When something falls 95%—be it a stock, cryptocurrency, or commodity—you’d call that a depression.

Well, in the case of capital markets activity, it’s been in a depression.

Capital markets activity broadly includes initial public offerings (IPOs), debt financings, and other “raisings of money.”

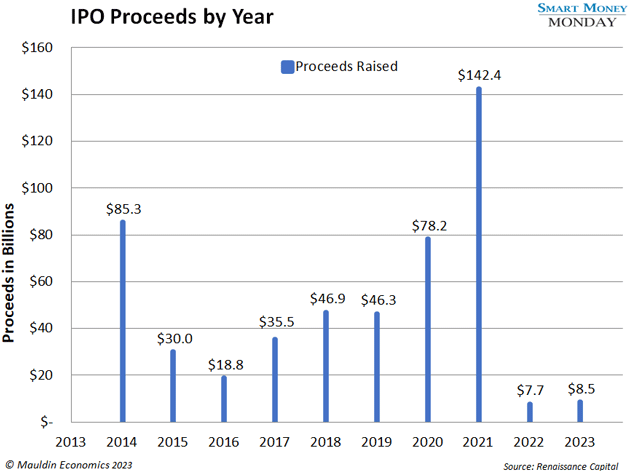

In 2021, according to research firm and ETF provider Renaissance Capital, companies raised $142 billion via IPOs. In 2022, that amount fell to $7.7 billion—a 95% decline.

So far this year, we’re right at $8.5 billion… but 2023 is only halfway through.

Investment banks such as Goldman Sachs and Wells Fargo thrive on investment banking activity. It’s extremely lucrative. Taking a few percentage points off a $1 billion transaction is a lot of money.

Unfortunately, the money spigot on this side of banking hasn’t been flowing for the past 18 months.

However, that’s starting to change, and I’ve found a way to capitalize on the return to normalcy in investment banking…

Pita and Falafel

Cava Group Inc. (CAVA) is the reason for the change. Cava is the Chipotle of Mediterranean-style food. It’s delicious—I eat there probably once a week.

The company went public in a splashy fashion. It raised nearly $318 million after selling 14.4 million shares at $22. But on the opening day of trading, CAVA popped to over $40 a share. Today, it sits at $42.

That’s a successful IPO.

Honestly, Cava is probably extremely overvalued here, as most IPOs tend to be. But it still gives us a good signal on investors’ appetite to buy stock in new companies.

Cava was the first IPO, but now more are coming. Panera is supposedly next. Fogo de Chão is another. Restaurant IPOs are starting to come back in vogue, and more sectors will follow.

All this to say: Capital markets activity is emerging from a long, cold winter.

So, how should you play it?

Since the S&P is 20% off the October ‘22 lows—we’re officially in a new bull market. But for investors on the sidelines waiting to get back in... is that the “green light” they’ve been waiting for? In this exclusive interview with former head trader at Lehman Brothers, Jared Dillian, you’ll learn exactly what you should do BEFORE you get back in the market. Click here to watch. |

Look for Ramped-Up Activity the Rest of the Year

Publicly traded Jefferies Financial Group Inc. (JEF) reported earnings last week. It’s an investment bank that also owns a few unrelated businesses. It has been selling those off and trying to focus on its capital markets and trading business lines.

Jefferies generated $4.3 billion in investment banking revenue in 2021. In 2022, that number was down 34% to $2.8 billion. It continued to fall in the most recent quarter, with investment banking revenue down 5%.

The reported numbers for a stock are relevant. But it’s the future that’s important. For Jefferies, it had this to say about investment banking:

The month of June has brought green shoots in our investment banking and capital markets business, and we are growing increasingly optimistic about the return to a more normal environment.

This is great news for Jefferies and other players in the capital markets world.

Cava is one signal. A great restaurant IPO usually brings out copycats. Again, Panera and Fogo de Chão are apparently next. The IPO window appears to be opening, and I expect more IPOs and capital markets activity as we enter the second half of 2023.

Now, Jefferies is a company I’ve long admired and followed, but it’s not one I own or recommend.

Earlier this year, I recommended doubling our position in this one name, making it our largest holding. And so far, so good—it’s up over 55% since we added to it, and there’s likely still room to run.

If you’d like to learn about High Conviction Investor, you can do so here. Then be sure to check out the April 2023 newsletter issue, “Buying More of What I Know Best,” for all the details on how you can tap into the opportunity unfolding in investment banking.

Thanks for reading,

—Thompson Clark

Editor, Smart Money Monday

Suggested Reading...