| | | Good afternoon. If you’re significant other has ever complained about the time or money you have spent on crypto, we’ve got just the “I’m sorry” gift for you. | Introducing, Binance’s “CRYPTO” Perfume. Made In China | Today’s Big Stories:

💡 Long-term thinking

⚡️ BTC breakout possibilities | Today's newsletter is 953 words, a 3.5-minute read. |

| |

| | |

|

Every Day is the Best Day to Buy Bitcoin |

For most retail investors, bitcoin’s recent prices have caught them by surprise. |

Sure, they had been watching the price slowly rise, but who could have expected the explosive 50% rise in price from $44k → $69k YTD. |

Now you, dear reader, would be well aware of what is going on (assuming you have opened and read these emails). |

That’s because we’ve been pounding the table… explaining that everything that caused crypto to crash was behind us. The future was bright. |

For example, on November 23, 2022, when headlines were screaming about the death of crypto, we wrote the following: |

We now have proof that we don’t need people like SBF to hold our hands. Why would you when DeFi does it better than him anyway? And thank God it does, because crypto’s mission is still crucially important. Fiat money is still being mismanaged to the tune of hyperinflation. Governments are still weaponizing control of bank accounts to subdue protests. The financial system is still value-extractive and inaccessible to most of the world. Lost in the sea of 2022s lousy news is that crypto has been addressing these issues. It’s become “basically a savior” in countries crippled by inflation, such as Turkey. It’s enabled political activism in repressive regimes. And it’s growing ever more popular in developing countries. The world still needs decentralized, transparent, and credibly-neutral money. We believe crypto will fill that void. And now is not the time to abandon that vision. There’s no reason to worry too much about short-term price drops from bad actors. As crypto fulfills its mission, the prices will follow. Don’t lose faith just yet. | | | | https://www.coinsnacks.com/p/why-you-shouldnt-lose-faith-in-crypto |

|

|

On that day, bitcoin was trading below $16,000. Since then? |

|

What’s next for crypto prices? In the short term, your guess is as good as ours. It’s the long run that we are focused on. |

But with bitcoin prices touching all time highs and memecoins skyrocketing in price, it’s important to think clearly. |

Don’t chase prices. Don’t give in to FOMO. Don’t be a part of what Travis Kling is calling Financial Nihilism. |

Buy what you know and sit back. This is a long game. |

|

SPONSOR | Where are you on your crypto trading journey? | Kraken wants to know: What kind of investor are you? | | No matter where you are in your journey, Kraken is a crypto exchange for everyone. | With more than 10 million users trading 200+ cryptocurrencies, Kraken makes it easy to take your crypto trading to the next level. | |

|

|

|

New ATH. Now What? |

As we all know by now, bitcoin broke its all-time high (so we think). This happened yesterday, rising a few hundred dollars above $69,000. Shortly after, the celebrations came to a screeching halt as liquidations started to hit. Bitcoin fell 14% off the new all-time high, hitting prices not seen in three days. |

But it's all probably fine, with Bitcoin recovering to ~$67,000 today… and perhaps gearing up for another breakout. 👀 |

Analyzing Breakouts |

Historically, surpassing all-time highs has been the ultimate prelude to significant Bitcoin rallies. Just take a look at these numbers @DylanLeclair_ pointed out: |

December 2020: Bitcoin doubled in 18 days March 2017: It took 84 days to double November 2013: Just 10 days to double March 2013: Another 18 days to double

|

Some napkin math: The average time it takes bitcoin to double after hitting a new all-time high is ~32 days. |

That means if history repeats itself, we could see $132k BTC by next month. |

Market Sentiment: |

As we’ve discussed in previous issues, this rally seems a bit muted with less hysteria overall. And that’s because, unlike past cycles, the retail crowd doesn’t seem to be doing much of the legwork. Rather, it’s the institutions via the ETFs. |

This is evident when looking at several alternative data points: |

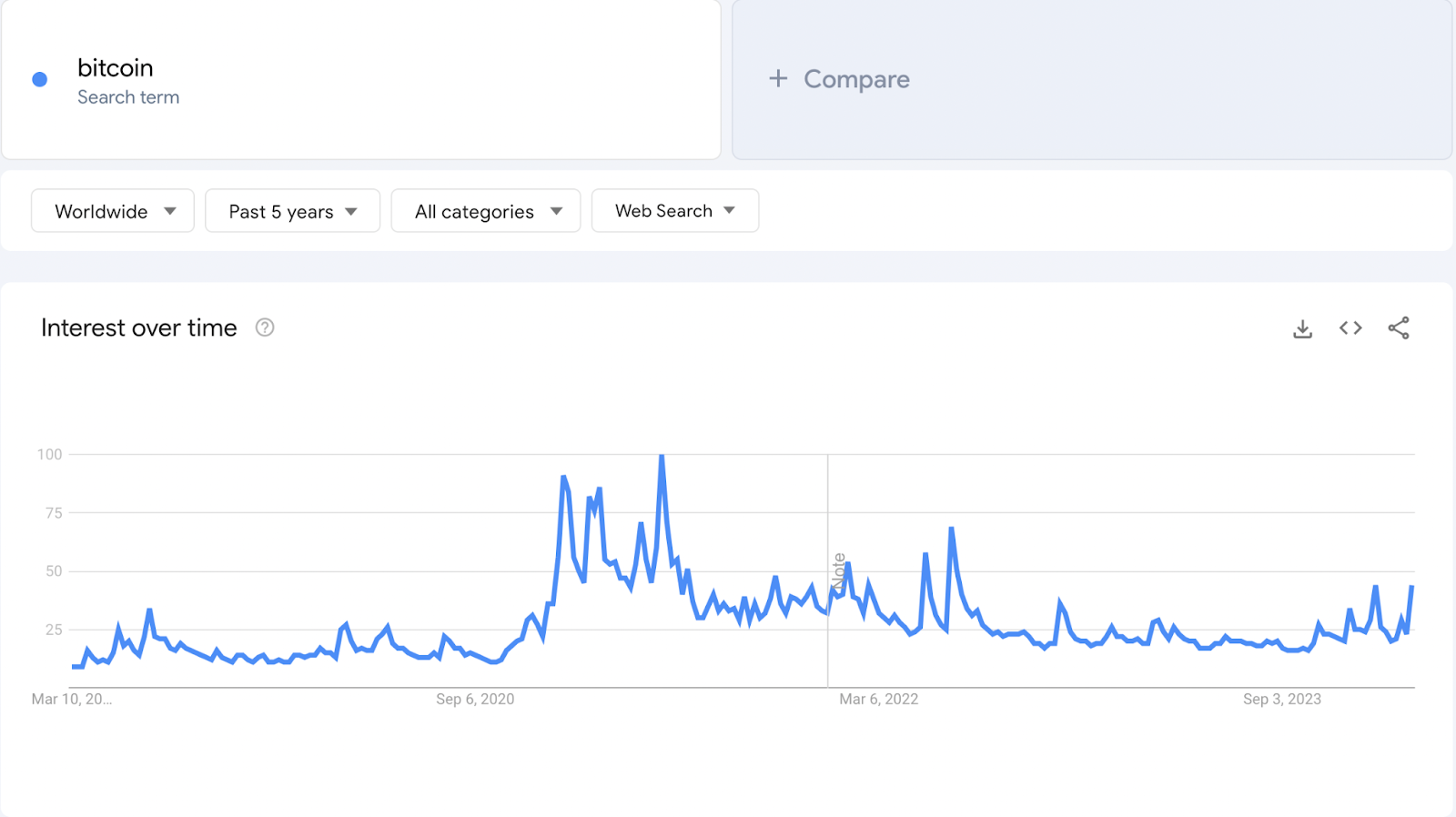

| Past 5Y search queries for “bitcoin” on google |

|

Google Trends data: Search queries for "bitcoin" are significantly lower than during previous all-time highs, indicating weaker retail interest. Wikipedia traffic: Bitcoin's Wikipedia page traffic also shows a similar decline compared to historical peaks. Social media: Crypto Twitter and Youtube engagement surrounding crypto even seems subdued compared to previous bull runs as well.

|

Another under-discussed aspect of this bull cycle is the noticeable decrease in marketing spend within the crypto industry. Speaking from our own experience as publishers reliant on advertising revenue, we've observed a significant downturn in marketing budgets (Sponsors reach out here!). |

With fewer promotional efforts by startups to attract new users, the potential influx of newcomers into the crypto space, and by extension, their impact on the market price, might partially explain the lack of hype. |

Either way, this muted sentiment – despite us being at another all-time high – suggests a different kind of bull market, potentially driven by institutional investment through ETFs rather than retail FOMO. |

Update on MVRV: |

We can’t talk about price breakouts without mentioning where we’re at on the MVRV scale. This metric, which we constantly circle back to, offers a window into the perceived overvaluation or undervaluation of Bitcoin at any given point. |

Currently, the market value to realized value (MVRV) ratio sits just above 3. That means, in aggregate, hodlers are up 3x on unrealized profits. This MVRV region is historically the goldilocks zone from which parabolic moves begin to develop. |

|

MVRV < 1 = Bottom discovery 1 < MVRV < 1.5 = Bear-bull transition 1.5 < MVRV < 3.5 = Equilibrium 3.5 < MVRV = Euphoria

|

In other words, at a ~3 MVRV, we’re getting real close to a potential euphoric breakout. The fact that we’re at an all-time high and we haven’t even hit an MVRV over 3.5 looks extremely bullish in the short-term. |

So, what should you do? Tell all your cousins and uncles who have held the bag since the last run to keep hodling. |

The retail FOMO crowd, if anything, is just starting to boil – not bubble. Crazy insanity price movement – not just new all-time highs – could be on the horizon. |

|

SPONSOR | Buying Altcoins? Don’t Go At It Alone. | With bitcoin hitting a new all-time high, we’re officially in another bull cycle. | First, it’s the majors like Bitcoin (BTC) and Ether (ETH) that go parabolic… Then, those returns cycle into the more lucrative altcoins. And we’re not making this up either. This is how altcoin mania’s happen every. single. time. | But that doesn’t mean you should just pick any altcoin. To make stable gains here, you have to diversify across a handful. You have buy what’s going to be trending, not what’s already trending. | Which is why you should watch this (or just sign up) for Weiss Ratings. | It’s a portfolio service you can count on. Plus, they’ve just released their new buy list of 7 “undiscovered” cryptos. We highly suggest you check it out here. | P.S. You really don’t have to do anything. They’ll tell you what to buy. When to buy. And when to sell. So if you’re reaching for the moon, you may as well do it with a helping hand. Click here to learn more » |

|

|

|

|

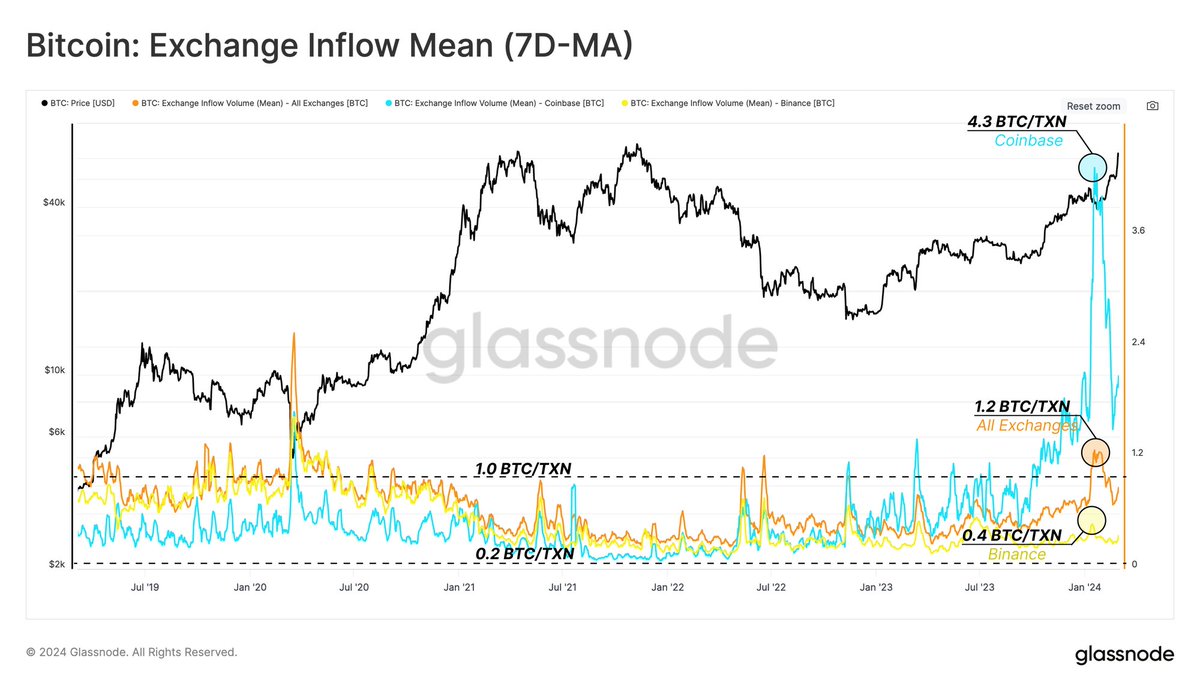

| Dillon Newman @Dilnewm |  |

| Where is crypto trading happening? Since ETF approval, far and away on Coinbase $COIN Source: @glassnode |  | | | Mar 6, 2024 | | |  | | | 54 Likes 9 Retweets 4 Replies |

|

|

|

Other Content You Might Enjoy |

In Partnership With One Page Crypto |

|

|

SPONSOR | Missed the Meteoric Rise of NVIDIA? Do This… | The AI Revolution is boosting stocks like Nvidia (up 438%), C3.ai (up 161%), and Symbotic (up 224%). | But one tiny, hidden AI gem with a massive DoD contract has the potential to disrupt the market even further. | It already helps power organizations like NYC's 911 system, the VA, and the US Navy, as well as Fortune 500 clients like ADP and Accenture. | Read more on this and other AI opportunities here... |

|

|

|

How did you like today's email? |

|

|

About CoinSnacks |

Launched in December 2017, CoinSnacks is home to the longest continuously running crypto newsletter. Each week, we publish our cryptoasset musings to an audience of 35k+ crypto enthusiasts and investors. |

In a space flooded with new projects, research, and narratives, you may feel overwhelmed or confused. CoinSnacks offers a solution by doing the digging for you, so you don't have to spend hundreds of hours sifting through the noise. |

|

Reach Our Audience |

If you’re a brand interested in partnering with CoinSnacks to find your next customers, partners, or allies, we’d love to hear from you. Learn more here. |

|

Join our other publications |

| Gold Playbook All your gold investing news in a single daily email. | | Subscribe |

|

9 |