Verging on unrealistic: The BoEâs overly optimistic updated economic projections leave the door wide open for more monetary stimulus later this year. Relative to the obvious challenges ahead linked to the COVID-19 pandemic, highlighted by the recent re-imposition of modest containment measures in major parts of the UK, the V-shaped recovery that the BoE continues to project seems unlikely, to put it mildly. The August minutes from the Monetary Policy Committee state that âGDP is not projected to exceed its level in 2019 Q4 until the end of 2021â. The BoE also looks for inflation to return to the 2% target in 2022 as output rises above its pre-pandemic level and 0.5pt of excess demand emerges. In our view, economic developments will very likely fall short of this near-perfect scenario and inflationary pressure will remain subdued for longer than the BoE currently expects. As a result, policymakers may eventually need to do more to support the recovery

For our base case, we expect the BoE to announce an additional £100bn in asset purchases for 2021 at the upcoming November Monetary Policy Report. However, as it may not become very clear that the recovery is disappointing relative to the BoEâs new projections until early 2021, we see some risk that that the bank may wait until early-to-mid 2021 to announce the additional stimulus.

Cautious tone on current conditions: The BoE estimates that real GDP was âover 20% lower in 2020 Q2 than in 2019 Q4â â slightly worse than our own estimate of 19.8%. The ONS will publish the official estimate of Q2 2020 on 12 August. Despite the less-horrific downturn versus the May projection, theminutes shows that policymakers remain circumspect in their assessment of current conditions. Despite clear evidence that a recovery is underway, the gains so far are uneven. Against the strong rebound in household consumption and residential real estate, policymakers highlighted the still weak activity and subdued expectations for business investment and spending.

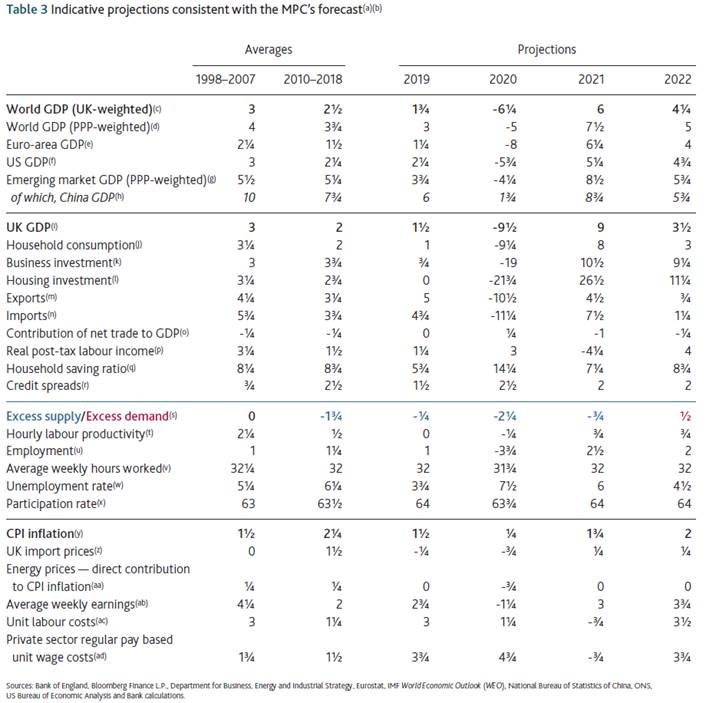

Still V-shaped: The BoE has abandoned the âillustrative scenarioâ from the May Inflation Report and returned to standard official forecasts. While the new estimates show a shallower recession, the profile of a rapid and uninterrupted recovery remains unchanged versus May. As Table 1 shows, the BoE now projects a 9.5% decline in GDP in 2020 followed by a 9% rebound in 2021 before a 3.5% gain in 2022. In May the BoE projected a 14% decline in 2020 followed by a 15% gain in 2021 and a 3% rise in 2021. While our 2020 forecast is in line with the BoEâs updated projection, we expect a smaller recovery in 2021(6.5%) and 2022 (2.2%). We expect real GDP to return to its Q4 2019 level by early 2023.

Still neutral guidance: Although the risks are clearly tilted heavily to the downside, and in contrast to the dovish communications by other central banks including the Fed and the ECB, the BoEâs updated forward guidance does not show a strong bias toward further easing. The August minutes state âThe Committee would continue to monitor the situation closely and stood ready to adjust monetary policy accordingly to meet its remit. The MPC would keep under review the range of actions that could be taken to deliver its objectives. The Committee did not intend to tighten monetary policy until there was clear evidence that significant progress was being made in eliminating spare capacity and achieving the 2% inflation target sustainablyâ.

Negative rates remain far off: The BoE has managed to do a good job at getting credit to the companies and households that need it. Unlike during the financial crisis when credit markets froze and worsened the slump, early and aggressive action â including direct interventions into money markets from March onwards and regulatory changes such as lowering capital requirements â helped to strengthen the transmission of monetary policy. Parsing through the August minutes, policymakers remain satisfied, at least for now, that the stimulus and the transmission mechanism are working sufficiently well. The Monetary Policy Report includes a section which assesses negative rates and the suitability of them for the UK. It concludes that ânegative policy rates at this time could be less effective as a tool to stimulate the economyâ.

Policy summary: At the August meeting, the nine member committee voted unanimously in favour of keeping the bank rate at 0.1% and continuing with its existing purchases of UK government bonds and sterling non-financial investment-grade corporate bond purchases, financed by the issuance of central bank reserves, with the target for such purchases maintained at £745 billion.

For a detailed analysis of the current and projected pace of asset purchases please see our preview to the August Inflation Report see here.

Table 1: BoE August projections |

|

Kallum Pickering

Senior Economist

Phone +44 203 465 2672

Mobile +44 791 710 6575