| Bloomberg Evening Briefing Americas |

| |

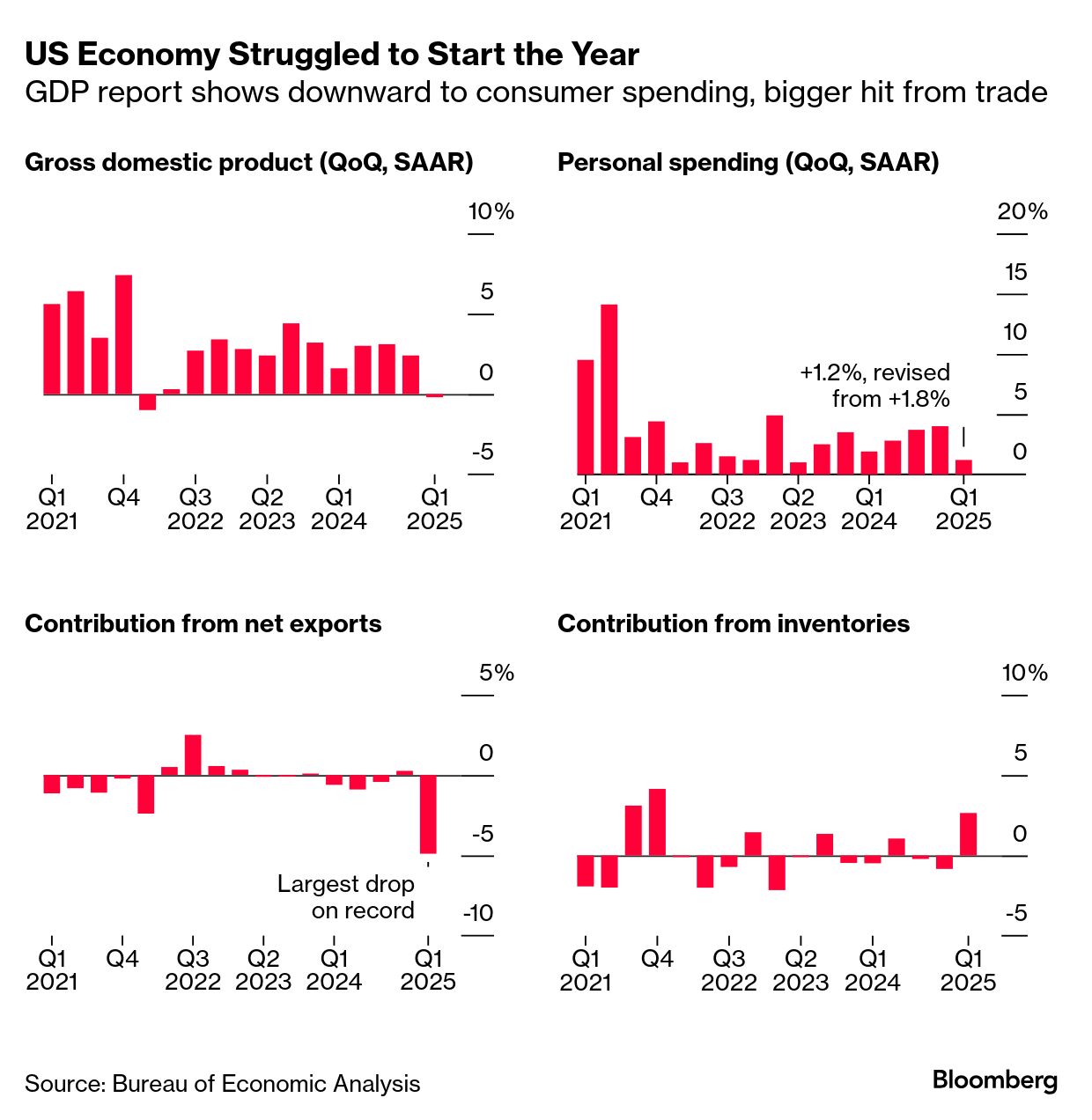

| The past four months have proven that some branches of the US government move faster than others. While President Donald Trump sprayed the world with repeated barrages of tariffs, litigation challenging his ability to do so quietly advanced in the background. Last night, the first ruling came down, and it immediately upended the signature effort of the 78-year-old Republican’s second term. The US Court of International Trade ruled that the bulk of Trump’s new import taxes were issued illegally because the administration wrongfully invoked an emergency law to justify them. While a federal appeals court temporarily paused the ruling from taking effect, the case will likely end up before the US Supreme Court. Separately, a second federal judge declared a number of Trump’s levies unlawful.  Trump has argued that his trade policies will stoke economic growth in the future, though many economists predict the opposite. And on Thursday, more data appeared to affirm their suspicions. The US economy shrank at the start of the year, restrained by weaker consumer spending and an even bigger impact from trade. Gross domestic product decreased at a 0.2% annualized pace in the first quarter. And there were also warning signs from the labor market. More on that below. —Jordan Parker Erb and David E. Rovella |

|

What You Need to Know Today |

|

| Trump met with Fed Chair Jerome Powell, pushing him to lower interest rates. Powell and Federal Reserve officials have held interest rates steady in 2025, arguing that a patient approach to policy is appropriate amid economic uncertainty caused by Trump’s tariffs. |

|

| |

|

| On Thursday, another court ruled against the Trump administration, albeit temporarily. This time the decision came as part of the White House’s multi-front legal assault on Harvard University. At a hearing in Boston federal court, US District Judge Allison Burroughs said she would extend a stay on the administration’s attempt to deprive the institution of foreign students. Harvard sued the administration on May 23, arguing Trump’s ban is illegal. |

|

|

| Recurring applications for US jobless benefits jumped to their highest level since November 2021, possibly presaging a rise in the unemployment rate this month. Continuing claims, a proxy for the number of people receiving benefits, increased by 26,000 to 1.92 million in the week ended May 17. That exceeded the median forecast of 1.89 million in a Bloomberg survey of economists. The numbers suggest the combined impact of the Trump administration’s trade policy and government spending initiatives are starting to take a larger toll on the labor market as those out of work increasingly struggle to find new positions. |

|

|

| Mortgage rates in the US rose for a third straight week, data released Thursday showed. The average for 30-year, fixed loans was 6.89%, the highest since early February and up from 6.86% last week, according to Freddie Mac. High costs and concern about the economy held back purchases of resale homes in April, a month when transactions typically pick up. A measure of contract signings plunged 6.3% from March, the biggest decline since September 2022, according to the National Association of Realtors. |

|

|

| Apollo is working with JPMorgan, Goldman Sachs and three other banks to trade private credit, partnering with Wall Street’s largest firms to syndicate investment-grade debt on a broader scale. It’s said the banks act as broker-dealers, sometimes buying debt originated by Apollo and putting it on their own balance sheets, and at other times brokering and pricing sales to third parties. That extra liquidity will allow Apollo to originate larger loans at a faster clip and support its efforts to reach individual clients, who often need to redeem their investments more frequently than institutions. |

|

| |

|

| United and JetBlue agreed to a far-reaching partnership that will allow travelers to use loyalty points and book flights across the two carriers. The deal, announced Thursday, will integrate the airlines’ operations in the New York City area, giving United a long-sought return to John F. Kennedy International Airport. It will also grant JetBlue access to some of United’s favored flight times at its nearby Newark Liberty International hub. The agreement fulfills United CEO Scott Kirby’s desire to secure flights at JFK at a time when air traffic control problems are hampering operations in Newark and cutting into the company’s quarterly profits. |

|

|

| |

What You’ll Need to Know Tomorrow |

|

| |

| |

| |

| Enjoying Evening Briefing Americas? Get more news and analysis with our regional editions for Asia and Europe. Check out these newsletters, too: Explore all newsletters at Bloomberg.com. |

|

| This newsletter is just a small sample of our global coverage. For a limited time, Evening Briefing readers like you are entitled to half off a full year’s subscription. Unlock unlimited access to more than 70 newsletters and the hundreds of stories we publish every day. | | |

|

|

| |

Before it’s here, it’s on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can’t find anywhere else. Learn more. Want to sponsor this newsletter? Get in touch here. |

|

| You received this message because you are subscribed to Bloomberg's Evening Briefing: Americas newsletter. If a friend forwarded you this message, sign up here to get it in your inbox. |

|

|