Click here for full report and disclosures

● Getting serious: The Bank of England (BoE) stepped up its fight against inflation yesterday. The nine-member Monetary Policy Committee (MPC) raised the Bank Rate by a further 50bp to 2.25% and announced a more aggressive balance sheet normalisation. While this was in line with our expectations, some market participants had expected the BoE to follow the US Federal Reserve with a 75bp hike. Five members backed a 50bp hike, three preferred to hike by 75bp and one preferred a mere 25bp move. The balance of votes reflects the uncertain inflation outlook and highlights the risk that future rate hikes could be larger.

● Stepping up quantitative tightening (QT): In addition to raising rates, the BoE yesterday fulfilled its August guidance to begin active gilt sales as part of its ongoing balance sheet normalisation. Over the next 12 months, the BoE plans to reduce its gilt holdings – through ceasing the reinvestment of maturing assets, as well as active sales – by £80bn to £758bn. As long as the unwind remains gradual and predictable, markets are unlikely to throw a tantrum. As a result, market pricing for gilts should largely remain a function of inflation expectations and the expected path of the Bank Rate.

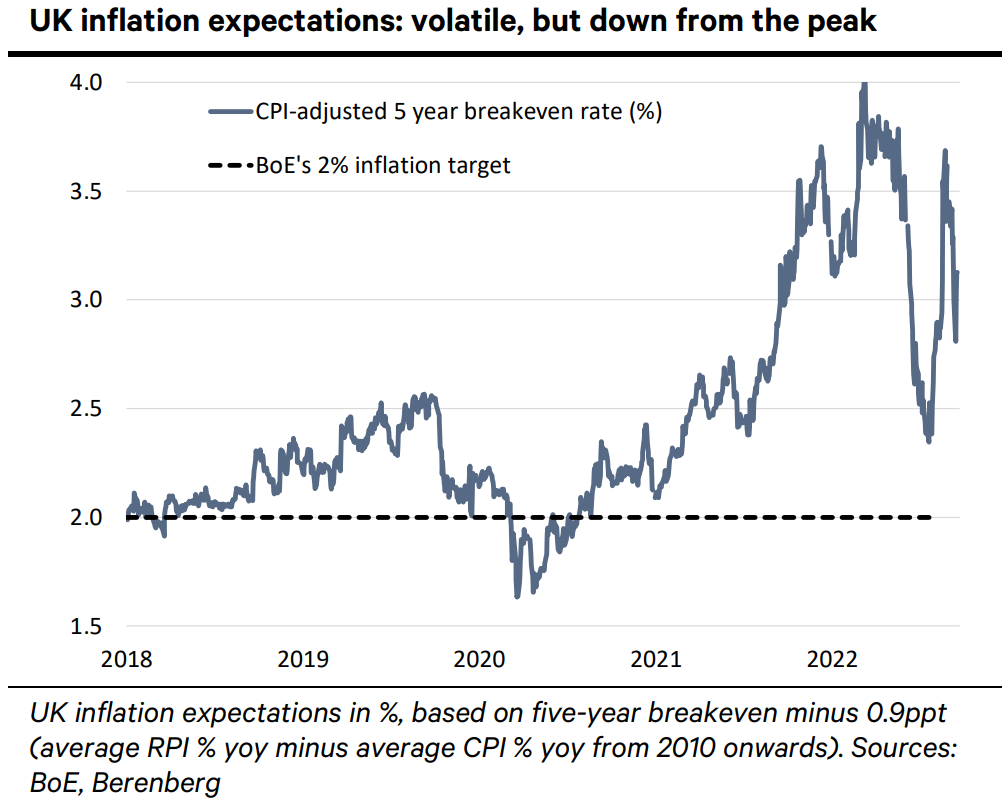

● The expectations game: Although market expectations remain volatile, they have fallen from their peak of nearly 4% in March to c3% currently – despite headline inflation rising from 7% to 10%. That suggests that the BoE is less behind the curve than before. Since UK inflation is a mixture of strong nominal demand combined with a major energy price shock (which monetary policy cannot control), inflation expectations may be a reasonable guide to underlying inflationary pressures. As long as inflation expectations remain broadly under control, there should be little need for the BoE to accelerate the pace of hikes, in our view. Of course, that may depend on what happens next with fiscal policy.

● “Trussonomics” adds to inflation risks: The BoE will provide a detailed assessment of Prime Minister Liz Truss’s economic policies at the November MPC. However, the September minutes provide more than a clue about how the BoE is thinking about their likely impact on growth and inflation. They state that the “Growth Plan” – which Chancellor Kwasi Kwarteng will unveil today – would likely “provide further fiscal support and was likely to contain news that was material for the economic outlook”. In addition, they note that the “Energy Price Guarantee” for households and firms would “lower and bring forward the expected peak in CPI inflation”, but would mean the “pressure of demand relative to supply was likely to be stronger than previously expected”. The BoE’s initial verdict seems clear: less inflation than previously thought near term, but possibly more than expected further out.

● Steeper path for rates: Judging by the balance of votes and the BoE’s warnings about Trussonomics, rates are likely to rise further and remain higher over the medium term than we had previously expected. We, therefore, raise our year-end estimate for the Bank Rate by 25bp, to 3.25%. We now expect the BoE to hike by 50bp at both its November and December meetings, up from 50bp and 25bp previously. The risks for November are skewed towards a 75bp hike – that may depend on what the Growth Plan involves. Instead of holding in early 2023, we now look for a further 25bp hike in February to take the Bank Rate to a cycle peak of 3.5% – versus 3% previously. With our expectation for 50bp of cuts in H2 2023 and 25bp in H1 2024 unchanged, our call for the 2024 year-end Bank Rate increases to 2.75% from 2.25%.

Chief Economist

+44 7771 920 377

holger.schmieding@berenberg.com

Senior Economist

+44 20 3465 2672

kallum.pickering@berenberg.com

Economist

+44 20 3753 3067

Disclosures

This material is intended as commentary on political, economic or market conditions for institutional investors or market professionals only and does not constitute a financial analysis or a research report as defined by applicable regulation. See the "Disclaimers" section of this report.

The commentary included herein was produced by Joh. Berenberg, Gossler & Co. KG (Berenberg). For sales inquiries, please contact:

Phone: +44 (0)20 3207 7800

Email: berenberg.economics@berenberg.com

BERENBERG

Joh. Berenberg, Gossler & Co. KG

Neuer Jungfernstieg 20

20354 Hamburg

Germany

Registered Office: Hamburg, Germany

Local Court Hamburg HRA 42659