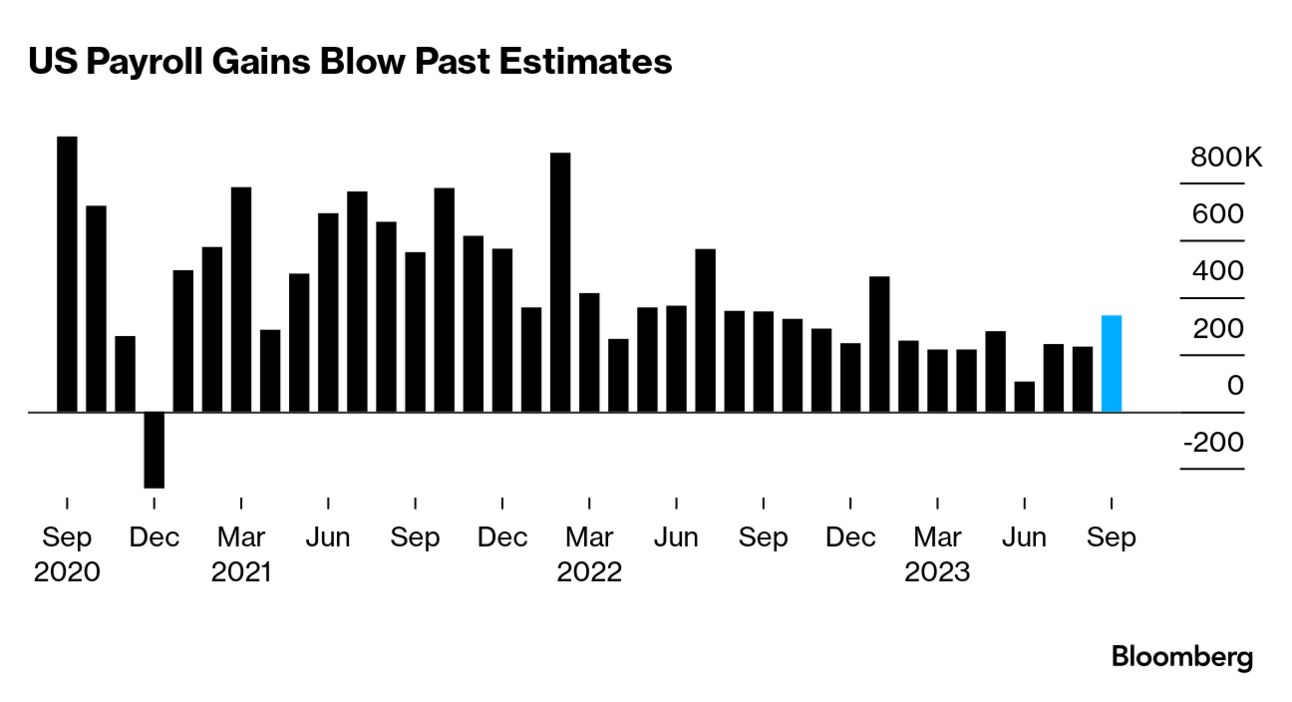

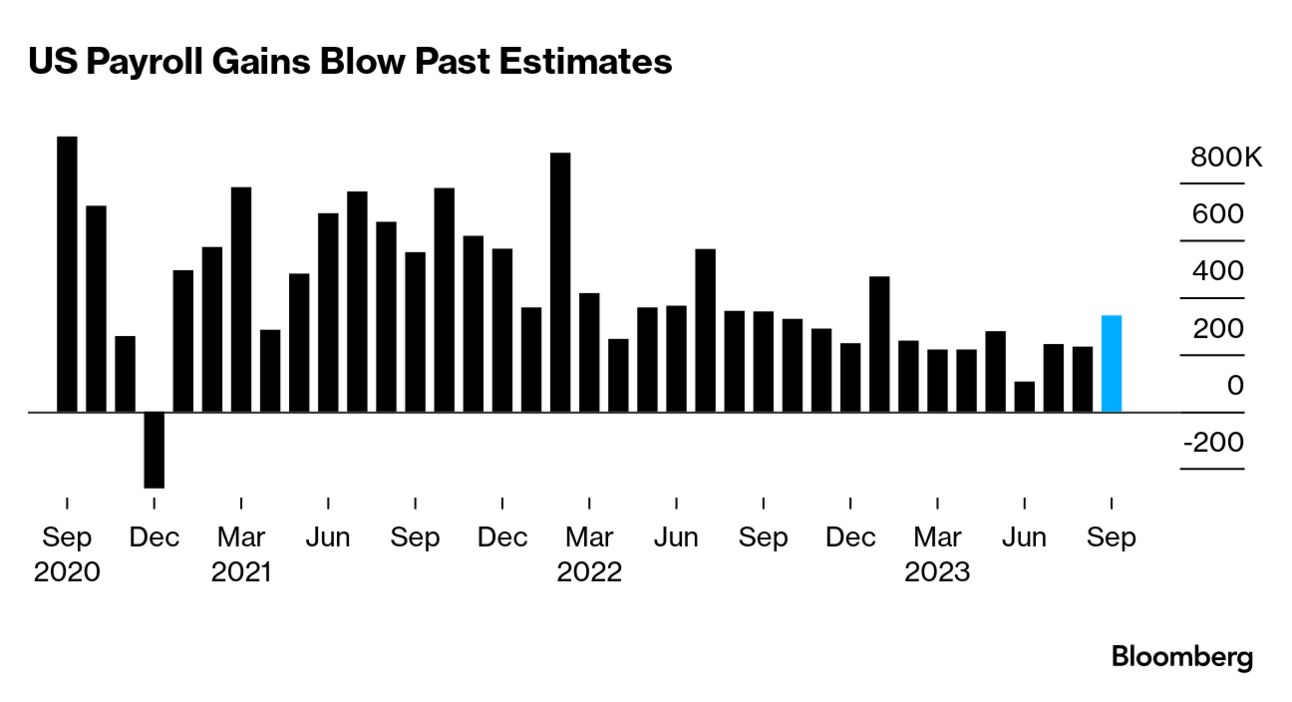

| When it comes to the near-term US economic outlook, there’s been a shift in tone this week. The Federal Reserve and most central banks around the world have successfully lowered both headline and core inflation from 2022 peaks through aggressive interest rate hikes. But the cost of doing so may be finally starting to show. Bond losses are beginning to rival even the dot-com meltdown. Yields rise when bond prices fall, and the 10-year Treasury is marching toward 5%. Those levels heighten the danger of a financial blowup (think Silicon Valley Bank). Longer run, they threaten to undercut the economy by markedly raising borrowing costs for consumers and companies.  After 18 months of rate hikes, the overall US economy remains robust. But as is often the case, good news for American workers is seen as bad news by investors. Fed officials have said the labor market—still near historic strength—remains overheated, contributing to wage and price pressures. And Friday’s hotter-than-expected jobs report may make it more likely that central banks raise rates again by year-end. Canada has similar issues. Its labor market blew past expectations for a third straight month while wage growth accelerated, lending weight to bets on another rate hike there. For central banks, the risk has always been about going too far and triggering a downturn, something that has yet to happen in the US despite more than a year of predictions otherwise. If Team Recession is eventually proven correct, however, it could mean a reckoning for companies that have continued to pile on debt amid higher rates. For now, the soft-landing crowd seems to still have momentum: The International Monetary Fund said this week that the odds are increasing that central banks can tame inflation without sending the global economy into recession. At least two things seem clear after the ouster of US House Speaker Kevin McCarthy, condemned by a handful of far-right Republicans and pushed off stage with unanimous Democratic support. First, a government shutdown by the GOP-controlled House seems more likely in November, with all the personal and governmental pain that goes with it. Second, the vote was a “stunning display of just how broken and dysfunctional” America’s political system has become, Johnathan Bernstein writes in Bloomberg Opinion, adding that the cause—a Republicans civil war in the House—won’t end anytime soon. That said, Michael Bloomberg writes that Democrats share in the blame by failing to reach across the aisle. So who’s next for this seemingly impossible job? Far-right Republican Jim Jordan of Ohio won the endorsement of Donald Trump over House Majority Leader Steve Scalise of Louisiana. Trump weighed in after spending the week watching his business acumen take a beating in a New York courtroom. Across the street, federal prosecutors alleged on the first day of Sam Bankman-Fried’s fraud trial that he “lied to the world” as he built his FTX cryptocurrency exchange. His on-and-off girlfriend, Caroline Ellison, struck a deal with the government and is amongthe potential witnesses expected to testify. As an aside, the US notified Bankman-Fried that it’s going after two luxury jets it says are proceeds of his alleged multibillion dollar fraud.  Sam Bankman-Fried outside the federal courthouse in lower Manhattan Photographer: Drew Angerer A bipartisan group of US senators will visit China next week in the hopes of meeting with Xi Jinping. Their trip follows several visits by high-level Biden administration officials seeking to smooth ties after months of escalating tension. President Joe Biden himself may meet with the Chinese leader in San Francisco next month. Meantime, several Taiwanese technology companies are helping Chinese tech company Huawei build infrastructure for a network of chip plants across southern China, a slap at the US and its sanctions effort at a time when Beijing regularly threatens Taiwan with invasion. The murder of Canadian citizen Hardeep Singh Nijjar near Vancouver has turned into both a geopolitical thriller and a test for India, which Canada accused of involvement (India denies it). It’s also raised questions about western efforts to turn India and its nationalist government under Narendra Modi into an unofficial ally. Canada is still negotiating the fallout of the Sikh activist’s killing as the Financial Times reports India told Ottawa to slash its diplomatic presence by two-thirds.  Demonstrators protesting the murder of Hardeep Singh Nijjar outside the Indian consulate in Toronto. Photographer: Arlyn McAdorey/Bloomberg Airbnb has had a rough 2023, with some hosts reporting sinking bookings. New York City also drastically tightened the screws on short-term rentals. But the company’s founder says he plans to “get our house in order.” If so, that would come at a good time for travelers, since hotel room rates in major cities from Boston to Mumbai are expected to jump by double digits. For those seeking the best accommodations as prices soar, you’re in luck: After 123 years of recommending restaurants, the Michelin Guide will soon begin rating hotels. - The IMF and World Bank hold their annual meetings in Africa.

- Many big US banks report results after beating estimates last quarter.

- New Zealanders head to the polls in what looks to be a close election.

- The reported deadline for many Canadian diplomats to leave India.

- A reinvigorated UK Labour Party holds its last annual conference.

In this week’s Bloomberg Originals short documentary, America’s Distressed-Debt Problem, we explore how the speed of interest rate hikes has caught some industries napping. Bankruptcies are rising at the fastest rate since the pandemic, but still some corporations are taking on more debt. It’s possibly a sign that the Fed’s work may not be done. And restructuring experts and debt investors warn there’s more pain to come. Get Bloomberg’s Evening Briefing: If you were forwarded this newsletter, sign up here to get it every Saturday, along with Bloomberg’s Evening Briefing, our flagship daily report on the biggest global news. Intelligent Automation—Transformation in a Time of Uncertainty: Top business and IT executives will gather in a city near you to explore ways in which intelligent automation can offset economic pressures and help organizations thrive by enhancing operational efficiencies and stakeholder value. We'll feature in-depth conversations about designing and implementing high-value projects, building teams that embrace automation and making the business case to top management about investing in transformation. For Toronto on Oct. 19, Register here; And for Seattle on Nov. 8, Register here. |