Click here for full report and disclosures

Click here to request a call about this note.

â Rapid rebound: After a mild dip in activity during the winter virus wave, the Eurozone economy is bouncing back fast. The broad-based surge in economic sentiment in May to within striking distance of its all-time high of December 2017 tilts the risk to our above-consensus calls for growth of 4.5% in 2021 and 4.4% in 2022 to the upside. With luck, the Eurozone may return to its pre-pandemic level of GDP in late 2021 instead of Q1 2022, as we currently project. Todayâs European Commission sentiment survey adds to the string of positive surprises from the purchasing managersâ indices and the key national business confidence surveys from Germany, France, Italy and other Eurozone member countries.

â Switching the economy back on: Following the US and the UK, the Eurozone has brought the winter wave of the pandemic under control. The rate of recorded infections, which had peaked well below the respective peaks in the US and the UK, has now fallen to its lowest level since September 2020. Warmer weather and rapid vaccination progress bodes well for the coming months. After a slow start to the campaign, the share of people who have received at least one jab has now risen to c39% in the Eurozone versus 57% in the UK and 49% in the US. As restrictions are relaxed gradually, high-frequency data such as retail and recreation footfall point to an ongoing rebound in consumer spending on services.

â We have a problem – but it is the right kind of problem: Like other regions, the Eurozone is facing an unusual problem: demand is outstripping supply. Shortages of semi-conductors and other critical supplies are hampering production in some sectors. As a result, we are not raising our forecast for a 1.8% qoq bounce in GDP in Q2 despite the positive survey data. However, we expect such supply issues to resolve soon. Elevated prices for critical inputs provide a strong incentive to produce more of them. Amid a buoyant inflow of orders, companies are likely to work overtime once these inputs become available again. Temporary supply shortages may thus distort the quarterly profile of the rebound and force some firms to shift some production into the second half of this year – or potentially even into early next year. But we do not expect these temporary bottlenecks to hold back the rebound from the pandemic for good.

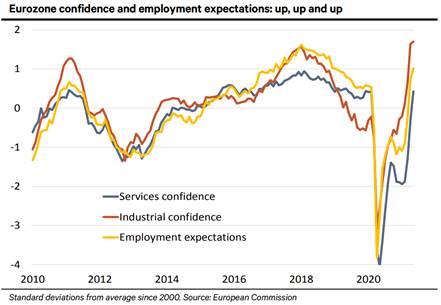

â Industry in the lead: Following the surge to a record high in April, confidence in the Eurozoneâs export-oriented industry advanced even further in May – see chart. The new rise in order books to the best level since June 2018 more than outweighed the modest decline in output expectations from their April 2021 record caused by some supply shortages. Eurozone industry faced increasing headwinds from early 2018 onwards as a temporary correction in China gave way to the disruptive US-Chinese trade war and the carnage from the first wave of the pandemic. This is over. Today, the Eurozone is benefiting nicely from a global tailwind, which we expect to blow at least through 2022.

â The strength at home: Helped by a major improvement in expectations as well as the assessment of the recent situation, services confidence rose to its pre-pandemic level in May. Encouragingly, employment expectations in the private economy advanced to their best level since the end of 2018. In all major sectors of the economy, companies expect to hire more workers. The Eurozone looks set to take the crucial step to make the recovery self-sustaining and to propel GDP well beyond its pre-pandemic level by early 2022 at the latest.

Holger Schmieding

Chief Economist

+44 20 3207 7889

holger.schmieding@berenberg.com

Kallum Pickering

Senior Economist

+44 20 3465 2672

kallum.pickering@berenberg.com

Disclosures

This material is intended as commentary on political, economic or market conditions for institutional investors or market professionals only and does not constitute a financial analysis or a research report as defined by applicable regulation. See the "Disclaimers" section of this report.

The commentary included herein was produced by Joh. Berenberg, Gossler & Co. KG (Berenberg). For sales inquiries, please contact:

Phone: +44 (0)20 3207 7800

Email: berenberg.economics@berenberg.com

BERENBERG

Joh. Berenberg, Gossler & Co. KG

Neuer Jungfernstieg 20

20354 Hamburg

Germany

Registered Office: Hamburg, Germany

Local Court Hamburg HRA 42659