|

To investors,

One of the most surprising data points over the last few weeks has been bitcoin’s stability against the uncertain and chaotic macro backdrop. The asset, which is historically considered highly volatile by legacy investors, has surprised many people. I asked Will Clemente, co-founder of Reflexivity Research, to write a guest post about this lack of volatility. Below is Will’s analysis.

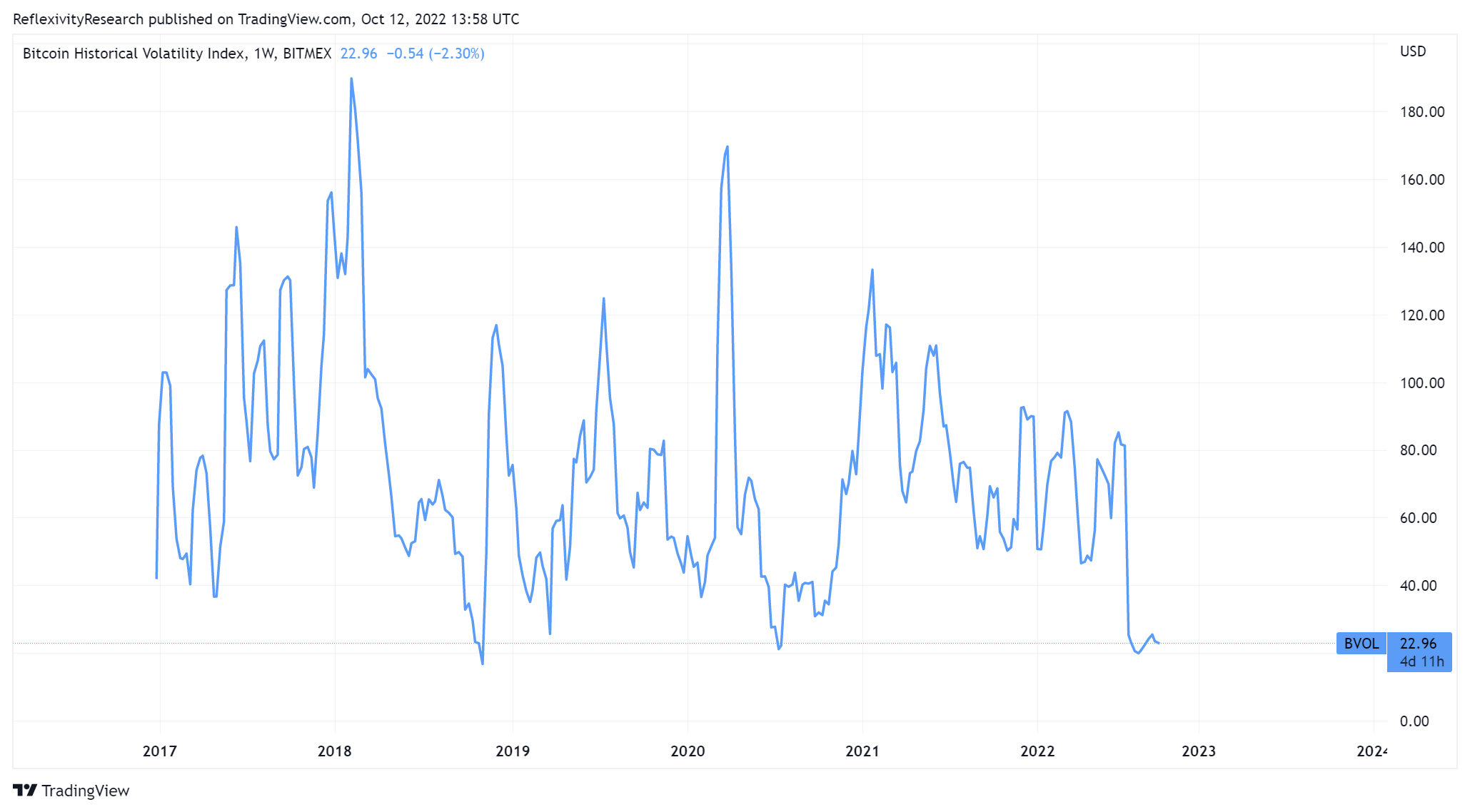

With a tremendous amount of macroeconomic uncertainty overhanging markets, it may be quite surprising for some to see Bitcoin maintain stability in the $18K-$19K range that its been in for several months now. Bitcoin volatility continues to compress near record lows, expressed by the Bitcoin Historical Volatility Index:

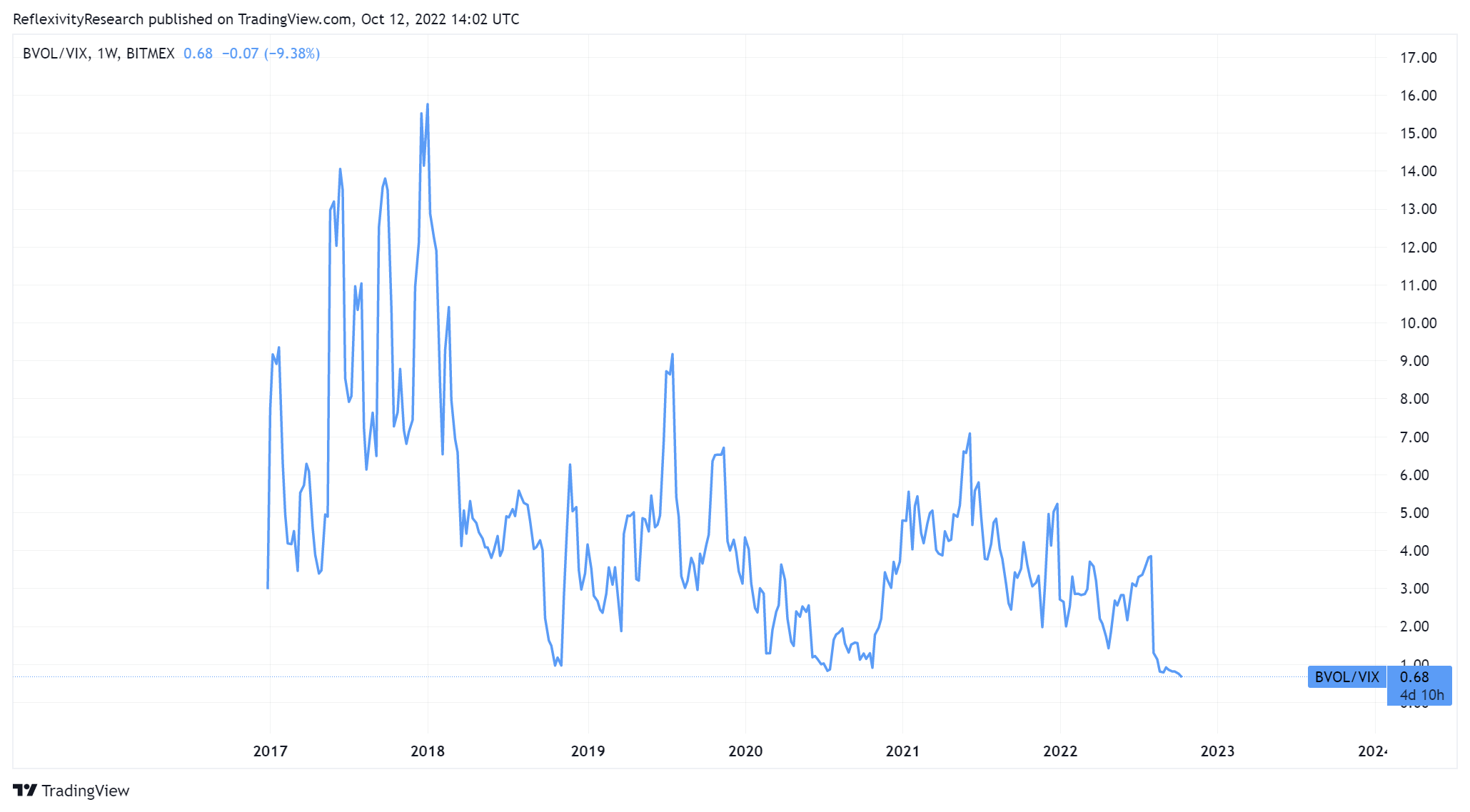

When comparing Bitcoin’s volatility to equities volatility via the VIX, we see that the ratio of the two is at all-time lows.

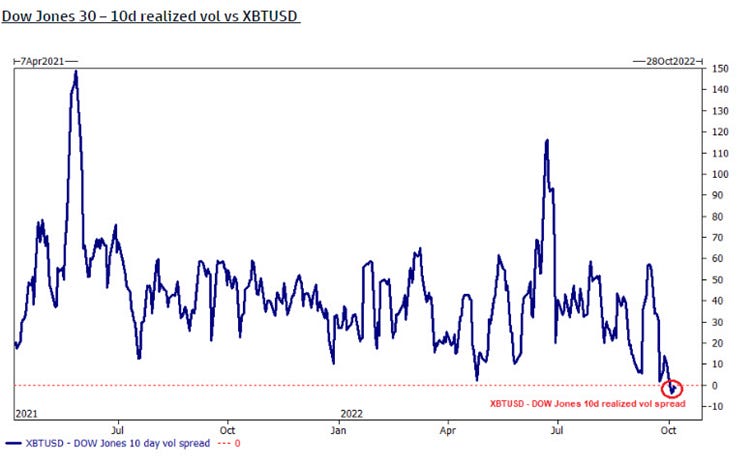

Comparing BTC’s 10 day realized vol to that of the Dow Jones, we can see that this has set new lows.

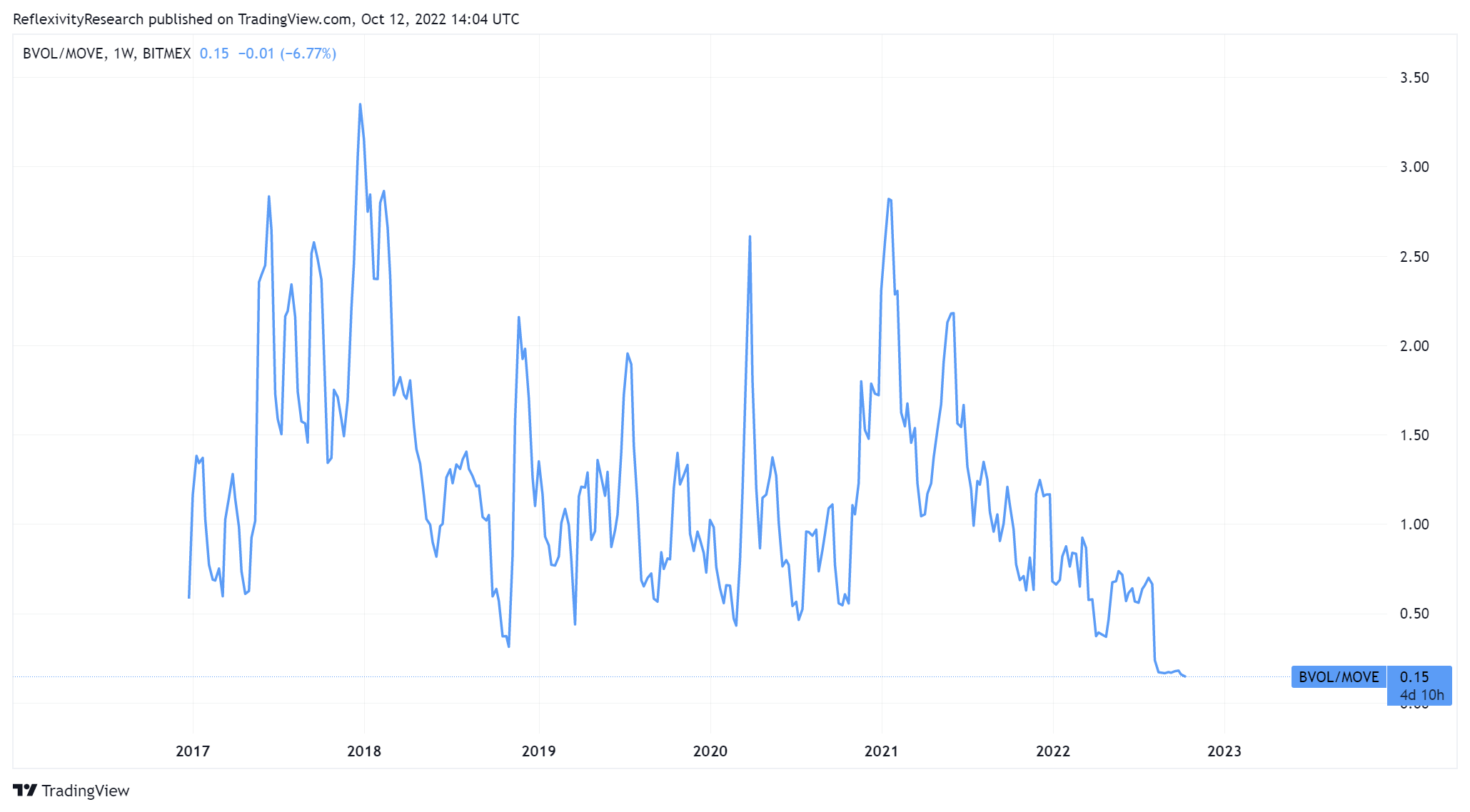

Also comparing the Bitcoin Volatility Index to MOVE (Treasury market volatility index), we can see that this ratio is also at new lows.

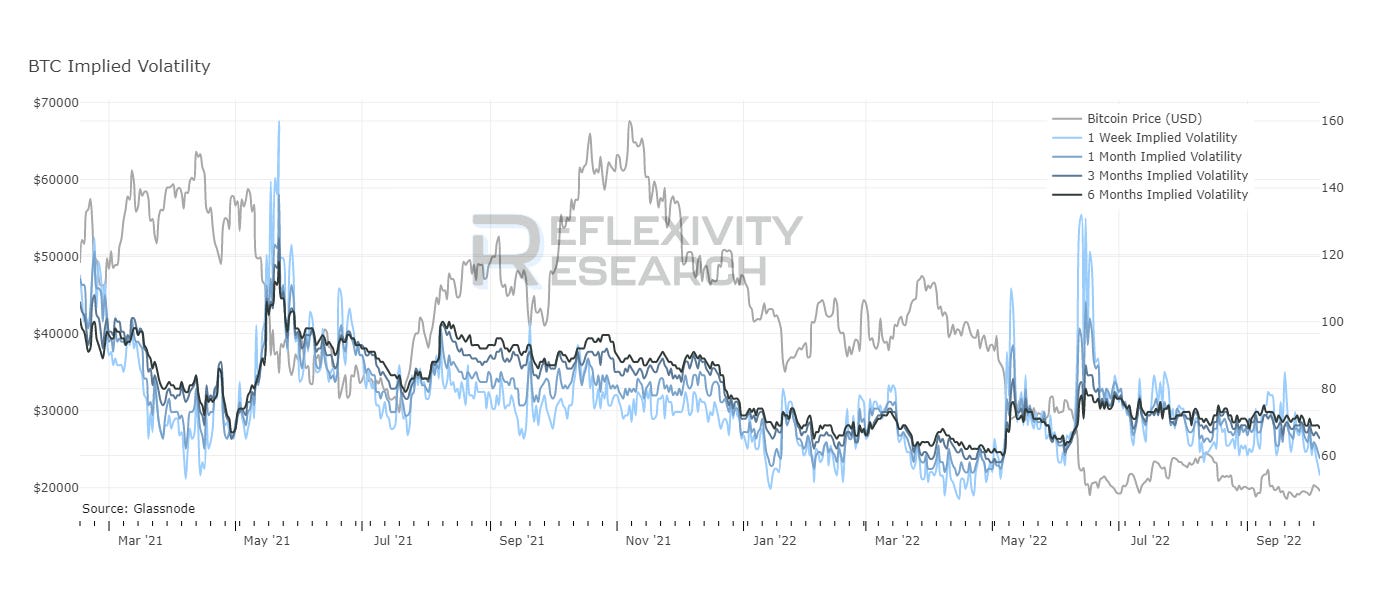

The Bitcoin options market is pricing in low volatility, with implied volatility across the spectrum approaching yearly lows.

Meanwhile, Bitcoin futures open interest has screamed to new all-time highs along with the ratio of adjusting open interest for market cap size. With CPI this morning and plenty of potential macroeconomic catalysts over the coming weeks, there is a high likelihood for a substantial move in BTC price with the combination of volatility near all time lows and futures open interest at all time highs.

The quick takeaway is to ensure that you pay attention in the coming days. The last few weeks are not necessarily indications of the next few weeks, although it has been a positive development to see the low volatility from Bitcoin.

Hope each of you enjoyed this quick analysis. If you would like to receive in-depth reports and research from the team at Reflexivity Research, you can subscribe here.

-Pomp

THE RUNDOWN:

‘This is serious’: JPMorgan’s Jamie Dimon warns U.S. likely to tip into recession in 6 to 9 months: JPMorgan Chase CEO Jamie Dimon on Monday warned that a “very, very serious” mix of headwinds was likely to tip both the U.S. and global economy into recession by the middle of next year. Dimon, chief executive of the largest bank in the U.S., said the U.S. economy was “actually still doing well” at present and consumers were likely to be in better shape compared with the 2008 global financial crisis. Read more.

Ark’s Cathie Wood issues open letter to the Fed, saying it is risking an economic ‘bust:’ The Federal Reserve likely is making a mistake in its hard-line stance against inflation Ark Investment Management’s Cathie Wood said Monday in an open letter to the central bank. Instead of looking at employment and price indexes from previous months, Wood said the Fed should be taking lessons from commodity prices that indicate the biggest economic risk going forward is deflation, not inflation. Read more.

Paul Tudor Jones Tamps Down Bitcoin Bullishness: "I still have a minor allocation to bitcoin," said Paul Tudor Jones during a CNBC appearance on Monday morning. It wasn't exactly a rousing endorsement of the crypto given Jones' major bullishness two-plus years ago. At the time, in mid-2020, the hedge fund giant said he had allocated 1%-2% of his multibillion-dollar portfolio to bitcoin. He later said he could see allocating as much as 5% of his assets to bitcoin if the U.S. Federal Reserve continued on its path of monetary debasement. His remarks at that time helped pump crypto prices – then already in a bull market – even higher. Read more.

Congress is still considering changes to the retirement system, including catch-up contributions: There’s still a decent chance that changes to the U.S. retirement system will be enacted before the end of the year. Despite there being just a few months left before the next Congress convenes Jan. 3 — the midterm elections will be Nov. 8 — the push to improve Americans’ ability to save for retirement is supported by both Republicans and Democrats. Read more.

Geoff Woo is an entrepreneur, investor, and a partner with Jake Paul at Anti-Fund.

In this conversation, we discuss the rise of creators, how creators are now private equity firms, Geoff's investment strategies, building vs. investing, and human optimization. We also talk about some of Geoff's companies including HVMN, betr, Archive.com and more.

Listen on iTunes: Click here

Listen on Spotify: Click here

Earn Bitcoin by listening on Fountain: Click here

Geoff Woo Explains Why MrBeast & Jake Paul Will Be Billionaires

Podcast Sponsors

These companies make the podcast possible, so go check them out and thank them for their support!

Alto IRAcan help you invest in crypto in tax-advantaged ways to help preserve your hard earned money. There are no setup or account fees, and it’s all you need to do to invest in crypto tax free. Open an Alto CryptoIRA to invest in crypto tax-free by clickinghere.

Eight Sleep is the most advanced solution on the market for thermoregulation by pairing dynamic cooling and heating with biometric tracking. Click here to check out the Pod Pro Cover and save $150 at checkout.

FTX US is the safe, regulated way to buy digital assets. Trade crypto with up to 85% lower fees than top competitors by signing up at FTX.US today.

Amberdata provides the critical data infrastructure enabling financial institutions to participate in the digital asset class. We deliver comprehensive data and insights into blockchain networks, crypto markets, and decentralized finance. Download our Digital Asset Data Guide here today.

SiGMA is the bridge between iGaming, online sports betting, and emerging technology, such as Blockchain, NFTs, fintech, GameFi, metaverse, and AI, is loud and clear. The largest global summit of this kind is heading to Malta from November 15 to 17. Log on to AIBC.WORLD or SiGMA.WORLD to see all our upcoming global summits!

Bullish is a powerful exchange for digital assets that offers deep liquidity, automated market making, and industry-leading security. Click here to learn more.

Valour represents what’s next in the digital economy -- providing simplified, trusted access to crypto, decentralized finance and Web 3.0 investment opportunities. For more information visit valour.com

Unstoppable Domains’ 10 NFT domain endings are now fully integrated with Trust Wallet. Claim your Unstoppable Domainhere today.

Compass Mining is the world's first online marketplace for bitcoin mining hardware and hosting. Visit compassmining.io to start mining bitcoin today!

LMAX Digitalis the market-leading solution for institutional crypto trading & custodial services. Learn more at LMAXdigital.com/pomp

Exodus is the world’s leading desktop, mobile, and hardware crypto wallets, with over 150 assets. Founded in 2015 to empower people to control their wealth. Visit http://exodus.com/pomp today.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

You’re a free subscriber to The Pomp Letter. For the full experience, become a paid subscriber.