| View in browser |

|

| |

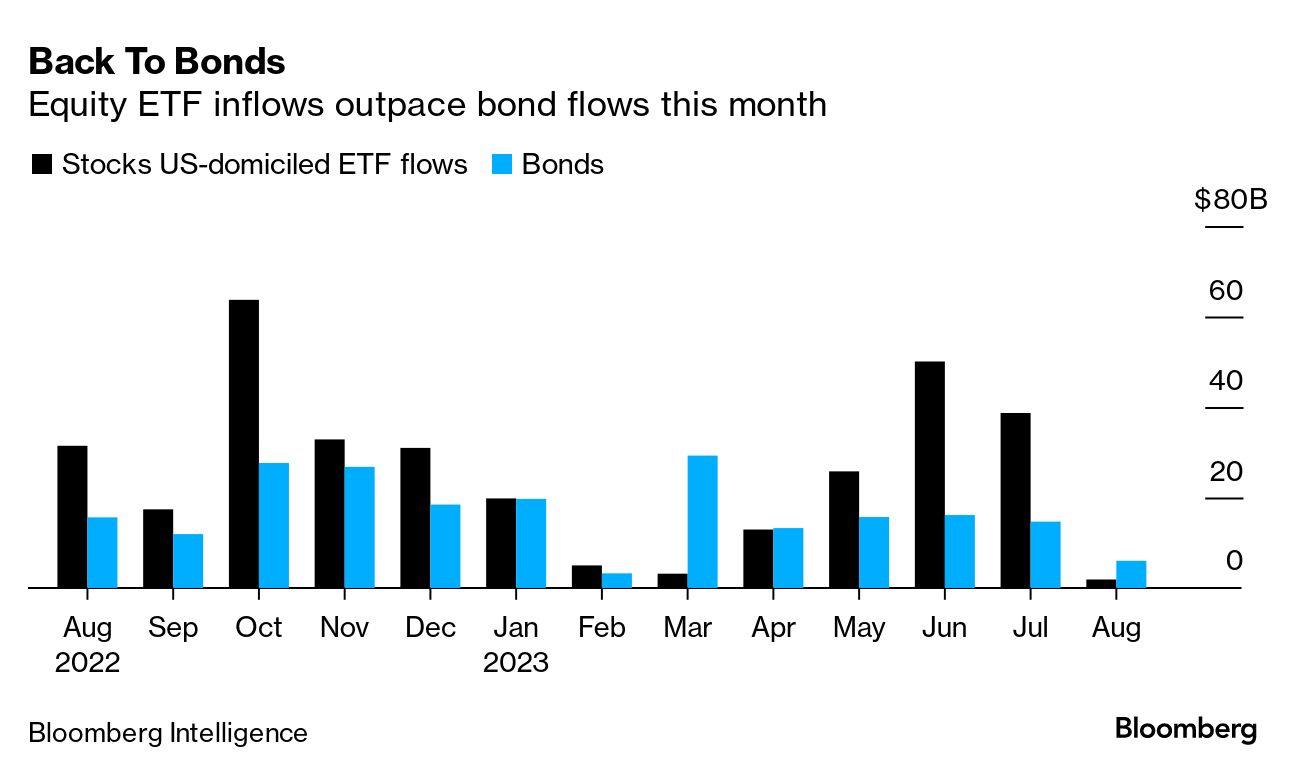

| Volatility in the world’s biggest bond market has finally caught the attention of stock-happy Wall Street. A Treasury rout that pushed 10-year yields close to their highest point since 2007 has spurred what is now the biggest break in an $8 trillion equity rally. Major US benchmarks just slid for a third straight week. While debate rages over why the bond market has turned dangerous, the issue for equity investors is less abstract. Rising risk-free payouts are getting too rich for many to turn down, particularly compared with expected returns in loftily priced stocks, says Ulrich Urbahn, head of multi-asset strategy at Berenberg. “Given rising real yields and ambitious valuation levels in particular for US stocks,” he says, “the risk-reward looks better for bonds.”

Only a week ago, Zhongzhi Enterprise Group attracted little notice within China and was almost unheard of everywhere else. Now, the secretive shadow banking giant has become the latest symbol of financial fragility in an $18 trillion economy where confidence among investors, businesses and consumers is rapidly dwindling. The privately owned manager of more than 1 trillion yuan ($137 billion) and its trust-company affiliates are under intense scrutiny after halting payments to thousands of customers. Chinese assets have tumbled as word of the company’s difficulties spread, pushing the yuan close to a 16-year low. A central bank rate cut this week has done little as concerns mount about more failures in the nation’s $2.9 trillion trust sector. The turmoil represents a growing threat for Xi Jinping, who is already grappling with a weak economy, a property selloff and growing geopolitical tensions. “This is a problem that’s only going to intensify,” Kathy Lien, managing director of BK Asset Management, said. “There is only so much they can do.” A period of unusual calm in crypto markets ended abruptly this week as the notion of higher-for-longer interest rates sparked a selloff in risk assets like Bitcoin, leading to mass liquidations of bullish bets. The rout pushed Bitcoin from near $29,000 to as low as $25,314 in a 24-hour span. More than $1 billion of positions were unwound in the selloff. With an unemployment rate below the national average—itself at half-century lows—Iowa has what its lawmakers and businesses see as a glaring problem: It needs more workers. That labor shortage has put some of the state’s Republican officials and legislators in a political bind, with many voicing a need for reform to ease the hiring crunch at home while not straying too far from the national party line on immigration. War may be coming to Niger. The Economic Community of West African States has called for dialogue with Niger’s junta while saying it stands ready for military intervention to restore democracy if talks fail. The regional bloc plans to send a mission to Niger this weekend to meet with the country’s self-appointed leaders who imprisoned the elected president, Mohamed Bazoum.  People cheer Nigerien troops in Niamey during a demonstration in support of Niger's junta, which overthrew the democratically elected government. Photographer: AFP/Getty Images A subsidy-fueled boom helped build China into an electric-car giant. But now the chickens are coming home to roost. That boom has left weed-infested lots across the nation brimming with unwanted battery-powered vehicles. China’s abandoned and obsolete EVs are piling up. The US intelligence community is warning the domestic space industry of the growing risk of espionage and satellite attacks from China, Russia and other adversaries. US space-related companies are in danger, says the National Counterintelligence and Security Center, the Federal Bureau of Investigation and the US Air Force. The US and Iran recently announced a surprise agreement: Both nations will release prisoners, and the US will unfreeze billions of dollars in Iranian oil revenue. On this episode of the Bloomberg Big Take podcast, we discuss the terms of the deal and what it suggests about the possibility of renewed negotiations over Iran’s nuclear program. Joining us is Ali Vaez, Iran Project Director at the International Crisis Group.  In October, demonstrators marched past the US Capitol during the “March of Solidarity for Iran” following the death of Mahsa Amini after she was arrested by Iranian security services. Photographer: Stefani Reynolds/AFP

When to harvest is one of the most crucial decisions a winemaker can make. Too early, and the result is bitter. Too late, and it’s overly sweet. It’s a delicate balance—one that’s increasingly being upended by the climate crisis. In France, global warming has been wreaking havoc on this ancient equation for some time. To acclimate, the old ways are increasingly being replaced by the new. Satellite technology is being used by vintners to harvest the right grapes at the right moment. And while this technology is already being brought to bear for winemaking, soon it may serve a more critical role in helping adapt all agriculture to an unstable climate.  French wine-growing regions have turned to advanced satellite sensor technology to adapt both growing and harvesting to the climate crisis. Source: European Space Agency

| |||||||

| Follow Us | ||||

|

|

|