| | | Good afternoon. Yesterday, The United States v. SBF got its start in a New York courtroom. Opening arguments beginning today. | And while headlines so far are relatively meek, we wouldn’t be surprised if every anti-crypto publication (we’re looking at you NYT) has their most vitriolic journalists sharpening their pencils waiting for a bombshell statement to explain why “crypto is bad”. | But you, dear reader, are smarter than that. You know that the technology of crypto is divorced from the individual actors. | Bernie Madoff is not the stock market. OJ Simpson is not the NFL. And SBF is not crypto. | Today’s Big Story:

🤔 Bitcoin's steady pulse | Today’s free newsletter is brought to you by Wellcore – a pioneer in hormone optimization to help people re-discover the best versions of themselves and enjoy healthy, satisfying lifestyles that they deserve. | Today's newsletter is 713 words, a 3-minute read. |

| |

| | |

|

📌 MUST READS |

|

Sometimes you gotta take the small wins when you get them. And this month delivered one. |

On the heels of rising yields, equites have been in an absolute bloodbath. So much so that the Dow industrials had its worst day since March and is now officially in the red on the year. |

| Dow Jones Industrial Average YTD |

|

The S&P is holding up a bit better, but is still down more than 5% over the past month. |

| S&P 500 returns over the past month |

|

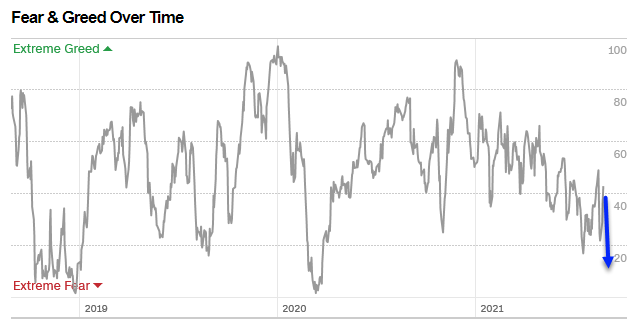

As a result, the market’s panic meter – as represented by the Fear & Greed Index – has been cranking. |

|

Now, the Fear & Greed Index isn’t anything to write home about. But we were inclined to look it up yesterday because we’re at that point where just about everything seems negative. |

Seriously, look at the mainstream financial press… Talk to your friends and family… Read the room… When was the last time overall economic sentiment was this bad? |

To no surprise, the index is currently screaming “extreme fear.” Yesterday, it fell to 17, just one tick above its most recent low of 16 last October. To put this into perspective, that’s only a few notches away from where the index was at when stocks were COVID crashing in March 2020. Pretty wild. |

| Jesse @Micro2Macr0 |  |

| Fear and Greed is at it's lowest levels since the March 2020 Pandemic drop. |  | | | Oct 3, 2023 | | |  | | | 144 Likes 14 Retweets 19 Replies |

|

|

This all goes to say that the cracks are beginning to surface as investors are coming to the realization that a higher-for-longer interest rate environment is more and more likely. |

Despite what the suits in Washington want you to believe, inflation has not been tamed yet. |

We're also witnessing escalating corporate and small business bankruptcies, stagnation in the housing market due to 8% mortgage rates, and a sharp increase in credit card defaults. Excess savings from the Covid era have vanished. Capitol Hill is in chaos. The Fed still continues to print money. And when you throw in an ongoing debt crisis, you can almost see the writing on the wall. |

You see, for the past year or so, the Fed has been desperately trying to cool down the economy. The intent was to curb demand, stabilize the job market, and suppress consumer spending, theoretically lowering prices. However, the US economy has defied expectations by displaying resilience, hinting at potential additional rate hikes. |

Now remember, all of this comes at a time when a material amount of US Treasuries are about to roll over. This means the Treasury will issue new debt at steeper rates, intensifying an already precarious situation. Further complicating matters is the imminent maturity wall confronting banks and corporations nationwide. |

It’s like if we raise rates… a debt crisis doom loop scenario slowly plays out. But if we don’t raise rates… inflation spirals out of control. |

So put it this way: The Fed has boxed itself in a corner and is running out of options to achieve a “soft landing.” |

To get to the point, though, all of this maelstrom has led to a selloff in bonds. It’s the big elephant in the room. |

It has shown us that people are getting less confident in the U.S. economy and are actively offloading U.S. debt as a result. |

| When the TLT (iShares 20+ Year Treasury Bond ETF) drops, it signifies that long-term interest rates are rising |

|

Zooming Out:

Remember the “small win” we mentioned? |

While stocks and treasuries have been falling over the last month, bitcoin is standing strong, up 5%. |

Call it what you want, but in the midst of the ongoing economic sh*tshow, bitcoin has held astonishingly steady. |

And while equities and treasuries are showing signs of “extreme fear,” bitcoin has been on a neutral island… |

|

In the past, we’ve highlighted bitcoin’s divergence from equities, only to eat crow a week later. Is this time any different? |

We don’t know. |

But what we do know is that it’s time to buckle up. In the event of a recession, it’s going to be wildly entertaining to see how things play out. After all, bitcoin was an invention out of our last recession. How it will perform during its first one is anyones guess. |

Bitcoin is boring as ever right now. And we’re here to tell you that’s a good thing. When the world's going crazy, maybe it's the steady ones who come out ahead. |

|

SPONSORED | Doctors say do this one thing to live a better life | Let’s get real - stretching, taking the stairs, and eating less pizza are good habits, but these alone will not change your life. So what will? Hormone Optimization. Here’s why: As we age, our testosterone levels decline and this can wreck our emotional, mental and physical health. | Enter Wellcore. They created The Best At-Home Hormone Optimization Program On The Planet. This scientifically-backed program can improve strength, fat loss, bone density, libido, blood sugar, mood, sleep and more. Right now, they are treating our readers like VIPs. | Order Wellcore's Painless At-Home Assessment Kit for only $99 (50% off) today! No code needed. Redeem at checkout. |

|

|

|

TWEET OF THE WEEK |

| Samson Mow @Excellion |  |

| In a single day, the US added more than half of #Bitcoin’s entire market cap in debt. That’s something like 10 million @btc. And yet there are still people that are unsure if $27k is a good price to buy. |  | | | Oct 4, 2023 | | |  | | | 2.65K Likes 629 Retweets 31 Replies |

|

|

|

Other Content You Might Enjoy |

Another L for the SEC: It’s Motion to Appeal Loss in Ripple Case Is Denied Chinese Firms Used Crypto Payments to Run Fentanyl Network Grayscale seeks to convert its Ethereum Trust to an ETF Ethereum futures ETFs garner lukewarm reception on first day of trading Sam Bankman-Fried is not a child Michael Lewis discusses his new book on SBF on "60 Minutes" 3 central banks unveil prototype for global Bitcoin monitoring Coinbase Lands Full Operating License in Singapore Blackbird, from the founder of Resy, expands loyalty program for restaurants

|

|

SPONSORED | “A Strange Day Is Coming To America” | Few people realize this could actually happen on U.S. soil. Or what a sizable impact it could have on your wealth. | In short, after predicting the crashes of 2020 and 2022, Marc Chaikin is seeing Americans make some very foolish mistakes with their money. | People have seen serious losses in the stock market, and he thinks it's going to get even worse. | But not in the way you might expect. | Because the fact is, if you know where to move your cash – a new vehicle 50 years in the making – you could make a huge profit as the whole thing unfolds. | Click here to get the full story. |

|

|

|

ABOUT COINSNACKS |

Launched in December 2017, CoinSnacks is home to the longest continuously running crypto newsletter. Each week, we publish our cryptoasset musings to an audience of ~30,000 crypto enthusiasts and investors. |

In a space flooded with new projects, research, and narratives, the average investor may feel overwhelmed or confused. CoinSnacks offers a solution by doing the digging for you, so you don't have to spend hundreds of hours sifting through the noise. |

|

REACH OUR AUDIENCE |

If you’re a brand interested in partnering with CoinSnacks to find your next customers, partner, or ally, we’d love to hear from you. Learn more here. |

|

JOIN OUR OTHER PUBLICATIONS |

| Gold Playbook All your gold investing news in a single daily email. | | Subscribe |

|

| Stocks & Income Stocks and income investing. | | Subscribe |

|

|