Click here for full report and disclosures

Click here to request a call about this note.

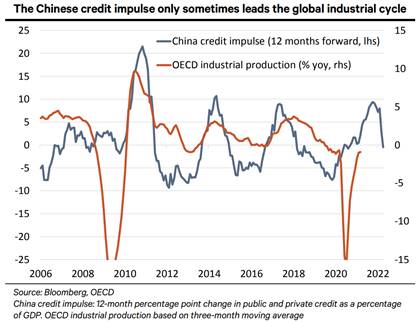

â Trouble ahead? A widely watched leading indicator of the global industrial cycle, the Chinese credit impulse, is now dropping sharply, having rolled over last autumn already. Does this put our above-consensus calls for economic growth in the advanced world at risk, in line with the âpeak growthâ concerns? In our view, it does not.

â China matters – up to a point: China often drives the global industrial cycle. But to some extent, the apparent fit of the chart reflects a sequence of events more than a strong causality. Upon the start of the Lehman crisis in late 2008 and the COVID-19 pandemic in early 2020, China went for a big stimulus. Shortly afterwards, the global cycle turned up. Although China contributed to the global rebound, the massive policy response of the US and Europe mattered even more.

â A natural correction: When the world economy succumbed to its worst post-war recession early last year, Beijing needed a big stimulus to stabilise and revive its economy during an unusual plunge in demand from abroad. Amid a rapid rebound in the global economy, which started last summer and is now gathering pace again after the lull caused by the winter wave of the pandemic in much of the northern hemisphere, China no longer has to offset an external weakness with a domestic stimulus. A self-sustaining global upturn needs no further artificial Chinese stimulus.

â Mind the base effect: In a mechanical sense, the Chinese credit impulse almost certainly predicts the overall direction of the yoy changes in global industrial output for the remainder of 2021. Because of the pandemic-related collapse of output in April 2020, the yoy output growth rate will show an unprecedented surge in April 2021. US data with a 22.8% yoy gain in manufacturing for April already shows that. As the base effect fades in the months ahead, reflecting the rebound in global output from May 2020 onwards, the yoy rate will moderate without any change in underlying trends.

â Solid growth beyond the rebound: Even abstracting from that base effect, the pace of output growth in the advanced world will likely decelerate in late 2021 or early 2022 once economies have returned to their pre-pandemic level of activity and the first rush to rebuild inventories has run its course. That will be part and parcel of a welcome return to less unusual times. The key question for the economic outlook and for risk markets is whether momentum will then stay firm or slow below normal. On that count, we remain more optimistic than consensus. Healthy consumer balance sheets on both sides of the Atlantic, a sustained upturn in business investment and a major push to raise public investment in the US and Europe can continue to drive above-trend gains in demand in 2022 and, probably, beyond.

â Have money, will spend: Despite the rapid rise and relevance of China in recent decades, wealthy western consumers remain the most important driver of the global economic cycle. They have accumulated a huge pile of excess cash during the pandemic as generous fiscal initiatives supported incomes, while lockdowns and other restrictions limited spending opportunities. From Q1 2020 through Q1 2021, US households accumulated an excess of savings worth some 20% of a usual year of consumption (2019 basis), with c14% for consumers in the eurozone and c15% in the UK. Eager to go out and spend after many months stuck mostly at home, cash-flush westerners want to enjoy themselves again. This will keep demand high for global producers through 2021 and 2022 – even as demand growth from China moderates.

Chief Economist

+44 20 3207 7889

holger.schmieding@berenberg.com

Senior Economist

+44 20 3465 2672

kallum.pickering@berenberg.com

Disclosures

This material is intended as commentary on political, economic or market conditions for institutional investors or market professionals only and does not constitute a financial analysis or a research report as defined by applicable regulation. See the "Disclaimers" section of this report.

The commentary included herein was produced by Joh. Berenberg, Gossler & Co. KG (Berenberg). For sales inquiries, please contact:

Phone: +44 (0)20 3207 7800

Email: berenberg.economics@berenberg.com

BERENBERG

Joh. Berenberg, Gossler & Co. KG

Neuer Jungfernstieg 20

20354 Hamburg

Germany

Registered Office: Hamburg, Germany

Local Court Hamburg HRA 42659