Click here for full report and disclosures

Click here to request a call about this note.

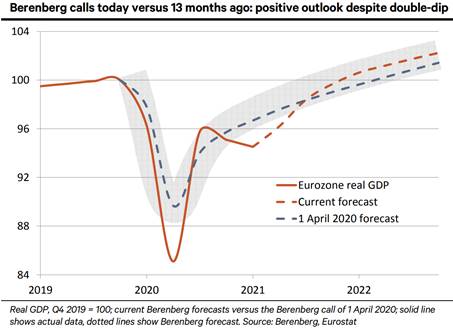

â No alphabet soup: At the height of the first wave of the pandemic 13 months ago, we predicted that advanced economies would rebound in a tick-shaped fashion. Neither a V, W nor L – let alone a K – would adequately describe the recovery that would start rapidly, lose momentum over time, but remain above the pre-pandemic trend rate of growth. We predicted that the Eurozone would return to its pre-pandemic level by early 2022. Despite a host of surprises in the meantime, the region seems to be on track for our above-consensus call and may even surpass it next year.

â Three negative surprises: A year ago, the economy tanked by more than we had initially expected for Q2 2020. Even worse, we had not pencilled in the dramatic new wave of the pandemic that hit the advanced world in November. More importantly, we had not expected that the spread of a more contagious variant of the virus would force much of Europe to extend the semi-lockdowns of November 2020 into, or even through, April 2021.

â A mild double-dip: As a result of the second and third of these negative surprises, the Eurozone economy fell into a double-dip recession. Real GDP contracted by 0.6% qoq in Q1 2021 after a 0.7% fall in Q4. While France eked out a little growth (0.4% qoq in Q1) and Italy and Spain got away somewhat lightly (-0.4% and -0.5% qoq, respectively), Germany suffered a 1.7% drop after having expanded by 0.5% (revised up from 0.3%) in Q4 2020. We estimate that the severe frost in February subtracted at least 0.3% from German Q1 GDP. That loss will be recovered with the advent of spring.

â Three positive surprises: Over the past 13 months, economic policy, global manufacturing and the rapid snap-back from the first virus wave surpassed our fairly optimistic expectations. Whereas Eurozone policy makers reacted roughly in line with our calls, keeping real household disposable incomes constant in 2020, we had not expected the US to raise disposable income by 5.8% in 2020 through unprecedented transfers. Boosted by US and Chinese stimuli and a need to replenish inventories, Eurozone industrial confidence surged to a record 10.7 in April from an already elevated 2.1 in March, far above the post-1999 average of -4.2. As usual, industry is riding the wave of global demand nicely.

â Back to more normal as fast as possible: Of the three positive surprises, none has been more impressive than the Eurozoneâs rapid rebound in Q3 last year when the economy recovered almost the entire unprecedented 11.6% qoq drop in real GDP of Q2, leaving the economy just 4.2% below its pre-pandemic level. We see this as a precedent: with the easing of restrictions that is now starting once more in the Eurozone, demand looks set to surge again.

â The upswing has started: Judging by high-frequency data ranging from retail and recreation footfall to economic sentiment and surveys of purchasing managers, the Eurozone economy hit the trough of the double-dip in February when exceptionally cold weather in core Europe added to the virus-related woes. Despite the new wave of the pandemic, activity apparently edged up already in March and gained significant momentum in April when confidence in the service sector surged from -9.6 to a 14-month high of 2.1. As the vaccination campaign picks up pace, with the share of the population that has received at least one shot doubling from 12.5% to 25% in April, we look for a strong bounce in activity from May onwards. While risks remain, chances are that reality may beat our above-consensus calls.

Holger Schmieding

Chief Economist

+44 20 3207 7889

holger.schmieding@berenberg.com

Kallum Pickering

Senior Economist

+44 20 3465 2672

kallum.pickering@berenberg.com

Disclosures

This material is intended as commentary on political, economic or market conditions for institutional investors or market professionals only and does not constitute a financial analysis or a research report as defined by applicable regulation. See the "Disclaimers" section of this report.

The commentary included herein was produced by Joh. Berenberg, Gossler & Co. KG (Berenberg). For sales inquiries, please contact:

Phone: +44 (0)20 3207 7800

Email: berenberg.economics@berenberg.com

BERENBERG

Joh. Berenberg, Gossler & Co. KG

Neuer Jungfernstieg 20

20354 Hamburg

Germany

Registered Office: Hamburg, Germany

Local Court Hamburg HRA 42659

Joh. Berenberg, Gossler & Co. KG is a Kommanditgesellschaft (a German form of limited partnership) established under the laws of the Federal Republic of Germany registered with the Commercial Register at the Local Court of the City of Hamburg under registration number HRA 42659 with its registered office at Neuer Jungfernstieg 20, 20354 Hamburg, Germany. A list of partners is available for inspection at our London Branch at 60 Threadneedle Street, London, EC2R 8HP, United Kingdom.

Joh. Berenberg, Gossler & Co. KG is authorised by the German Federal Financial Supervisory Authority (BaFin) and deemed authorised and regulated by the Financial Conduct Authority. The nature and extent of consumer protections may differ from those for firms based in the UK. Details of the Temporary Permissions Regime, which allows EEA-based firms to operate in the UK for a limited period while seeking full authorisation, are available on the Financial Conduct Authorityâs website. For further information as well as specific information on Joh. Berenberg, Gossler & Co. KG, its head office and its foreign branches in the European Union please refer to http://www.berenberg.de/en/corporate-disclosures.html.