Click here for full report and disclosures

â It ainÂft over yet: After a spectacular bull run for risk assets such as equities, two macro concerns rattled markets in the past two weeks: 1) will the best growth be over soon, and 2) will higher inflation force central banks to tighten the reins to such an extent that equities are crushed in a pincer grip of slower growth and higher bonds yields? Both concerns contain a kernel of truth. But both are overdone. The macroeconomic backdrop for risk assets remains favourable, in our view.

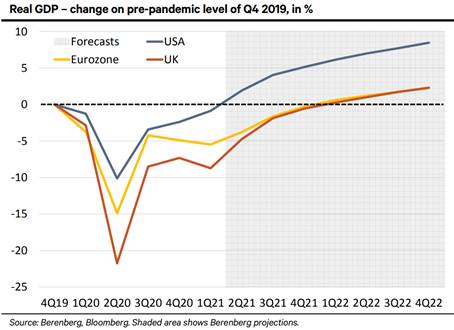

â Peak growth? The term âpeak growthâ is a misnomer. Harsh lockdowns in the US and across Europe to curb the COVID-19 pandemic from February 2020 had caused a once-in-a-lifetime collapse in economic activity. Between Q4 2019 and Q2 2020, real GDP plunged by c10% in the US, by c15% in the Eurozone and by c22% in the UK. Upon the reopening of economies, activity snapped back rapidly from May to October 2020. But a snap-back from supply restrictions should not be treated as âgrowthâ in the normal sense.

â Big bounce after the big switch-on: After a temporary slowdown in the US and some setback in Europe in reaction to the winter wave of the pandemic, the snap-back has started again in the US and the UK and looks set to do so shortly in the Eurozone. Compared with this bounce, all future growth rates must by definition look less impressive. But that is the wrong comparison. What matters is whether growth can remain above the sluggish pre-Lehman trend even after economies have started to surpass their pre-pandemic GDP (US Q2 2021, Eurozone and UK Q1 2022).

â Still room for upside surprises: Fuelled by pent-up demand from consumers, who are sitting on a huge pile of excess savings, as well as aggressive policy support from major governments and central banks, we expect growth to surprise to the upside relative to market expectations over the next two years. Across the western world, our forecasts for real GDP are above consensus: US at 7.2% (6.3%) for 2021 and 4.6% (4.0%) for 2022; Eurozone at 4.4% (4.1%) for 2021 and 4.4% (4.2%) for 2022; and the UK at 6.8% (5.7%) for 2021 and 5.5% (5.5%) for 2022 (consensus data in brackets, taken from Bloomberg). Even beyond the next two years, we expect the advanced world to gradually return to the pre-Lehman normal: less subdued inflation, faster gains in GDP per capita and productivity as well as less depressed central bank rates and bond yields. The adjustment may not always be smooth. However, sustained better economic performance should overwhelm any temporary bouts of fear.

â Still in the sweet spot: The surge in US and – to a lesser extent – in Eurozone inflation is making headlines. For three reasons, it should not cause a sustained bear market in equities. 1) Part of the spike reflects temporary base and one-off effects that will not be repeated. For example, transport and other supply bottlenecks are likely to ease over time. 2) The overall modest uptrend in underlying inflation that we predict partly reflects companiesâ increased pricing power amid sustained rapid gains in demand; this is good for earnings. 3) Central banks will have to react eventually, but will not do so in a hurry. Relative to the expansion of nominal demand, central bank rates and bond yields will likely remain favourable for years to come. From a macroeconomic perspective, the sweet spot of the cycle need not be over yet.

Chief Economist

+44 20 3207 7889

holger.schmieding@berenberg.com

Senior Economist

+44 20 3465 2672

kallum.pickering@berenberg.com

Disclosures

This material is intended as commentary on political, economic or market conditions for institutional investors or market professionals only and does not constitute a financial analysis or a research report as defined by applicable regulation. See the "Disclaimers" section of this report.

The commentary included herein was produced by Joh. Berenberg, Gossler & Co. KG (Berenberg). For sales inquiries, please contact:

Phone: +44 (0)20 3207 7800

Email: berenberg.economics@berenberg.com

BERENBERG

Joh. Berenberg, Gossler & Co. KG

Neuer Jungfernstieg 20

20354 Hamburg

Germany

Registered Office: Hamburg, Germany

Local Court Hamburg HRA 42659