32,000 and $40,000. Until price makes a decisive move in either direction, there is a lot of capital on the sidelines waiting to be deployed once the market decides. There are a lot of bids beneath us, set at $33,000 and below. In addition, there are a lot of sell orders around $40,000 and above. To break out of the range, high volume will be needed to fill those order walls. After consolidating this long, I would expect a strong move in either direction once price has that break out of this range. Until then, we are in no man’s land.

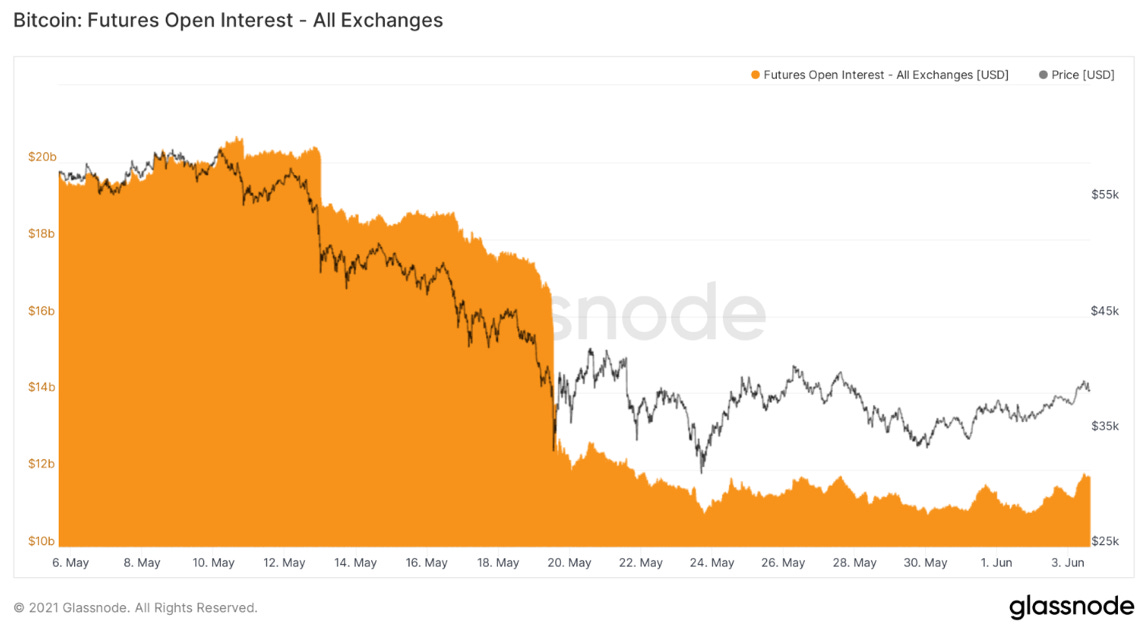

In the bottom half of the chart above, you can see the number of futures contracts has been flat. Also, in the chart below you can see that futures open interest is flat. To me, this suggests the futures traders that didn’t get rekt in the drop to $30K got spooked and now are waiting for confirmation out of this range before taking a directional position.

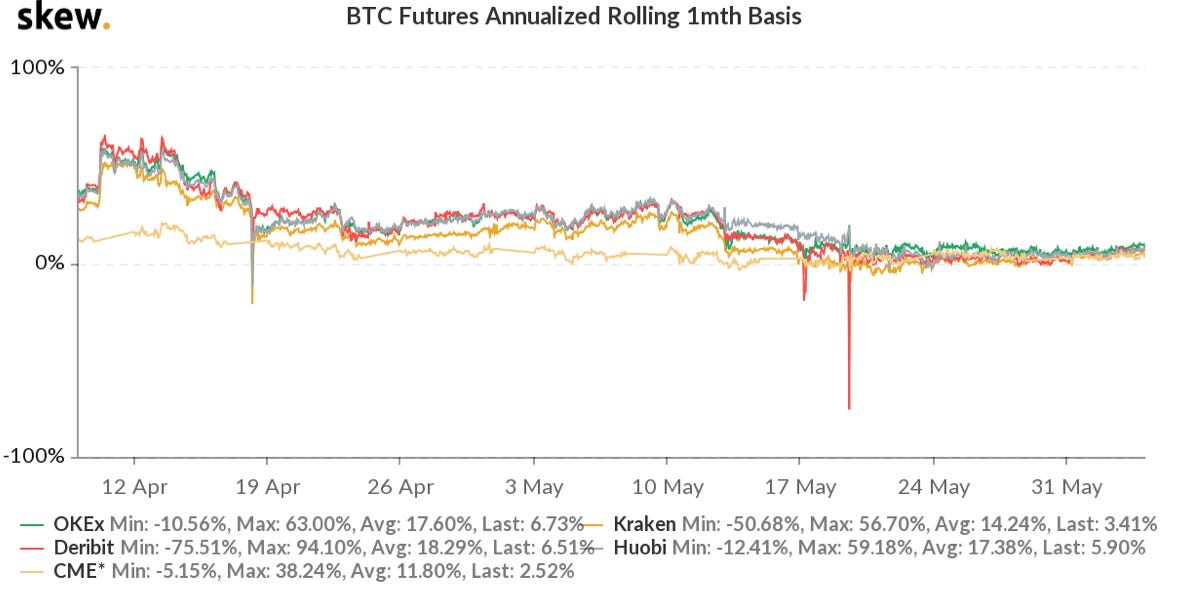

The annualized spreads between spot and 1-month futures contracts are flat as well. This comes after these spreads reached above 50% annualized in early April. I think this also visualizes how the amount of leverage on these different exchanges correlates to the spot/futures spreads. Notice that CME (the bottom line) is significantly lower than others up until mid to late May when we saw leverage get wiped out from the other platforms listed.

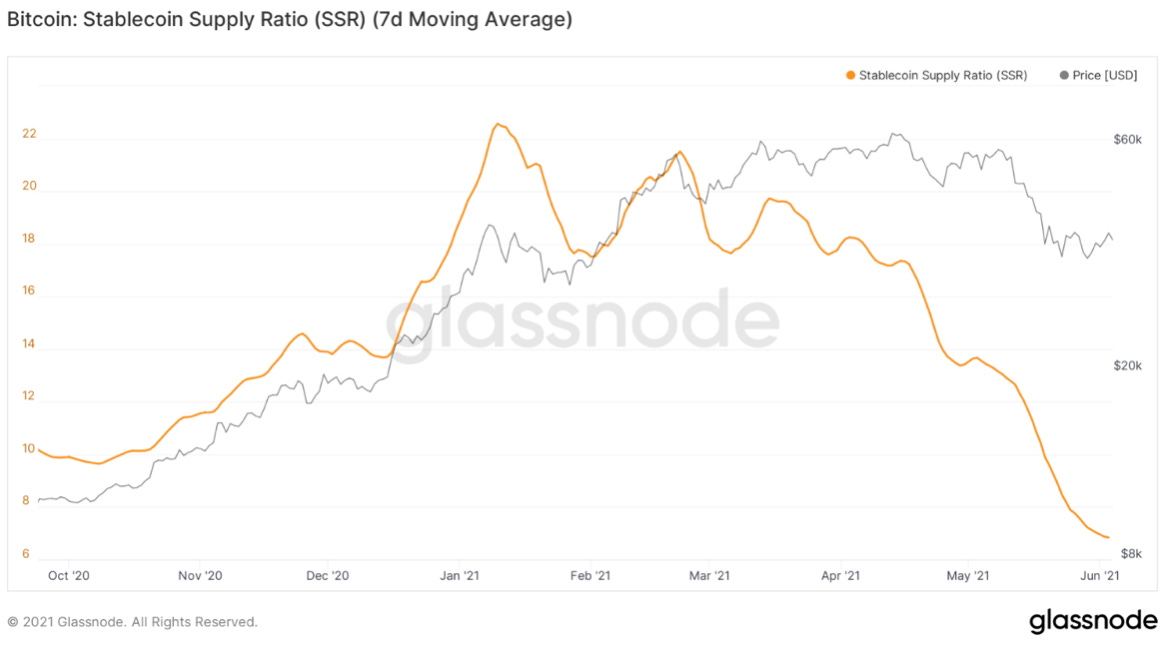

There is also a lot of dry powder in the form of stable coins on the sideline waiting to be deployed. This can be shown by the stablecoin supply ratio. When the stablecoin market cap grows in relation to Bitcoin market cap, the ratio goes down. Some of this decline has to do with Bitcoin’s market cap going down as well.

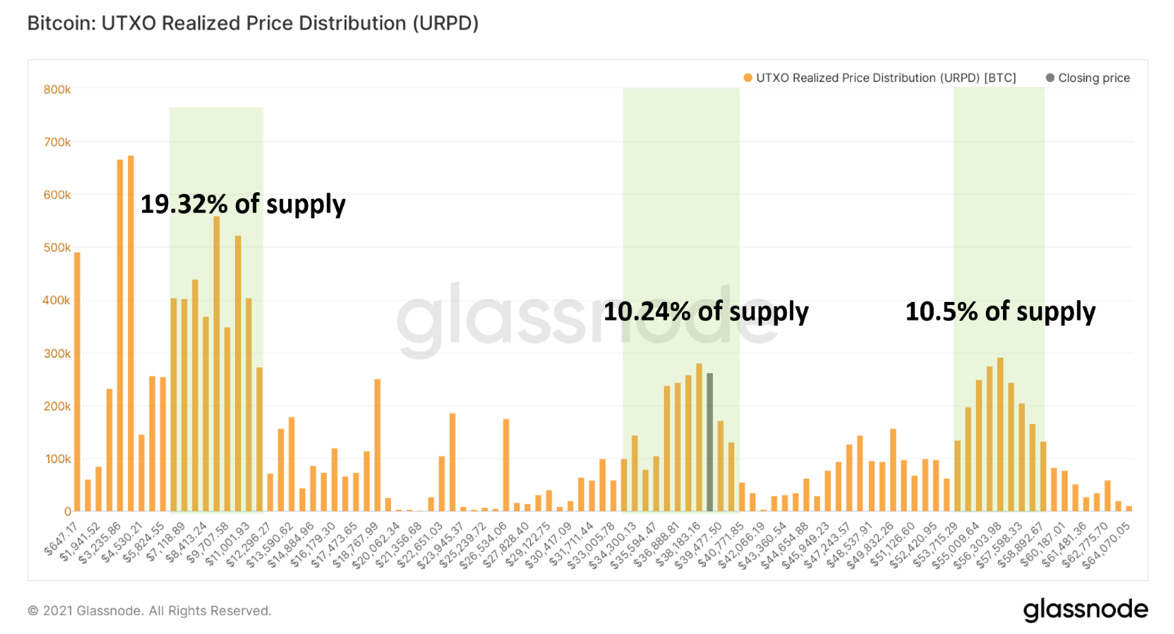

With that being said, whenever the move comes, it will likely be large. Until then, we keep trading between $32K-$40K. All that trading volume is adding up. We have now formed the third largest cluster of on-chain volume this bull run, only behind the one we’ve talked about often between $53,000 and $59,000, and between $7K-$11K. This is one of the reasons I had been bullish prior to the crash, as strong volume zones have historically formed a base of capital for the remainder of the bull market. Of course, that 10.5% in supply of volume is going to serve as a resistance on the way back up. Over 10 percent of Bitcoin’s money supply has now moved between $33,000 and $40,000. However, if we lose the low 30Ks, we do not have much distribution below aside from some at 27K, 23K, and of course 20K.

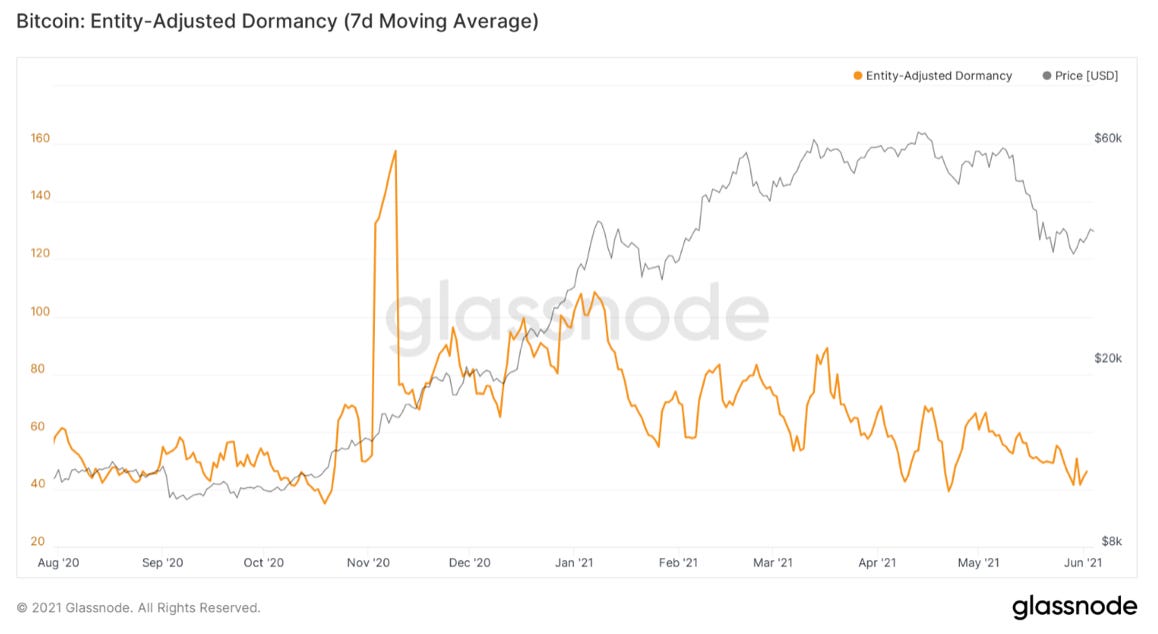

One interesting trend to note: another spike in selling from coins aged 3-6 months old. These entities would have bought back between December and March. There is another spike in selling from 1–3-month-old coins as well.

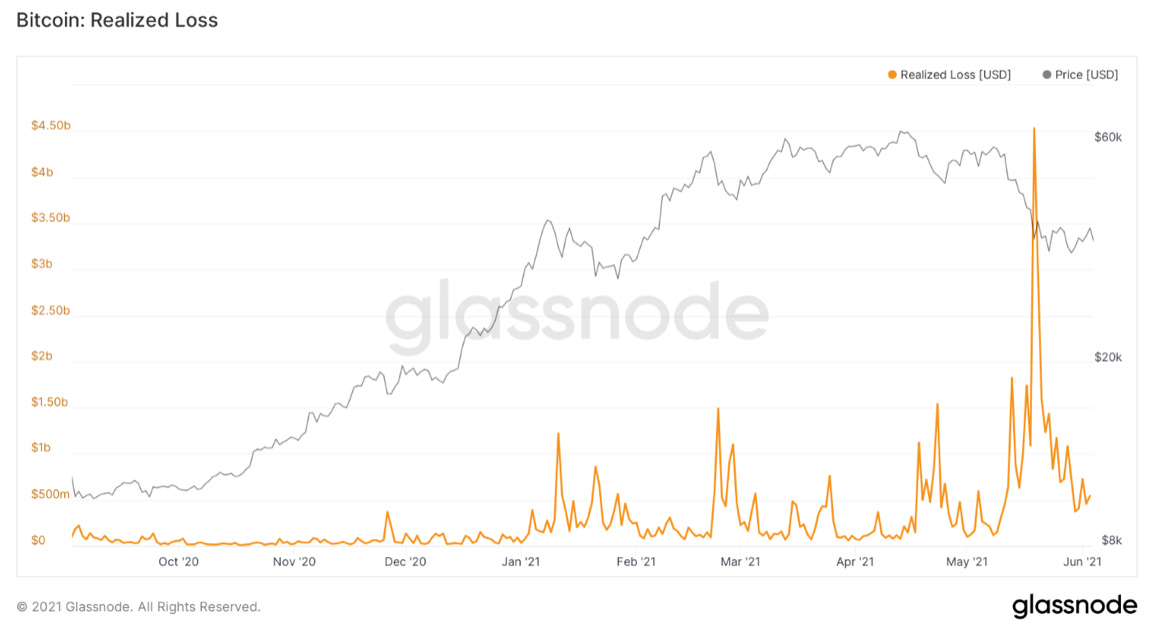

Coins are still being sold at a loss, although realized losses are trending down following the big price dump. Even yesterday (Thursday) over $540M of losses were realized by the market. Bitcoin has an uphill battle because there is fair portion of supply bought overhead in the consolidation between $50K-60K. Some of these buyers will be looking to minimize their losses realized by selling on what they believe is a complacency bounce on the way up. It will probably take some more time for these coins to be accumulated, but we’re on the right track.

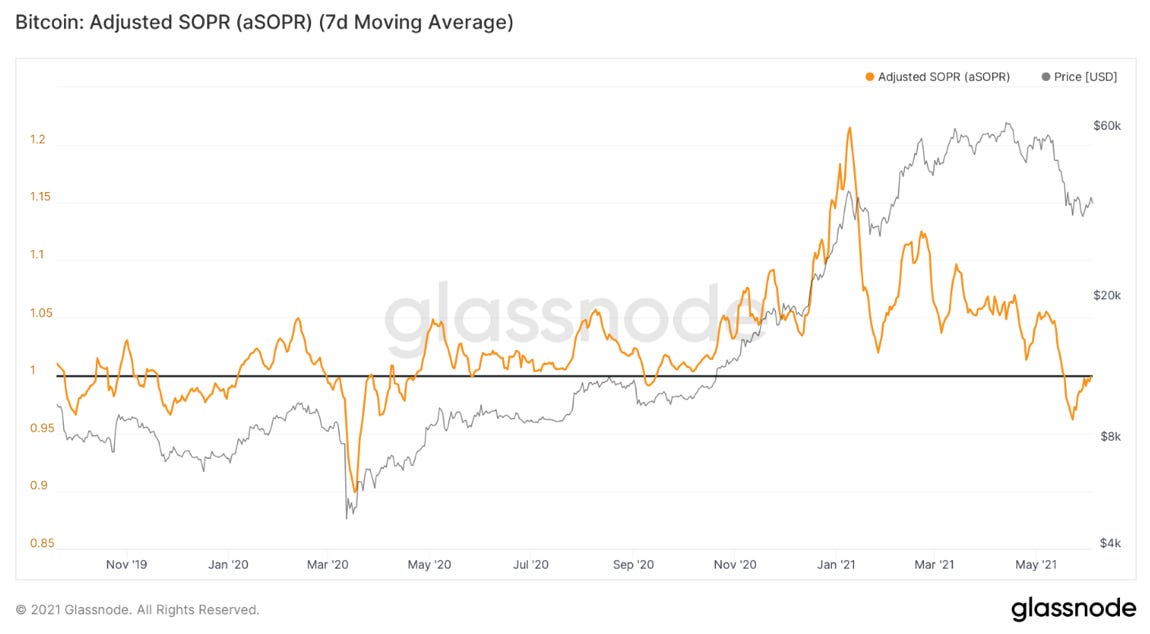

Similarly, SOPR on a weekly timeframe, (which we’ve described in multiple newsletters now), is on the threshold of the market selling at a profit or loss.

Long-term holders continue to add to their holdings, +158,641 over the last week. They’ve added +305,305 BTC to their holdings over the last month now.

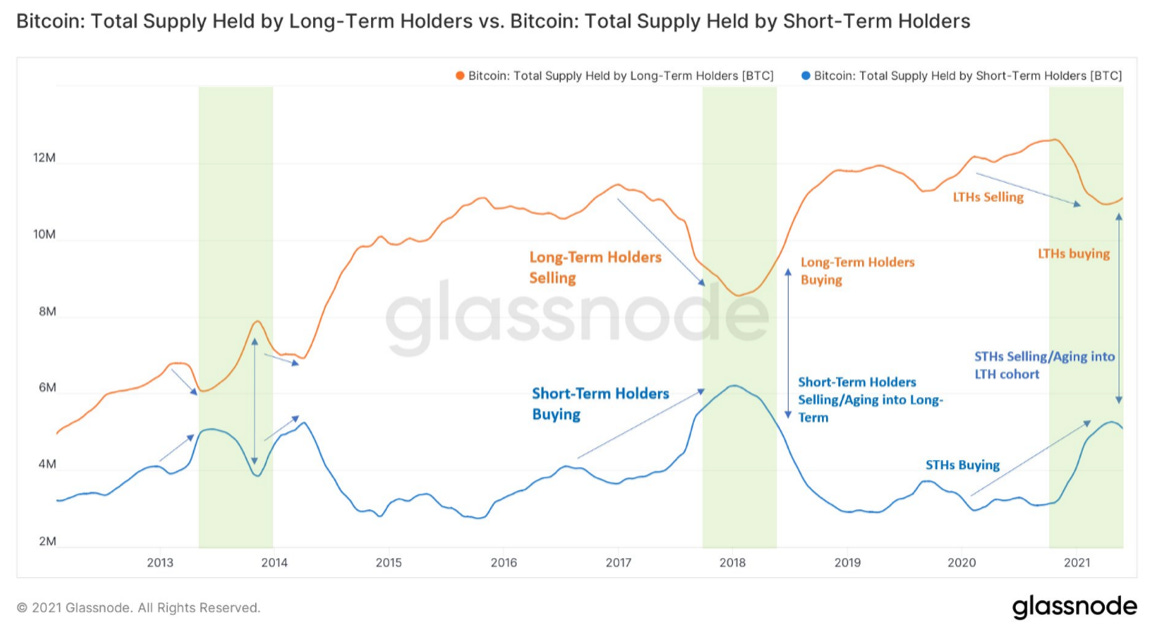

Zooming out you get this divergence between the two (short and long term holders). Based on historical behavior of these cohorts, we are either headed into a full-fledged bear market or are in a “mini bear market” similar to the consolidation between the two double pumps (but still in a broader bull market). At that time there was a similar phenomenon of long-term holders stepping in and doing the heavy lifting while short-term holders panic sold. Based on metrics looking at the broader cycle, I tend to side more with the latter, but I could be wrong.

In conclusion, we remain in limbo for the time being. Waiting for a decisive move with volume to break us out of this 32K-40K range. For the bulls: looking for a jolt in new whales to help do some of the heavy lifting. Want to keep seeing long-term holders offset selling from those short-term holders, many of whom are selling at a loss. For the bears: Still no real price momentum, market is still selling at a loss and is fragile (Elon moved the market again with a tweet last night), downtrend in whales still continues while retail buying heavily.

Looking forward to talking with you guys tomorrow on Pomp’s pod. Have a great weekend and for anyone in Miami, have fun. Cheers!

That is it for today’s analysis. Hopefully you found this helpful. I highly suggest you subscribe to Will Clemente’s email where he breaks down on-chain metrics multiple times per week: Click here

This installment of The Pomp Letter is free for everyone. I send this email to our investors daily. If you would also like to receive it every morning, join the 180,000 other investors today.

You’re on the free list for The Pomp Letter. For the full experience, become a paying subscriber.