Click here for full report and disclosures

â Stagnation: Depressed by an apparent pre-Christmas collapse in retail sales and a decline in machinery investment, the German economy stagnated in Q4 2019. As supply chain interruptions caused by the coronavirus pandemic may temporarily weigh on manufacturing output, the economy may not fare much better in early 2020. We would not pay much attention to these weak data, though. As special factors distorted the December data and most pandemic-related losses in manufacturing output will likely be recovered once supplies from China are flowing in again, the underlying momentum of the German economy seems to be less subdued than the current hard data indicate.

â A questionable quarter: According to Destatis, a reduced momentum in private consumption and public spending contributed to stagnation in Q4 2019. We would take this with a pinch of salt. Solid gains in real disposable incomes and still elevated levels of consumer confidence suggest that the data will either be revised up for late 2019 or show a significant snapback for early 2020. Also, Germany looks set to step up its slow-motion fiscal stimulus from c0.3% of GDP in 2019 to c0.4% this year as the supply constraints holding back public investment growth are easing.

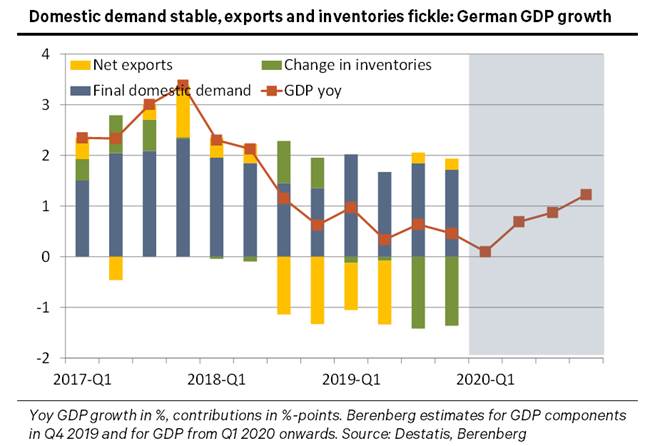

â Shifting trends: Annual comparisons bring out the trends more clearly than the more volatile quarterly changes that can be subject to significant revisions. As our chart shows, the yoy change in German GDP has plunged from a recent peak of 3.4% in Q4 2017 to just 0.5% in late 2019. Base effects and the coronavirus impact may depress the rate to a trough of 0.1% in early 2020 before a gradual recovery may set in.

â The story behind the headline data: Our chart brings out the shifts in demand that are driving German GDP. A synchronised global upswing supported by a major Chinese stimulus in 2017 and the early 2018 US tax cut raised net exports strongly in 2017 and early 2018. With a slight lag, companies reacted by building up inventories. When export growth started to stall in late 2018 under the impact of trade war uncertainties, Brexit risks and a generic Chinese slowdown, net exports subtracted from GDP growth. In response to these external shocks, companies curtailed their inventories strongly over the course of last year. Judging by the available data for the first three quarters of 2019 and Destatis comments about Q4, the inventory correction may have depressed 2019 annual GDP by a very significant 0.7ppt. As import growth has softened in line with a reduced desire to hold inventories, net exports no longer subtracted from GDP in late 2019 on a yoy basis.

â The strength at home: Inventory corrections are temporary factors. We expect inventories, which are notoriously difficult to estimate, to stabilise at a lower level from Q2 2020 onwards. Despite some quarterly volatility such as a weaker Q4 after a robust Q3, final domestic demand has proven to be remarkably stable and resilient amid the major gyrations in GDP over the past few years. We look only for a modest temporary loss of momentum for final domestic demand this year. If exports and imports pick up gradually from Q2 2020 onwards amid less pronounced trade tensions and a fading of the coronavirus impact, the end of the inventory correction should underpin a gradual return of German GDP growth towards a rate close to the underlying trend of almost 1.5% by late 2020.

Chief Economist

+44 20 3207 7889

holger.schmieding@berenberg.com

Senior Economist

+44 20 3465 2672

kallum.pickering@berenberg.com

Florian Hense

European Economist

+4420 3207 7859

Disclosures

This material is intended as commentary on political, economic or market conditions for institutional investors or market professionals only and does not constitute a financial analysis or a research report as defined by applicable regulation. See the "Disclaimers" section of this report.

The commentary included herein was produced by Joh. Berenberg, Gossler & Co. KG (Berenberg). For sales inquiries, please contact:

Phone: +44 (0)20 3207 7800

Email: berenberg.economics@berenberg.com

BERENBERG

Joh. Berenberg, Gossler & Co. KG

Neuer Jungfernstieg 20

20354 Hamburg

Germany

Registered Office: Hamburg, Germany

Local Court Hamburg HRA 4265