|

Russia’s invasion of Ukraine has reverberated throughout the global economy.

International sanctions against Russia have thrown European and other oil and gas markets into disarray.

It’s led to a surge in natural gas demand as countries seek alternative sources for their energy needs.

Using Chief Investment Strategist Adam O’Dell’s proprietary six-factor Stock Power Ratings system, I found a “Strong Bullish” natural gas stock:

- It increased its annual sales by 16% from 2020 to 2021.

- Its stock ran up 77.3% from July 2022 to September 2022.

- The company scores a 99 on our Stock Power Ratings system.

Let’s see why this natural gas stock is on track to keep its strong performance throughout 2022 and beyond.

| One of the absolute best income plays right now pays an incredible 10% monthly dividend ... yet few people even know that it exists. In fact, Chief Investment Strategist Brett Owens is so excited about it that he's made it a core holding in his exclusive "7% Monthly Payer" portfolio — an easy-to-buy collection of stocks and funds that could hand you $3,000+ in dividend payouts every single month! |

|

Argentina Needs Natural Gas Natural gas is a big source of electricity around the world.

This, coupled with shutting off supply from Russia — one of the largest natural gas providers in the world — has led to an increase in demand.

One country that would be in a tough spot without this resource is Argentina:

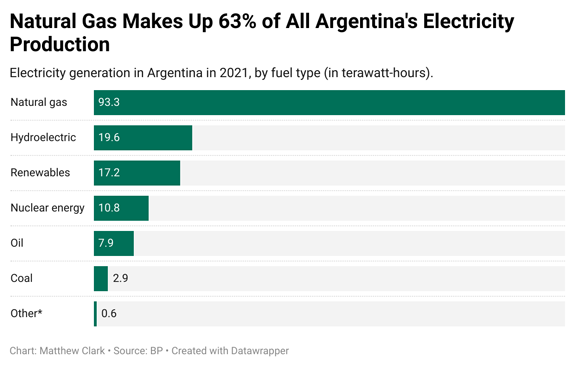

(Click here to view larger image.)

The chart above shows how Argentina generates its energy.

In 2021, natural gas accounted for 63% of all electricity generated in the country.

Bottom line: Argentina, like many European countries, needs natural gas.

Bullish Breakdown of Transportadora De Gas Del Sur (TGS)

The rise in international energy prices isn’t weakening Argentina’s demand for natural gas.

Transportadora De Gas Del Sur TGS. (NYSE: TGS) is an Argentinian company that produces and sells natural gas in South America.

Let’s dive into how this stock has performed.

TGS Stock’s 77.3% Jump Over 2 Months

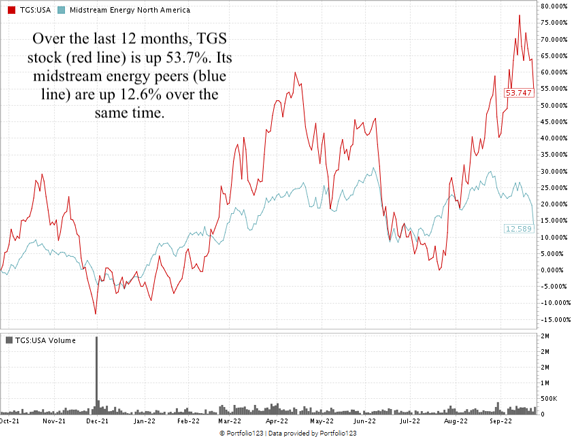

(Click here to view larger image.)

Over the last 12 months, TGS crushed its industry peers by more than four times.

From a low point in July to a 52-week high in September, the stock climbed 77.3%!

I have strong conviction this stock is going higher.

| If you thought inflation was the biggest threat to your retirement this year, think again. There is a ticking time bomb hidden within most American retirement accounts … with the power to “delete” up to 70% of your retirement savings. My new video exposes this hidden threat. |

|

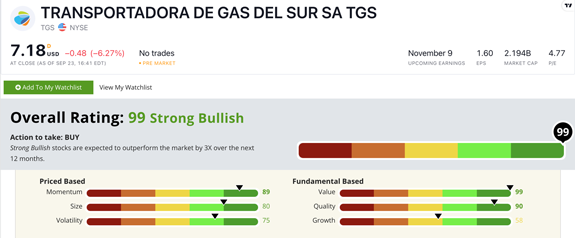

Transportadora De Gas Del Sur Stock Power Ratings Using Adam’s six-factor Stock Power Ratings system, Transportadora De Gas Del Sur stock scores a 99 overall.

That means we’re “Strong Bullish” on the stock and expect it to beat the broader market by at least 3X over the next 12 months.

(Click here to view larger image.)

TGS rates in the green on five of our six factors:

- Value — TGS’ price-to-earnings ratio is three times lower than the midstream energy industry average of 14.4. Transportadora earns a 99 on value.

- Quality — Transportadora’s net margin is 25.5% compared to the industry average of 8.7%. Its return on assets is 11.8% — almost four times higher than its peers'! TGS scores a 90 on quality.

- Momentum — Transportadora saw a 77.3% run-up from a low in July 2022 to its 52-week high set in September 2022. TGS earns an 89 on momentum.

- Size — With a market cap of $2.2 billion, Transportadora is a large company, but one that can still produce outsized gains. TGS earns an 80 on size.

- Volatility — The stock’s upward trajectory has come with little downside since June. It scores a 75 on volatility.

Its annual sales growth rate is 16%, and its earnings-per-share growth rate is 378.9%.

This earns TGS a 58 on growth.

Bottom line: Argentina, like many other countries, needs natural gas to run its power grids.

And that demand isn’t going away anytime soon.

That’s why TGS will be a strong stock for your portfolio going forward.

Safe trading,

Matt Clark

Research Analyst, Money & Markets

Suggested Stories:

The Surprising Winner of the Inflation Reduction Act

Mine Gains With 98-Rated Coal Power Stock!

|

2008: Chinese astronaut Zhai Zhigang, born of an illiterate mother who sold sunflower seeds to pay for her children’s education, performed the first Chinese spacewalk. His home country broadcast the event live for audiences to witness the historic moment.

|

|

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets permits editors of a publication to recommend a security to subscribers that they own themselves. However, in no circumstance may an editor sell a security before our subscribers have a fair opportunity to exit. Any exit after a buy recommendation is made and prior to issuing a sell notification is forbidden. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication.

(c) 2022 Money & Markets, LLC. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe |

|---|

|