Ghost Bites:

- Capitec's valuation is finally coming back down to Earth - or just to Jupiter as a start

- Hyprop's balance sheet is looking much stronger as malls have returned to pre-pandemic levels of activity

- Kibo Energy is already a small group, yet it is looking to hive off some renewable assets into another listed vehicle

- Netcare's case mix is normalising, with a terribly sad trend in mental health patient days

- Thungela has no interest in renewables, despite a report from Bloomberg suggesting otherwise

And guess what else, Ghosties? Motus released a clarification announcement that I'm certain wouldn't have happened without Ghost Mail yesterday. Ghost Bites is absolutely packed with insights this morning, ranging from how to understand a Price/Book multiple for a bank through to details of Motus' announcement. Read it here>>>

Valuation. Valuation. Valuation.

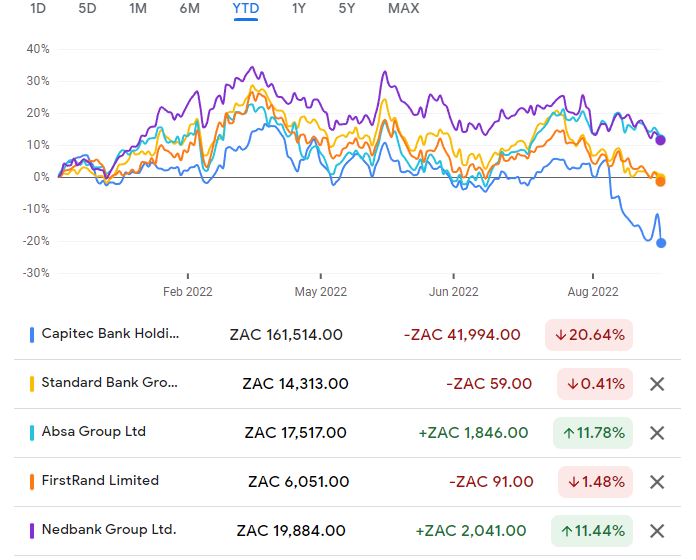

In property, it's all about location. In the market, it's all about valuation. Just take a look at this chart of bank share prices and see for yourself:

Yes, Capitec is now the worst performing major bank in 2022. At the top of the pile, we find Absa.

Does this mean that Absa is the best local bank and Capitec is the worst? Most certainly not. All it means is that the disconnect between underlying performance and the valuation multiple was most favourable at Absa and least favourable at Capitec. This is precisely why I always say that you cannot possibly be a stock picker unless you understand something about valuations.

This is also why I recommend Magic Markets Premium for those of you who are more serious about your investing or trading, or ready to take it to the next level. You can't do your own research unless someone has shown you how to do it. For just R99/month, the cost of a subscription is nothing compared to the mistakes it can save you from in the market. Join me in Magic Markets Premium by subscribing at this link. You won't regret it, I assure you.

Risk-on. Risk-off.

Emerging markets are under pressure (again), with TreasuryONE noting that the markets had a risk-off flavour in the last hours of trade yesterday. The rand was comfortable below the R18 level (it hurts to even say that) until the winds changed and it headed towards the key R18.20 level. Keep a close eye on that.

There was some relief for the pound and the euro at least, gaining against the dollar. That would usually be a rand-positive outcome, yet sentiment towards emerg ing markets didn't improve in line with Europe.

Unlock the Stock

As mentioned yesterday, the recording of the most recent edition of Unlock the Stock is now available. It featured JSE newbie CA Sales Holdings, an FMCG business with big dreams and proper plans to achieve them. Watch the recording (including the Q&A) at this link>>>

The next event is on Tuesday 4th October at midday, featuring property giant Growthpoint. If you are interested in learning more about the local property market, you would be very silly to miss this one. Register for FREE at this link>>>

Magic Markets

It's Friday, which means there's a new Magic Markets episode available. Petri Redelinghuys of Herenya Capital Advisors joined us to talk about making money in a bear market and the importance of trading with caution. Listen to it here>>>

In case you're wondering, DealMakers should be back soon once the team returns from a well-deserved break.

Have yourself a lovely weekend with (hopefully) less load shedding!