To investors,

Bitcoin’s on-chain distribution continues to become more decentralized over time. We can explicitly prove this claim by looking at the on-chain metrics, which offer unique insight into the amount of bitcoin that is held by each individual bitcoin address.

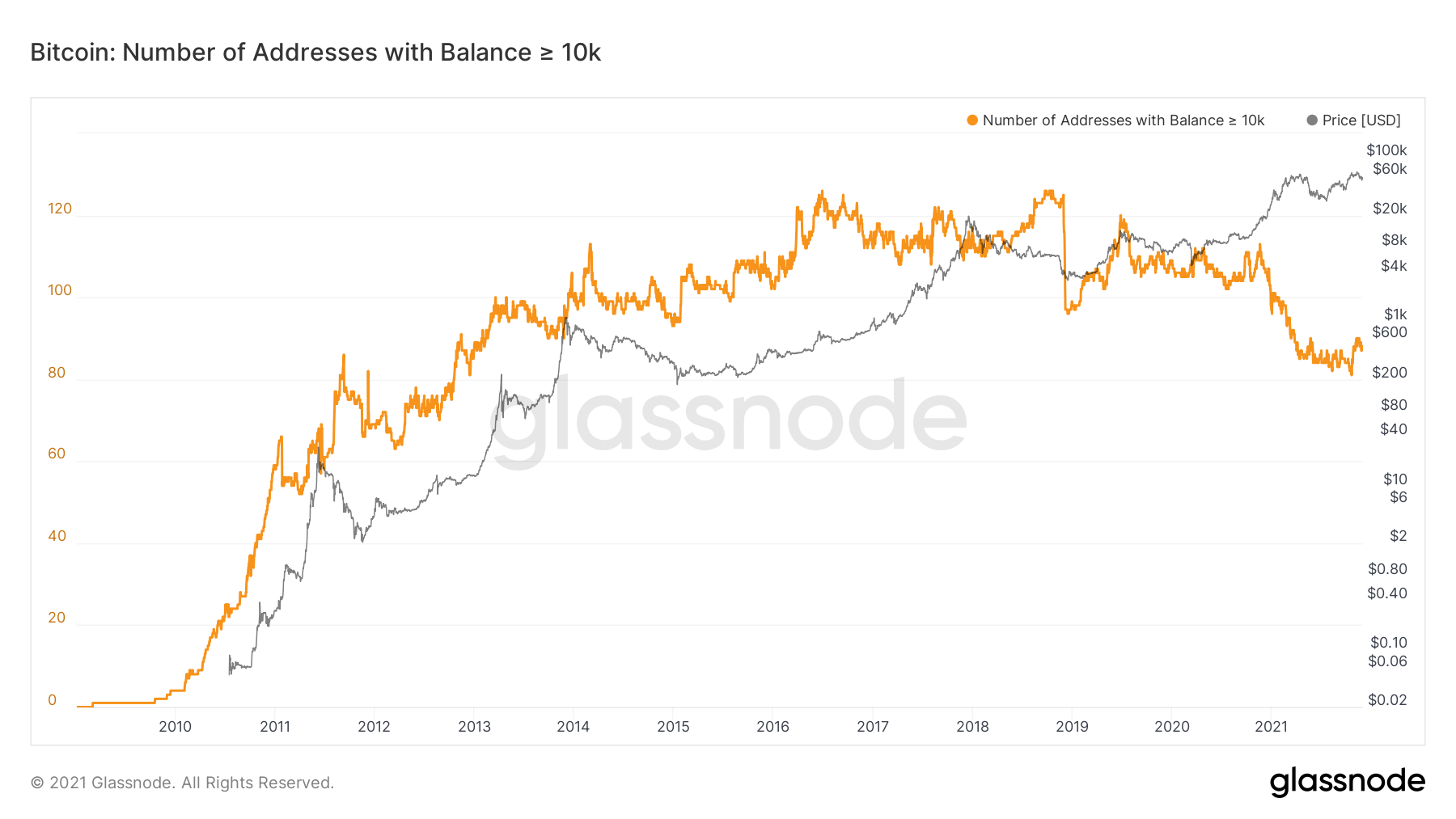

First, let’s take a look at the largest holders of bitcoin on-chain. We can see that the number of bitcoin addresses with at least 10,000 bitcoin in their balance peaked in October 2018. Bitcoin's price was ~ $6,500 and we were about to get the final puke down in price of the 2018 bear market.

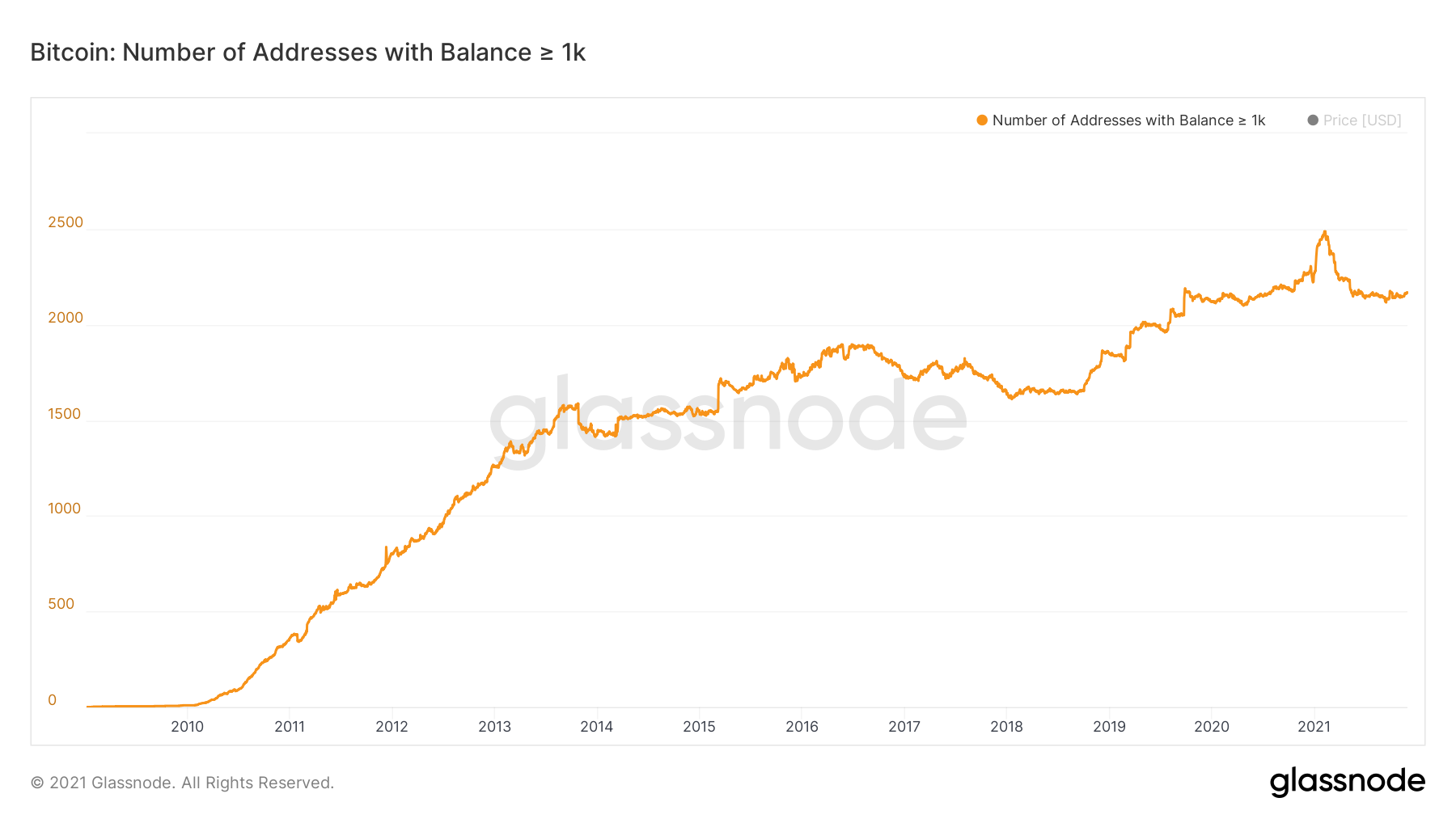

If we look at an order of magnitude smaller, the number of bitcoin addresses with a balance of 1,000 bitcoin or more peaked in February of 2021. There are currently about 2,100 bitcoin addresses that hold 1,000 bitcoin or more, which is very similar to where we were throughout most of 2020.

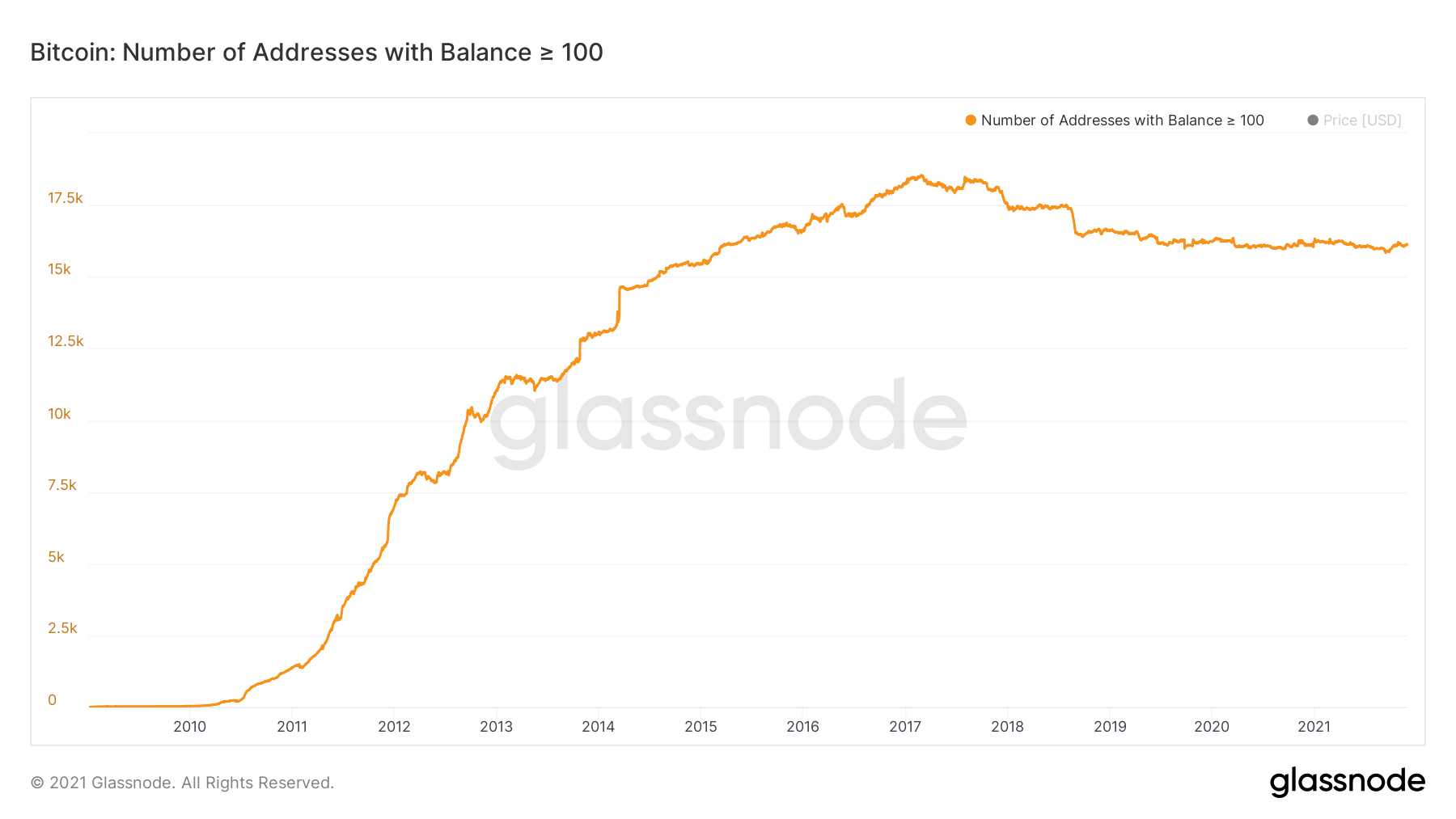

Now let’s take a look at bitcoin addresses with a balance of 100 bitcoin or more. The all-time high for that measurement peaked in February 2017, which was before the craziness of the 2017 bull market. At the time, there were about 18,500 bitcoin addresses that met the criteria, but today we have only approximately 16,100 bitcoin addresses with 100 bitcoin or more.

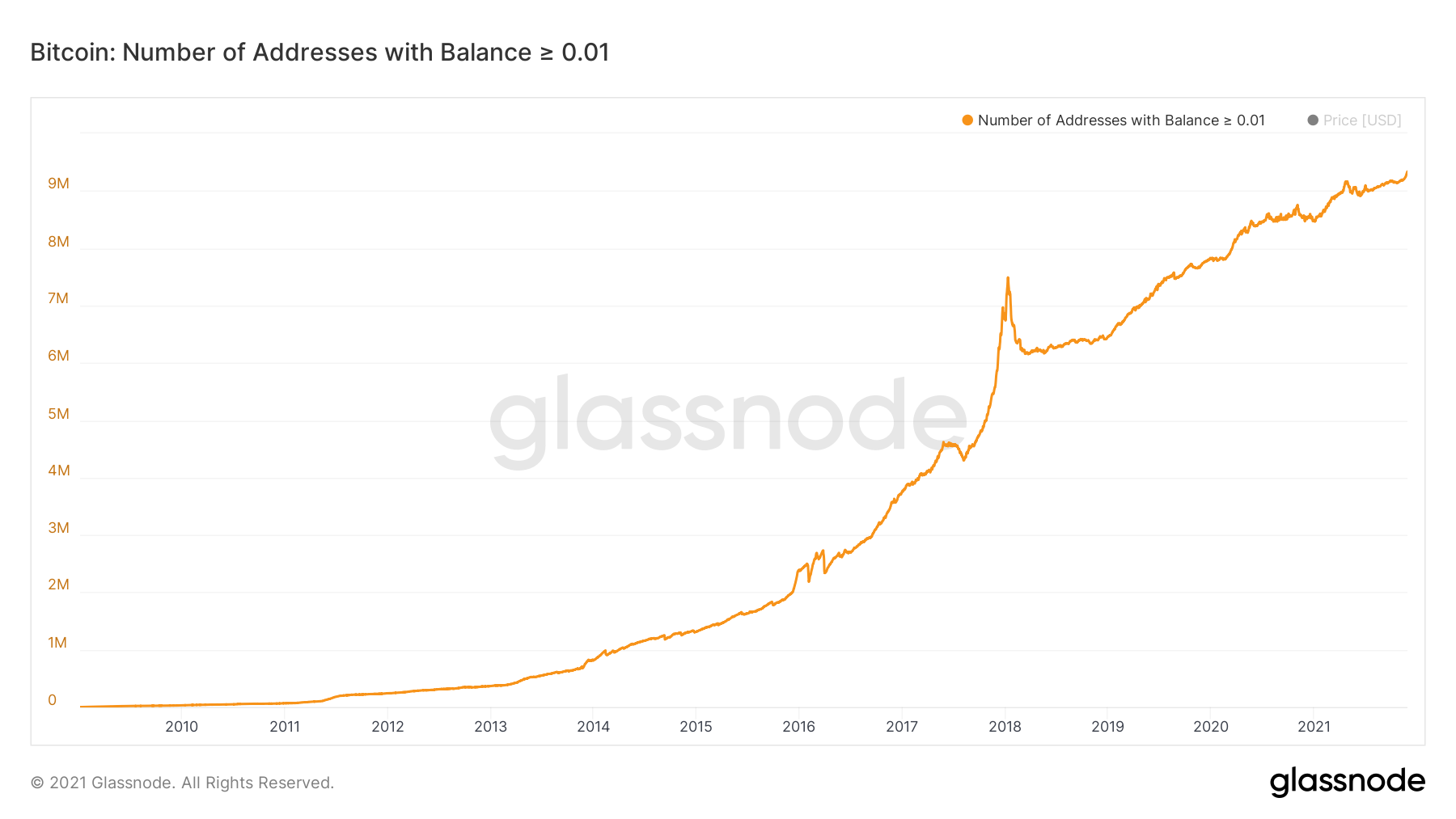

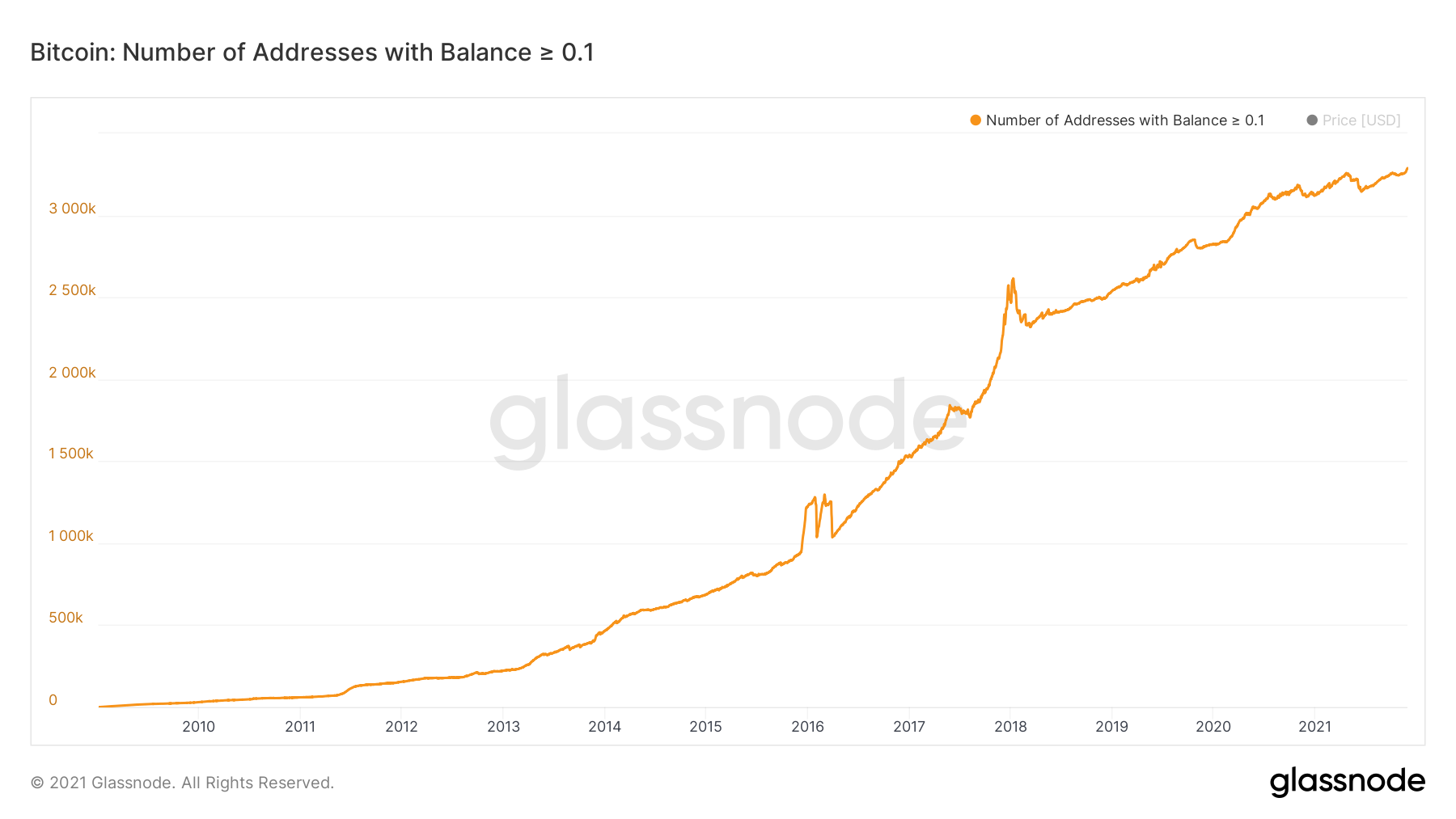

But here is what is really interesting — bitcoin addresses with at least 0.01 bitcoin or 0.1 bitcoin in their balance have continued to hit all-time highs. Today, there has never been more bitcoin addresses on-chain in the 12 year history that hold these smaller amounts of bitcoin.

Here is the 0.01 bitcoin balance chart, which shows more than 9.33 million bitcoin addresses:

Here is the 0.1 bitcoin balance chart, which shows more than 3.28 million bitcoin addresses:

These distribution charts are noteworthy because they highlight a very important part of the bitcoin story. As time goes on, the digital store of value continues to become more decentralized. This increase in decentralized ownership is not only a positive security feature, but it also means that the benefits of economic empowerment that bitcoin presents will eventually be enjoyed by more people globally.

You can think of the distribution of bitcoin holders as one piece of a three-legged stool. Bitcoin miners continue to get more decentralized over time and we continue to see more bitcoin node operators popping up around the world. This symbiotic relationship between holders, miners, and node operators allows bitcoin to gain strength, while continuing to run effectively without a CEO or centralized control.

Bitcoin’s design is beautiful and things are playing out exactly how they were intended. The electronic peer-to-peer cash system is evolving into a fully decentralized, digital store of value that can’t be debased, censored, or manipulated.

Hope each of you has a great start to your week. I’ll talk to everyone tomorrow.

-Pomp

GET HIRED IN CRYPTO: Are you looking for a job in the bitcoin and crypto industry, but don’t feel like you understand the nuances of the industry well enough to be hired? We have a training program aimed at helping people just like you.

The 3 week intensive course was created with the help of the HR teams at top companies in the industry and has seen graduates get hired at Coinbase, Gemini, BlockFi, Kraken, Anchorage, Strike, BTC Inc, and many more.

Our next cohort starts November 30th. APPLY HERE: www.pompscryptocourse.com

SPONSORED: Gun.io is every fast-growing technology company’s secret weapon. With Gun.io, companies hire world-class developers in a fraction of the time.

Finding the right technical talent is hard, especially in this competitive hiring market. Gun.io gives you access to peer-vetted developers who you won’t find on job boards. We combine our industry-leading matching algorithm with human relationships and support to uncover the right developer for your team, fast.

The result? No stacks of resumes or endless interviews. Instead, you can have a conversation with the candidate our team of senior engineers believes is perfect for your role within days, not weeks.

Whether you’re growing your team, in need of short-term help, or making your first technical hire, meet the right candidate for the job on Gun.io.

THE RUNDOWN:

El Salvador Buys 100 More Bitcoins as Crypto Market Falls: The government of El Salvador bought 100 more bitcoin, President Bukele tweeted on Friday, while the price of the largest crypto currency by market-cap fell near $54,000. “El Salvador just bought the dip. 100 extra coins acquired with a discount,” Bukele said. Bitcoin price fell about 8% on Friday around $54,237, as broader markets tumble on new COVID-19 variant fear. Read more.

Crypto.com to Sponsor Latin America’s Leading Soccer Competition: After renaming the Staples Arena in a $700 million deal in November, Singapore-based crypto exchange Crypto.com will become an official partner of Latin America’s leading soccer competition, CONMEBOL Libertadores. Through an agreement with CONMEBOL, the governing body for soccer in South America, Crypto.com will serve as an official partner of CONMEBOL Libertadores from 2023 to 2026 and as a licensee of the competition’s official non-fungible tokens as of 2022, the company said in a statement Thursday, without disclosing further terms. Read more.

Japanese Consortium Plans to Issue Bank Deposit-Like Digital Yen by End of Next Year: A consortium of 74 Japanese firms is planning to issue a digital yen that will work similar to bank deposits by the end of 2022, the consortium’s secretariat, DeCurret, said in a white paper and a progress report published on Wednesday. To ensure the stability of the digital currency, the consortium, dubbed Digital Currency Forum, is proposing a model similar to how bank deposits work, according to the white paper. The digital yen will be issued by banks as their liability, the paper added. Read more.

Hackers Are Attacking Cloud Accounts to Mine Cryptocurrencies, Google Says: Hacked Google Cloud accounts were used by 86% of the “malicious actors” to mine crypto currencies, according to a new report. Of the 50 hacked Google Cloud Platforms or GCPs, 86% of them were used for cryptocurrency mining, which typically consumes large amounts of computing resources and storage space, Google’s Cybersecurity Action Team wrote in the report. The remainder of the hacking activities included phishing scams and ransomware. Read more.

LISTEN TO THIS EPISODE OF THE POMP PODCAST HERE

Preston Pysh is a financial investor and host of the "We Study Billionaires" podcast.

In this conversation, we discuss negative yielding debt, increasing stress on pension plans, and how Bitcoin can solve recent macro economic problems.

LISTEN TO THIS EPISODE OF THE POMP PODCAST HERE

Podcast Sponsors

These companies make the podcast possible, so go check them out and thank them for their support!

Mode allows you to buy, earn and grow Bitcoin, all in one app. Not only is it an easy and safe way to buy and hold Bitcoin, Mode allows you to pay and receive up to 10% Bitcoin Cashback for FREE from its growing list of online partner brands. Download Mode today and enjoy 0% trading fees on all Bitcoin buys and sells until Dec 31, 2021. Only available in the UK.

Coin Cloud has been serving customers since 2014 and has established itself as the world's leading digital currency machine (DCM) operator. More than just a Bitcoin ATM, Coin Cloud machines make it easy to buy and sell Bitcoin and 30+ other digital assets with cash. To get your $50 in free Bitcoin, visit www.Coin.Cloud/Pomp

Compass Mining is the world's first online marketplace for bitcoin mining hardware and hosting. Compass was founded with the goal of making it easy for everyone to mine bitcoin. Visit compassmining.io to start mining bitcoin today!

Choice is rebuilding the way bitcoiners approach retirement by making it possible to invest in bitcoin and 19 other digital assets inside your IRA. Choice enables you to trade real bitcoin, other crypto, and stocks without having to pay a dime in capital gains. Join me and the 20,000 other bitcoiners who have started their tax-efficient stack, and open your Choice Account today. Search ‘stack sats’ in the app store or visit www.choiceapp.io/pomp

BlockFi provides financial products for crypto investors. Products include high-yield interest accounts, USD loans, and no fee trading. To start earning today visit: http://www.blockfi.com/Pomp

Gemini is a leading regulated cryptocurrency exchange, wallet, and custodian that makes it simple and secure to buy, sell, store, and earn bitcoin, ether, and over 40 other cryptocurrencies. Open a free account in under 3 minutes at gemini.com/pomp and get $20 of bitcoin after you trade $100 or more within 30 days.

CityCoins are programmable tokens that allow citizens to become stakeholders in their favourite cities. MiamiCoin was the first CityCoin launched and within it’s first two months it has already raised over $10 million USD in donations for the City of Miami. Join the CityCoins Discord to become part of the community, and help us build towards a crypto civilization.

Crypto.com allows you to buy, sell, store, earn, loan, and invest various cryptocurrencies in an user-friendly mobile app. Join over one million users today. You can download and earn $50 USD with my code “pomp” when you sign up for one of their metal cards today.

Circle Yield offers qualified businesses superior returns on USDC holdings for terms of up to 12 months. Managed by professional financial institutions, Circle Yield is the best way to earn returns on your USDC. Visit circle.com/pomp today; terms apply.

Nasdaq-listed BTCS was the first US-public company to secure today’s top layer one protocols. Recently, BTCS launched the beta version of its digital asset analytics dashboard! From across multiple exchanges, the BTCS Data Analytics Dashboard lets you evaluate your entire portfolio’s performance with plans to add year-end reports and yield earning on your crypto through linking to staking pools. Test out the BTCS Data Analytics Dashboard today at BTCS.com

LMAX Digital is the market-leading solution for institutional crypto trading & custodial services - offering clients a regulated, transparent and secure trading environment, together with the deepest pool of crypto liquidity. LMAX Digital is also a primary price discovery venue, streaming real-time market data to the industry’s leading analytics platforms. LMAX Digital - secure, liquid, trusted. Learn more at LMAXdigital.com/pomp

Okcoin is one of the most popular licensed exchanges. Okcoin is the first to bring new cryptos to market, offering some of the lowest fees in the industry, an easy to use app, and Earn feature! It’s easier than ever to sign up, buy and trade crypto in just 2 minutes on Okcoin with credit & debit cards or just link your bank account to the best new crypto assets. So get started, and go to okcoin.com/pomp

Matrixport is Asia’s fastest growing digital asset platform with $10 billion in assets under management and custody. It offers one-stop crypto financial solutions including fixed income, DeFi in 1-click, structured products, Cactus Custody™, spot OTC and lending. Go download the Matrixport App and enjoy a welcome offer of 30% APY on USDC for new users.

Ethernity.io is the world’s first authenticated and licensed NFT platform, trusted by over 150,000 members. Visit Ethernity.io, where you can buy and sell authenticated NFTs from top notable figures, rights, license, and IP holders you can’t find anywhere else; the start of an entire ecosystem bringing utility to #NFTs.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable.

Nothing in this email is intended to serve as financial advice. Do your own research.

You’re a free subscriber to The Pomp Letter. For the full experience, become a paid subscriber.