| Independent journalism, powered by our readers. | |

|

Britain borrowed over £25bn to balance the books last month, the second-highest borrowing for an April ever, and more than expected.

Soaring inflation and the cost of capping energy bills drove up borrowing again, the latest figures from the Office for National Statistics show.

Borrowing was £11.9bn higher than in April 2022, and the second highest since monthly records began in 1993 (behind April 2020, when the pandemic hit the economy).

Economists polled by Reuters had predicted that public sector net borrowing, excluding the impact of state-owned bank, would have hit £19.75bn in April.

Although public sector receipts rose by £900m in April compared with March, that was dwarfed by a £12.8bn rise in public sector spending.

High inflation continued to drive up the cost of the national debt, as many government bonds are pegged to the rising cost of living.

The interest payable on central government debt jumped to £9.8bn in April, a jump of £3.1bn compared with April 2022. That was was due to the increase in the RPI measure of inflation.

The ONS explains: "Rises in the retail prices index have increased the interest payable on index-linked gilts. This represents the third-highest interest payable in any month on record, behind the £20.0bn in June 2022 and the £18.0bn in December 2022."

The UK’s energy support packages meant central government spent £3.9bn on subsidies, £1.8bn more than in the April 2022.

Meanwhile, outgoing Tesco chair John Allan is stepping down from his role chairing housebuilder Barratt Developments earlier than planned, at the request of the board.

Barratt told the City this morning that Allan will step down as chair of the board and as a director of the company from 30 June 2023.

Allan had been expected to step down in September, to be replaced by non-executive director Caroline Silver, but this plan – announced in January – has been brought forward.

Barratt told shareholders that they had decided to speed up the transition to prevent allegations made against Allan from becoming disruptive to the company, saying: "At the request of the board, John Allan will step down as chair of the board and as a director of the company on 30 June 2023.

"The board believes it is in the best interests of Barratt to accelerate the planned transition to the new chair of the board to prevent the ongoing impact of the allegations against John from becoming disruptive to the company."

Barratt added that it has not received any complaints about John Allan during his tenure at the company, which he joined in 2014.

Last Friday, Tesco announced that Allan would step down in June, after the Guardian reported that Allan allegedly touched the bottom of a senior member of Tesco staff in June 2022, at the company’s last AGM.

Four allegations about Allan emerged during the Guardian’s investigation into the Confederation of British Industry (CBI) – the UK’s foremost business lobbying group.

Allan was president of the organisation between 2018 and 2020 and then vice-president until October 2021.

He has denied three of the four claims made against him. He has admitted making a comment about a CBI staffer’s appearance that she found to be offensive in 2019, and apologised for the remark.

The agenda

• 9am BST: Eurozone flash PMI surveys for May

• 9.30am BST: UK flash PMI surveys for May

• 10.15am BST: Treasury Committee hearing with the Bank of England over monetary policy

• 11.15am BST: IMF 2023 Article IV end-of-mission press conference in London

We’ll be tracking all the main events throughout the day ... |

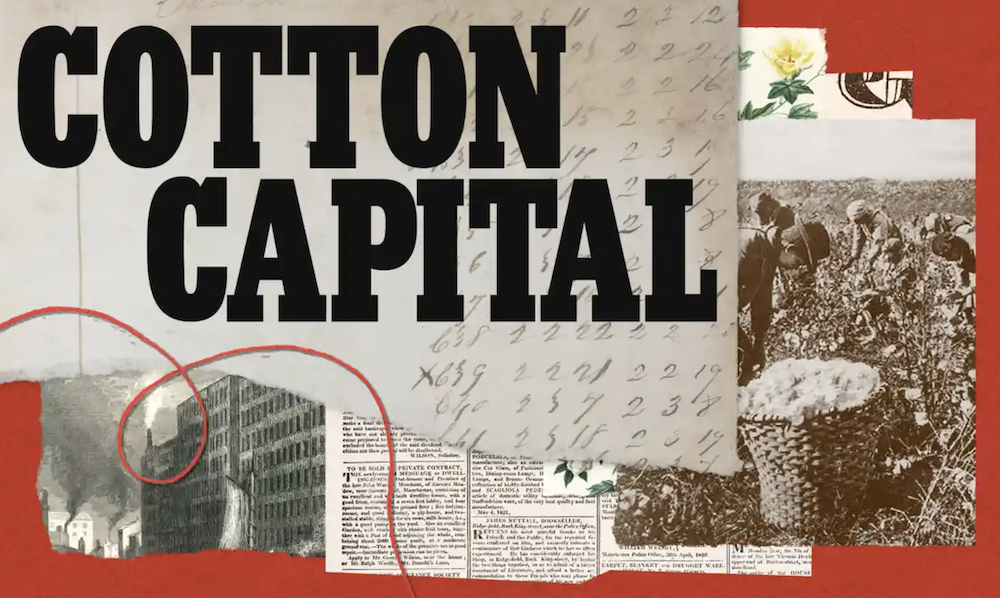

| |  | | A closer look at the legacy of transatlantic slavery | | Starting with the Guardian’s own history, Aamna Mohdin and colleagues offer an in-depth look at the project | | |

|

Guardian newsletters offer an alternative way to get your daily headlines, dive deeper on a topic, or hear from your favourite columnists. We hope this brings something different to your day, and you’ll consider supporting us.

For more than 200 years, we’ve been publishing fearless, independent journalism on the events shaping our world. Now, with a daily readership in the millions, we can bring vital reporting to people all around the world, including emails like this, direct to your inbox.

As a reader-funded news organisation, we rely on the generosity of those who are in a position to power our work. This support protects our editorial independence, so our reporting is never manipulated by commercial or political ties. We’re free to report with courage and rigour on the events shaping our lives. What’s more, this funding means we can keep Guardian journalism open and free for everyone, regardless of their ability to pay for it.

If you share in our mission for open, independent journalism, and value this newsletter, we hope you’ll consider supporting us today. If you can, please support us on a monthly basis. It takes less than a minute to set up, and you can rest assured that you’re making a big impact every single month in support of open, independent journalism. Thank you. |

| | |

| Manage your emails | Unsubscribe | Trouble viewing? | | You are receiving this email because you are a subscriber to Business Today. Guardian News & Media Limited - a member of Guardian Media Group PLC. Registered Office: Kings Place, 90 York Way, London, N1 9GU. Registered in England No. 908396 |

|

|

|

|

|