To close out the last few years, I’ve made some predictions for the following year. I’m batting about .500. Some of them turned out great, and some turned out comically bad.

The truth is that it is hard to predict things a year out. Ask the Wall Street strategists. They get it wrong year after year. Instead, I’ll outline some broad strokes on the types of things we might expect in the next 12 months.

I think 2023 will be a decent year. Not great, but decent. We’re coming off a huge sentiment bottom, the bond market is pricing in 200 basis points of Fed cuts, and I expect most of those cuts to happen. I believe inflation will continue to ease, as will financial conditions. Volatility will be low, and credit spreads will tighten. Things will be good enough that we will believe that the worst is over—but really, it is just the eye of the hurricane. 2024 will be much, much worse.

Eye of the Storm

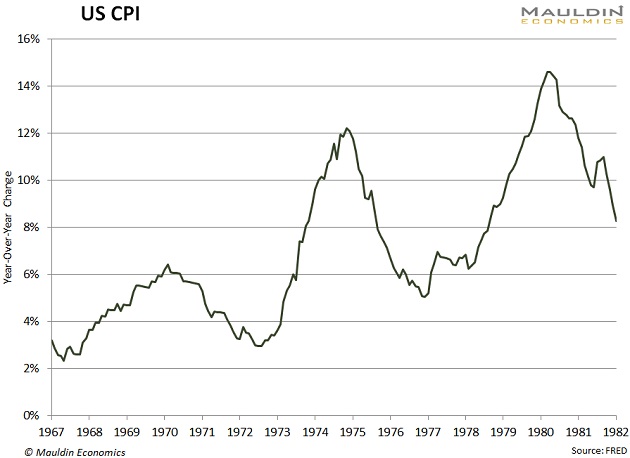

The 1970s aren’t the best analog for what we’re currently experiencing, but the thing we learned about the 1970s is inflation came in waves, and each wave was successively bigger. Check out this chart of inflation from 1967–1982:

In each case, inflation peaked, the Fed did something about it, and then it turned lower, only to have a bigger wave follow it—because the Fed never addressed the root cause of inflation—the psychology. And keep in mind, while we still don’t really know what causes inflation, it is a psychological phenomenon, first and foremost.

In this case, handing out $3 trillion in free money during the pandemic seemed to do it. And the one thing I do know about this inflation is the psychological phenomenon that began during the pandemic is still present. Pressures have eased a bit, but people are still expecting higher prices in the future and accelerating economic activity. I believe that CPI will drop to 4% or so (as most people do), but that will not be the end of the story.

In 2024, inflation will be back with a vengeance. And the Fed will be forced to tighten much more than it did in this current episode. We’re talking double-digit interest rates. And risk assets will not do well in a period of double-digit interest rates. We could have a 50% drop in the stock market and a 50% drop in the bond market—in the middle of an election year. Cash will be king. Commodities will fly—when I look at the price of oil, gold, and other commodities, I can’t help but think what an outstanding buying opportunity they are at the moment, after all the froth from the Ukraine War has worn off. 2024 will be a very interesting year.

But as I said, 2023 will be decent—which would surprise everyone. And we all know that the markets do what surprises people the most.

Too Early

It is too early to think about 2024. One of my rules of trading is that you have to trade within the time frame of your forecast. You can’t think long term and trade short term, or vice versa. You’ll tie yourself in knots. There will be more opportunities in 2024 than in 2023, but we will have to wait.

The point here is that you have to hold two ideas in your head simultaneously. The first is that in the long term, we are doomed. The second is that in the short term, things will be great. This reality will be harder to navigate than it sounds. It is hard to be long stocks for any length of time when you know that we are all doomed in the long run. But that is what I am asking you to do.

I’ll take a stab at a prediction—stocks will rise 10%–20% in 2023, getting back near previous highs. We’re in the midst of a bottoming process, fighting against a downtrend, and I think the downtrend will be broken, forming a massive head-and-shoulders bottom. I was at a cocktail party recently, and three different people came up to me and asked what was wrong with the stock market. Bearish sentiment is picking up again, and so are put option volumes. This will end badly for the bears, as it usually does.

Yes, things are terrible. But the financial markets frequently do things that don’t make any sense. For example, the energy bulls are doing a lot of head-scratching on how the price of oil went from $120/barrel to $70 in the face of all this underinvestment and supply constraints.

And yet, it happened. It’s a market. Markets go up and down and, in the short to medium term, are driven by sentiment.

This letter is the last 10th Man of 2022. I hope you enjoyed my writing this year. I’ll be back with more opinions and observations next year.

Jared Dillian

P.S. I want to welcome our new Yield Shark editor and lead analyst, Kelly Green, to Mauldin Economics. Kelly has 12+ years of experience researching and writing about income-producing dividend stocks—the kind of opportunities that deliver steady, reliable payouts.

If you’re interested in learning more about Kelly and her work, check out this brief introductory interview.

Suggested Reading...