Click here for full report and disclosures

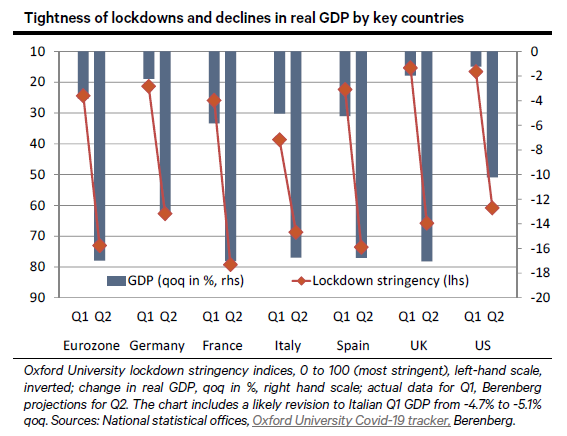

â Lockdown recession: The coronavirus knows no borders. But the damage is not uniform. Using daily data from the University of Oxford, we calculate the average degree of restrictions that major countries of the advanced world have imposed to combat the pandemic. As the chart shows, countries with tighter average restrictions in Q1 such as France and Italy suffered a worse drop in Q1 GDP than the US, the UK and Germany, which introduced lockdowns later (US, UK) and/or less harshly (US, UK, Germany). See this report for a survey of lockdown issues and strategies as of 7 May.

â At the trough: The spread of the virus has slowed down, in Continental Europe more so than in the US and the UK. In response, countries have started to lift restrictions. To estimate a likely average degree of restrictions for Q2, we assume that each country will gradually remove half of its current (14 May) restrictions until the end of June. We expect GDP in the advanced world to plunge in Q2 by more than ever before in peacetime. By and large, the depth of the Q2 recession will likely correspond roughly to the harshness of restrictions that countries are maintaining in Q2 – see chart.

â The restrained rebound: While lockdowns will likely be lifted gradually in coming months, some restrictions on international travel and big public events may have to be maintained into 2021. Social distancing rules will also affect some businesses. Nonetheless, most economic supply can probably be switched on again in the coming months. Unfortunately, demand is likely to lag behind supply. Scared by the pandemic experience, consumers will hold back on purchases for a while, businesses will invest less than they would have done otherwise. Chinese data showing a 3.9% yoy rise in industrial output but a 7.5% yoy drop in retail sales for April fit the pattern we expect for the advanced world.

â Tick-shaped recovery: Despite some fast initial gains in output in the worst-affected sectors once supply is switched on again, it will take roughly two years for GDP to rise back from the Q2 2020 trough to the pre-pandemic level of late 2019. Even then, private consumption and business investment will probably take another year to recover fully. We look for the significant fiscal boost that is being put into the pipeline to close this demand gap by mid-2022.

â The big risk: In the US and the UK, a tardy and occasionally incoherent response of national leaders may have exacerbated the pandemic problem, propelling both countries to the top of the infections tables for advanced countries. Whereas the UK is now lifting its restrictions only very cautiously, parts of the US are already easing up while the infections curve is not yet as flat as in Continental Europe. Therein lies a risk: if the virus were to come back badly in a second wave, a need to re-instate harsh lockdowns on a broad scale could deal a huge blow to the economic outlook as well as to financial markets across the globe. We do not expect this risk to materialise. The massive ramping up of testing capacities in the US, the UK and Continental Europe should enable countries to spot and contain new regional hotspots early before they trigger a massive national second wave. But as economists who cannot really judge the virus dynamics, we need to acknowledge that, for this year, risks to our outlook remain tilted to the downside.

Chief Economist

+44 20 3207 7889

holger.schmieding@berenberg.com

Senior Economist

+44 20 3465 2672

kallum.pickering@berenberg.com

Florian Hense

European Economist

+4420 3207 7859

Disclosures

This material is intended as commentary on political, economic or market conditions for institutional investors or market professionals only and does not constitute a financial analysis or a research report as defined by applicable regulation. See the "Disclaimers" section of this report.

The commentary included herein was produced by Joh. Berenberg, Gossler & Co. KG (Berenberg). For sales inquiries, please contact:

Phone: +44 (0)20 3207 7800

Email: berenberg.economics@berenberg.com

BERENBERG

Joh. Berenberg, Gossler & Co. KG

Neuer Jungfernstieg 20

20354 Hamburg

Germany

Registered Office: Hamburg, Germany

Local Court Hamburg HRA 42659