Click here for full report and disclosures

Click here to request a call about this note.

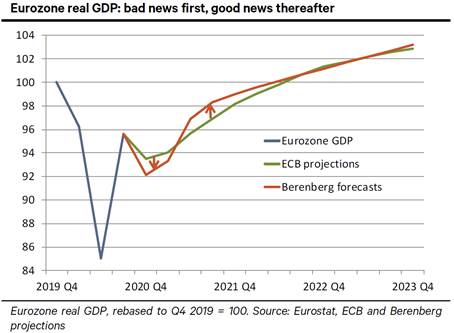

â A sharper or flatter profile? Battered by the SARS-CoV-2 pandemic, economic activity remains on a rollercoaster. After plunging by a record 11.7% qoq in Q2, the Eurozone recovered almost the entire Q2 loss with a 12.5% qoq rebound in Q3. But due to renewed lockdowns to contain the second wave, GDP looks set to decline again in late 2020. But how bad will it be – and how fast can the region recover thereafter? On these counts, the staff projections of the European Central Bank (ECB) and our own forecasts differ substantially – see chart. We look for a bigger decline in activity in late 2020 than the ECB – followed by a much stronger rebound next spring to take GDP well above ECB projections by mid-2021.

â A dark December: Near-term, the renewed rise in infections to record levels in many countries, high death rates across the Eurozone and the return to harsh lockdowns – for instance in Germany and the Netherlands – will likely take a heavy toll on activity. The easing of some November restrictions in a few countries, such as France and Belgium, in December will not suffice to offset this damage. The ongoing rebound in manufacturing backed by a need to replenish inventories and solid export demand will curtail the losses in Q4. However, the collapse in activity by up to 30% in March and April illustrates the potential lockdown hit to some consumer-facing services. We would be surprised if Eurozone GDP were to contract merely by 2.2% qoq in Q4, as the ECB – and Bloomberg consensus – expect. Having projected a Q4 decline in GDP by 3.0% at the cut-off time of the ECB forecast on 17 November, we lowered that call to -3.6% qoq two weeks ago.

â Back and forth in Q1: Restrictions that are sufficiently tight can contain the spread of the virus even in the dark and cold season. France, Italy, Belgium and other countries showed that in November. However, a premature loosening of restrictions or insufficient measures such as those in Germany in November and early December can allow the situation to worsen. For Q1, we pencil in some back and forth across the Eurozone, a loosening of restrictions in many places for some of the time followed by some renewed tightening here and there. GDP will likely increase only modestly in Q1.

â Sunny spring: The advent of sunnier and warmer weather should help to reduce the spread of the virus. Vaccination campaigns will also reduce the medical risks over time. Judging by the almost V-shaped rebound in Q3 2020 from the Q2 plunge, we expect a strong 3.8% qoq surge in activity in Q2 2021 to erase the Q4 2020 drop. Of course, consumers and businesses may hold back by more and for longer after the second wave than after the first wave. Twice bitten, twice shy. However, the December rebound in the French services PMI to 49.2 from 38.8 in November after the re-opening of non-essential shops shows that the mood and the readiness to spend is not (yet) impaired by the recent round of restrictions. In 2021, GDP may be boosted instead by pent-up demand to meet friends in the pub or frolic on Mediterranean beaches.

â Whatever it takes: At its 10 December meeting, the ECB de facto vowed to do whatever it takes to ensure very favourable financing conditions for households, companies and sovereigns. Weaker data for early 2021 may fuel speculation that the ECB could buy more assets; a strong bounce in Q2 coupled with some increase in core inflation could lead to market talk that the ECB may buy less than expected. We would not pay much attention to that. The precise amount of purchases does not matter much. The ECB will prevent any major rise in financing costs that could harm the economic rebound. The monetary and fiscal tailwind for economies and markets will continue to blow strongly throughout 2021.

Chief Economist

+44 20 3207 7889

holger.schmieding@berenberg.com

Senior Economist

+44 20 3465 2672

kallum.pickering@berenberg.com

Florian Hense

European Economist

+4420 3207 7859

Disclosures

This material is intended as commentary on political, economic or market conditions for institutional investors or market professionals only and does not constitute a financial analysis or a research report as defined by applicable regulation. See the "Disclaimers" section of this report.

The commentary included herein was produced by Joh. Berenberg, Gossler & Co. KG (Berenberg). For sales inquiries, please contact:

Phone: +44 (0)20 3207 7800

Email: berenberg.economics@berenberg.com

BERENBERG

Joh. Berenberg, Gossler & Co. KG

Neuer Jungfernstieg 20

20354 Hamburg

Germany

Registered Office: Hamburg, Germany

Local Court Hamburg HRA 42659