Click here for full report and disclosures

â On track for a tick-shaped rebound: On both sides of the Atlantic, the latest data show that economies are recovering from the COVID-19 mega-recession. Following a record drop in output in March and April, confidence, spending and expectations turned up nicely in May as countries eased restrictions. This supports our call that major economies can enjoy a robust âtick shapedâ recovery and that the lasting damage from the COVID-19 will be minimal.

â Solid snap back in the US: Retail sales surged by a record 17.7% mom in May. The reopening of the US economy, pent-up demand and very generous government transfer payments helped to underpin the strong recovery in demand after a 10.5% mom rise in personal incomes in April. Reacting to the positive surprise, we upgraded our 2020 US real GDP forecast to a decline of 4.1% from 6.4% previously.

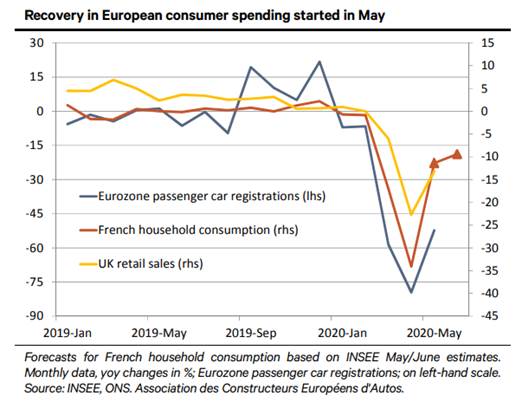

â Good news in European data too: With the easing of lockdowns in major parts of Europe in May, households have started to open their wallets again. The rebound seems to be less impressive than in the US, partly because the transfers to unemployed and furloughed workers are less generous than in the US. Still, Eurozone car registrations, French consumption and UK retail sales all rebounded in May – see chart. Helped by supportive fiscal and monetary policies and a further easing of restrictions, European demand will likely recover further in the coming months.

â European upgrade: Incoming data suggest that the economic recovery started in earnest roughly two weeks earlier than we had anticipated. Although we saw some tentative evidence of a modest recovery in high frequency data such as retail footfall, energy consumption and port traffic already in early May, the first batch of hard data for May is on balance slightly better than expected. As a result, we upgrade our Eurozone and UK economic forecasts modestly.

â Shallower recession: Because of an early start to the rebound, Q2 data for major parts of Europe will probably be slightly less horrific than initially anticipated. With less of a contraction for Q2 overall, the Q3 snapback will also not be quite as pronounced either as more supply was switched back on in Q2 already. In the Eurozone, we now expect real GDP to contract by 9.0% in 2020 instead of 9.6%, followed by growth of 6.9% instead of 7.1% in 2021. The risks to these forecasts are balanced. For the UK, we upgrade our 2020 call to -9.0% from -10.0% while cutting 2021 to 5.0% from 6.0%. Amid continued UK-EU continued uncertainty, the risks to the UK outlook remain tilted to the downside.

â One swallow does not a summer make: Despite some early evidence of a robust rebound in major western economies, economic activity remains very depressed relative to potential. The outlook remains uncertain and a recovery hinges on continued stable or improving virus trends, a sustained rebound in confidence, generous economic policy support and no new negative surprises. On balance, we are cautiously optimistic that the key components for a sustained rebound are in place. After many months of massive disappointments, we are finally seeing a few positive surprises.

Chief Economist

+44 20 3207 7889

holger.schmieding@berenberg.com

Senior Economist

+44 20 3465 2672

kallum.pickering@berenberg.com

Florian Hense

European Economist

+44 20 3207 7859

Disclosures

This material is intended as commentary on political, economic or market conditions for institutional investors or market professionals only and does not constitute a financial analysis or a research report as defined by applicable regulation. See the "Disclaimers" section of this report.

The commentary included herein was produced by Joh. Berenberg, Gossler & Co. KG (Berenberg). For sales inquiries, please contact:

Phone: +44 (0)20 3207 7800

Email: berenberg.economics@berenberg.com

BERENBERG

Joh. Berenberg, Gossler & Co. KG

Neuer Jungfernstieg 20

20354 Hamburg

Germany

Registered Office: Hamburg, Germany

Local Court Hamburg HRA 42659