Click here for full report and disclosures

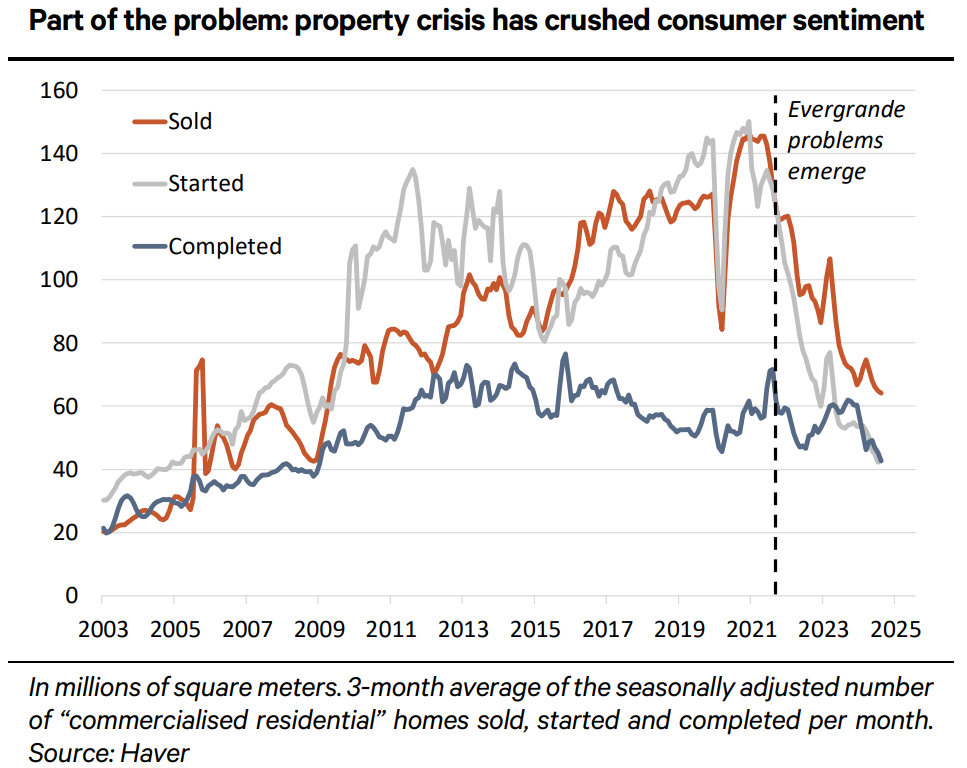

â Property downturn continues to crush sentiment: Chinaâs residential property market remains mired in a deep crisis. Real estate developers sold significantly more homes than they could deliver throughout the 2010s as a huge wave of migration from rural to urban areas, rapid gains in living standards and strong house-price growth encouraged very high demand â see chart. However, the fundamental drivers of strong demand have faded. After authorities started to rein in the exuberance, the collapse of Evergrande and other private developers shattered buyersâ faith that prices would always go up and that all the homes they had paid for would be delivered. As a result, home sales and prices have slumped and consumer confidence has hovered around record lows since 2021.

â Growth slows: Chinaâs strategy to offset weak domestic demand by aggressively offloading the products for which it has built up subsidised overcapacities on world markets has supported industrial output. However, the attempt to buy market share is meeting ever stiffer resistance abroad. It has become increasingly clear that without intervention the economy will fall short of the leadershipâs 5% growth target, even on the not fully trustworthy official numbers. Softer consumption growth caused GDP growth to slip back to 4.7% yoy in Q2. The increase in retail sales cooled to 2-3% yoy whereas it was regularly close to 10% prior to the pandemic. A recent drop in hours worked and incomes suggests that consumption and the labour market could deteriorate further. That might have been the trigger for the coordinated policy response announced this week.

â Supply of credit alone cannot rectify the problem: It is unusual for the Peopleâs Bank of China (PBoC) to cut interest rates (monetary policy) and lower reserve requirements (financial stability policy) at the same time. The simultaneous change on Tuesday suggests that policymakers are getting more serious in their efforts to stabilise the property market. However, improving the supply of credit cannot rectify the slowdown in lending to households on its own. After large falls in prices, there is very little appetite to invest in property. Making it easier and cheaper to borrow may not make a huge difference.

â Fiscal announcements bring promise: Fortunately, Chinaâs policy U-turn went beyond money and credit policy this week. The readout from the Politburoâs quarterly meeting on economic affairs followed by a more detailed Reuters story promising fiscal stimulus suggest that policy support could be effective. The special issue of sovereign bonds equivalent to 1.4% of GDP points to a sizeable fiscal boost to come. Moreover, the intervention appears to be geared towards consumption. According to Reuters, the funds will be used to distribute consumption vouchers and a generous child benefit allowance of RMB800 ($114) a month per child, excluding the eldest. While it may be too late to ensure China hits the growth target this year, we are raising our forecast for the officially published GDP growth rate in 2025 from 4.2% yoy to 4.4% after 4.7% in 2024.

â Headwind to Europe eases: China matters. It accounts for 6% of German goods exports. Weaker demand from China has contributed to the prolonged economic stagnation in heavily exposed Germany. The drop in the Eurozone composite PMI from 51.0 to 48.9 in September indicates a risk that Eurozone GDP growth could also disappoint later this year (see âDeepening contraction in Germany drags Eurozone growth to a haltâ). Chinaâs stimulus package will not be a global game changer, in our view. But less-depressed domestic demand in China could remove one headwind and support our view that Eurozone growth will stage a recovery from spring 2025 onwards after a period of very subdued growth up to then.

Holger Schmieding

Chief Economist

holger.schmieding@berenberg.com

+44 7771 920377

Felix Schmidt

Senior Economist

+49 69 91 30 90 1167

Salomon Fiedler

Economist

+44 20 3753 3067

Andrew Wishart

Senior UK Economist

+44 20 3753 3017

Disclosures

This material is intended as commentary on political, economic or market conditions for institutional investors or market professionals only and does not constitute a financial analysis or a research report as defined by applicable regulation. See the "Disclaimers" section of this report.

The commentary included herein was produced by Joh. Berenberg, Gossler & Co. KG (Berenberg). For sales inquiries, please contact:

Phone: +44 (0)20 3207 7800

Email: berenberg.economics@berenberg.com

BERENBERG

Joh. Berenberg, Gossler & Co. KG

Neuer Jungfernstieg 20

20354 Hamburg

Germany

Registered Office: Hamburg, Germany

Local Court Hamburg HRA 42659