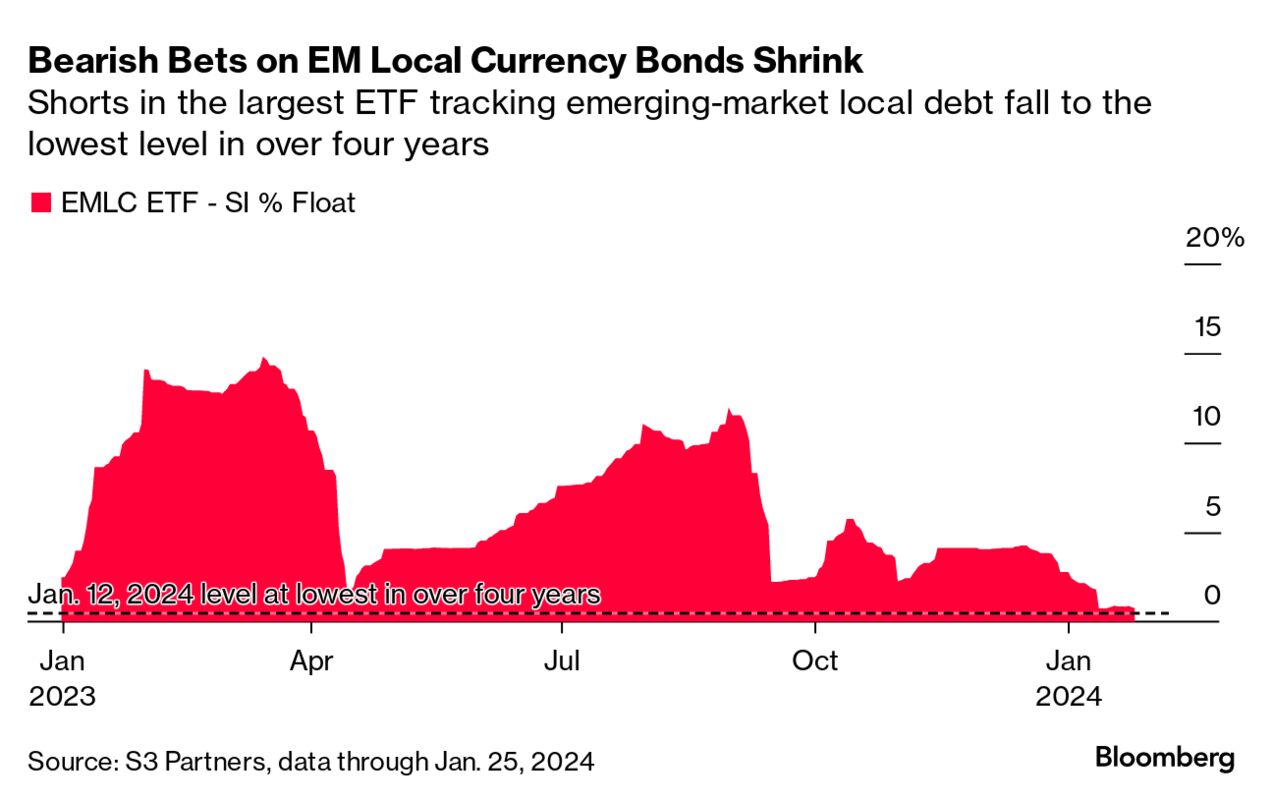

| Off a highway in Phoenix, cranes tower over a stretch of land larger than 60 football fields. The first of five hulking bunkers are under construction. Thirty miles away, engineers are plotting another complex on 400 acres, some three times the footprint of the Mall of America. If all goes as planned, both sites will be home to thousands of computers churning mountains of data, powered by the energy needed for hundreds of thousands of homes. This is Blackstone’s bet on the AI revolution. After its $10 billion takeover of data center operator QTS in 2021, the world’s largest private equity firm is fueling rapid growth at a top landlord for tech giants while bankrolling the massive structures that will handle crucial computing needs—all while reshaping communities across America. —Natasha Solo-Lyons China Evergrande Group’s liquidation order by a Hong Kong court cements the downfall of a company that exemplified the country’s real estate boom and bust. For global investors, what happens to the remnants will have implications far beyond one property developer. Mortgage rates in the US will decline this year, stoking optimism about the battered real estate market, according to the latest Bloomberg Markets Live Pulse survey. The rate on a 30-year, fixed mortgage is expected to fall to 5.5% at the end of the year, according to the median from 236 respondents. That’d be down more than a full percentage point from its current level of about 6.69%, and the first annual decline after three straight years of gains. Walmart is offering annual stock grants as a new incentive for store managers, bringing potential pay for the most successful ones to more than $400,000. Starting in April, all US store managers will receive as much as $20,000 in Walmart stock every year, as the world’s largest retailer seeks to attract and retain staff.  Photographer: Alejandro Cegarra/Bloomberg US workers are more downbeat about the prospects for their employers than at any time in nearly a decade, but some may have to grin and bear it as layoffs mount and their job options ebb. The share of workers who said they had a positive six-month outlook for their organization fell to 45.6% in January, according to Glassdoor. One of last year’s best wagers in emerging-market debt is getting a fresh boost from bets the US Federal Reserve will finally begin cutting interest rates. Optimism is sweeping through domestic bond markets as investors anticipate the Fed will soon start lowering rates. Alongside a weaker dollar, a potential US pivot would help coax central bankers in emerging markets to ease—resulting in a possible windfall for holders of local-currency debt. Reddit is said to be weighing feedback from early meetings with potential investors in its initial public offering that it should consider a valuation of at least $5 billion, even as it is estimated below that figure in the volatile market for shares of private companies. One of Goldman Sachs’s most senior executives, Jim Esposito, is leaving after almost three decades with the firm. Esposito helped run the bank’s core trading and dealmaking business after he had pushed to combine the two operations. More recently, Esposito, 56, had emerged as one of the key internal critics of the bank’s ill-fated foray into consumer banking. Climate change challenged winemakers in 2023, the hottest year in history, and will continue to do so for the foreseeable future. Wildfires in Greece; massive heat and drought in Spain; and floods, frost and hail elsewhere in Europe all took their toll last year, resulting in one of the smallest harvests ever. But Napa, subject to wildfires and heat waves in the recent past, escaped with one of the best vintages ever. You could argue that global warming has been good for the UK, as well as fledgling vineyard efforts in Norway and Sweden—places where, in the past, it would have been too cold and rainy to ripen grapes sufficiently. All of this makes its impact very hard to predict for the coming year. Here are the six major trends we’re watching.  A glass of Brut sparkling wine at the Chapel Down Group vineyard and winery in Tenterden, UK. Photographer: Chris Ratcliffe/Bloomberg Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive Bloomberg’s flagship briefing in your mailbox daily—along with our Weekend Reading edition on Saturdays. |