| | | Good afternoon. Yesterday marked 15 years since Satoshi Nakimoto, sent the "Bitcoin P2P e-cash Paper" to a email list of cryptographers, kickstarting what would become a trillion dollar industry. | Happy birthday bitcoin. | Today’s Big Story:

🔑 Halve you forgot? | Today's newsletter is 760 words, a 3-minute read. |

| |

| | |

|

SPONSORED

The Next Generation Of The Internet Is Here | Savvy investors have always made the most money by investing early, in market trends, and in companies with critical IP in those markets. | Utherverse is a metaverse and software development company that hits all of these points. Since its inception, the company has: | Generated more than $77 million in revenues through memberships, marketplaces, advertising and other metaverse-related revenue streams. Had more than 80 patents issued for the company's technology. Franchised their previous Metaverse Platform iteration across 17 countries. Boasts over 18 years of experience in managing Metaverse environments.

| Utherverse has spent more than $40 million in development of its Metaverse offerings. And now, investors can claim their piece of the company for as little as $100. | |

|

|

|

We Are Only Six Months Away From One of the Most Important Moments in Bitcoin |

While we celebrate bitcoin’s 15th birthday, there is another significant event just on the horizon. It’s an event that happens only once every four years and every time significantly impacts the price of bitcoin. |

We are of course talking about the bitcoin halving which will take place on ~April 24, 2024 – less than 6 months from now. |

A quick reminder on the halving: |

The bitcoin halving is a mechanism that Satoshi Nakimoto setup in order to slowly bring bitcoin’s total supply to a halt, thus leaving the total supply capped at 21 million. This key feature is what separates bitcoin from every other form of fiat money – the inability to be “printed” or artificially created. |

Compare this to the current worldwide fiat system where currencies like the US Dollar or the Euro have printed trillions of dollars since Covid. |

But while the current fiat money supply inflates more and more every day, bitcoin’s inflation rate is about to drop from ~1.8% to ~.8%, as it trends down to eventually 0%. |

This is the power of Satoshi’s bitcoin and why the halving is so important. |

The Halving Is Not Priced In |

Taking a closer look we can see exactly how the halving drives scarcity. |

With the halving poised to occur, we are on the brink of a significant reduction in Bitcoin's annual issuance rate – a drop from 328,000 to 164,000 BTC. This decrease in supply arrives amid a landscape where the demand for Bitcoin is not just stable but arguably on an upward trajectory. |

The result? An exacerbated imbalance between supply and demand. The reduction in supply is guaranteed – slashed by half in an instant – but, again, there's no corresponding expectation for a reduction in demand. |

According to Glassnode, there are approximately 4.5 million addresses that have greater than .1 bitcoin (~$3,500 worth at today’s prices). That means that less than .05% of the world’s population have any real, meaningful exposure to bitcoin. [Yes, these are rough numbers and you could argue that purchasing power parity in other countries sways how important .1 btc is, but we are just loosely discussing this here.] |

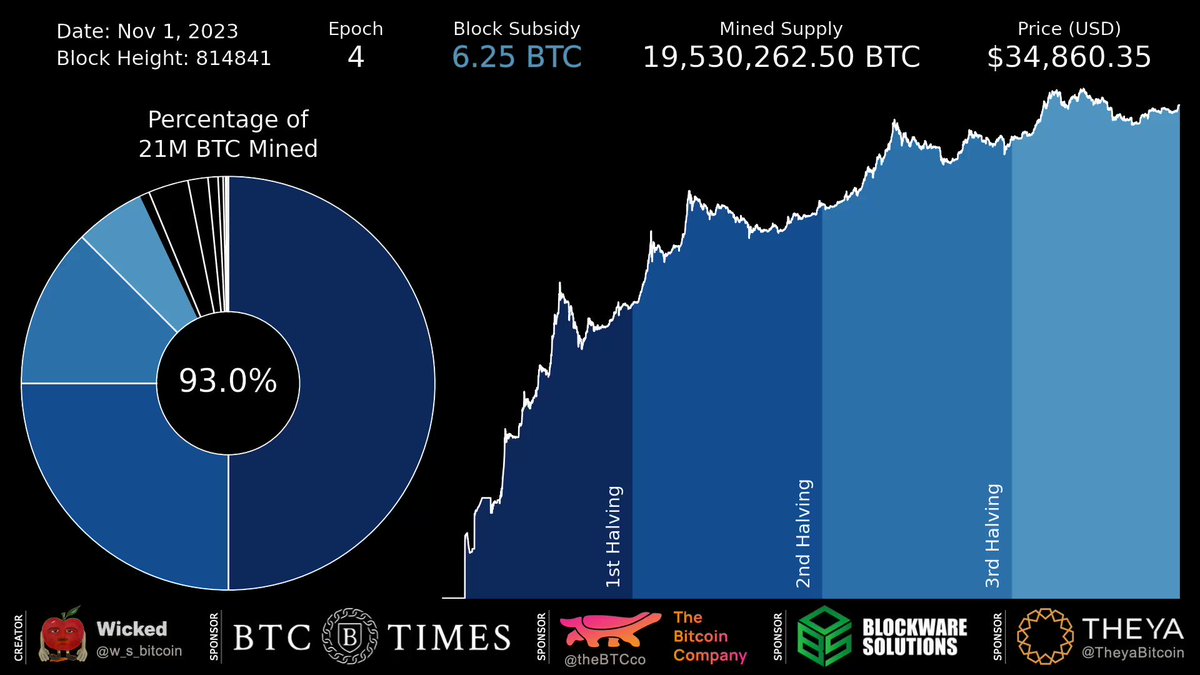

Think about that for a second. Less than 1% of the world population has any real exposure to bitcoin… yet 93% of all bitcoin that will ever be issued has already been issued. And as the world economy is getting less secure and money printers are in overdrive, millions of people around the world are looking to opt out of the fiat system. |

So is the halving priced in? We’d say no. |

A Walk Back In History |

As we celebrate bitcoin's 15th birthday it is worth remembering what caused bitcoin to start in the first place – bank bailouts. |

In the bitcoin Genesis block, Satoshi encoded a message that stated: “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks”. |

Meanwhile, here we are sitting in 2023 and bank bailouts are once again looking more and more likely to be on the horizon. |

|

SVB and First Republic might have only been the start. |

| Porter Stansberry @porterstansb |  |

| Losses in $BAC $760B bond portfolio rose by $25B (24%) in the quarter to $131.6 billion. These losses dwarf the bank’s $7.8B in quarterly earnings and represent an existential threat to the bank — but are not counted against earnings or reg capital. | | | Oct 17, 2023 | | |  | | | 336 Likes 61 Retweets 36 Replies |

|

|

Have You Already Missed Out? |

As of today, all eyes are on a spot BTC ETF approval – and for good reason. It is expected to boost bitcoin demand significantly from an institutional standpoint. |

Yet, amidst these discussions, the profound impact of the halving on Bitcoin’s scarcity and value seem to be significantly overlooked. |

We didn’t want to wait to discuss the halving until a few days prior to it happening. |

Now is the time to research, learn, and take a deep hard look at your portfolio and decide whether or not it is prepared for what is to come. |

|

Tweet Of The Week |

| Wicked @w_s_bitcoin |  |

| We’ve officially mined 93% of the 21m #bitcoin. Only 7% left. |  | | | Nov 1, 2023 | | |  | | | 725 Likes 186 Retweets 14 Replies |

|

|

|

SPONSORED

Master ChatGPT & AI Hacks for Free to become successful investor and make better decisions | 🚀Join this 3-hour power-packed workshop by Growthschool to achieve peak efficiency and 10x your output at work | (It is a paid workshop worth $99 but it’s Free for the First 100 readers) | 👉Click here to register (Free for First 100) 🎁 | In this workshop, you will learn how to: | 📘Optimize risk management in investment & operational efficiency | 📘Analyze the market to time your investment | 📘Leverage AI for problem-solving and strategic decision-making | 👉Click here to register (Limited seats: Free for First 100 people only) 🎁 |

|

|

|

Other Content You Might Enjoy |

The great bitcoin decoupling Use LastPass? Own Crypto? You could lose everything if you don't act fast Gaming tokens GALA, Axie Infinity, and ApeCoin post huge gains Bitcoin rally cools, but Solana, Pepe, and XRP all jump in price Bitcoin options open interest hits ATH; CME becomes second-largest Bitcoin futures exchange Kraken notifying customers it will send their data to the IRS this Nov. Bitcoin's page on Wikipedia sees highest views since June 2022 amid ongoing rally Bitcoin surges to ATHs in Turkey and Nigeria ‘Buy Bitcoin’ search queries on Google surge 826% in the UK UK bill for seizing illicit crypto finally becomes law Hyperbullish research note from Galaxy: Bitcoin spot ETFs could see inflows of $14.4B in first year Bitcoin funds gain $57 million in fresh cash amid ETF mania U.S. SEC messed up in handling contentious crypto accounting bulletin

|

|

How did you like today's email? |

|

|

About Coinsnacks |

Launched in December 2017, CoinSnacks is home to the longest continuously running crypto newsletter. Each week, we publish our cryptoasset musings to an audience of ~30,000 crypto enthusiasts and investors. |

In a space flooded with new projects, research, and narratives, the average investor may feel overwhelmed or confused. CoinSnacks offers a solution by doing the digging for you, so you don't have to spend hundreds of hours sifting through the noise. |

|

Reach Our Audience |

If you’re a brand interested in partnering with CoinSnacks to find your next customers, partner, or ally, we’d love to hear from you. Learn more here. |

|

JOIN OUR OTHER PUBLICATIONS |

| Stocks & Income Stocks and income investing. | | Subscribe |

|

| Gold Playbook All your gold investing news in a single daily email. | | Subscribe |

|

|