|

Sources: Bureau of Labor Statistics, Haver Analytics |

Click here for full report and disclosures

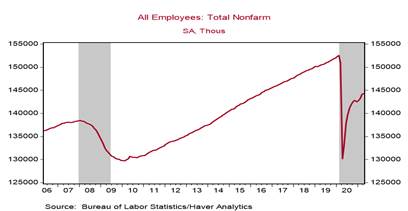

â The U.S. Bureau of Labor Statistics reported 266,000 payroll gains in April in its Establishment Survey, seemingly understating widespread anecdotal evidence of strong labor markets, but it also highlighted mounting wage pressures, while the Household Survey reported another jump in the labor force. Adding up the evidence, labor markets are continuing to recover strongly.

â The monthly data are bouncing around lot. Marchâs 770k gains were strong. Not surprisingly, employment in the leisure and hospitality sector rose 331k. More difficult to explain are the net reported declines in manufacturing and construction and all other service sectors, including transportation and warehousing, education and health, and finance.

â The labor force is increasing but the supply of workers is insufficient. A sizable 430k increase in the labor force lifted the labor force participation rate to 61.7 and household employment rose 328k, but a 120k rise in unemployment resulted in a tick up in the unemployment rate to 6.1%.

â Wage increases are jumping. Average hourly earnings rose 0.7%, highlighted by 1.6% increases in leisure and hospitality (14 million jobs) and transportation and warehousing (6.7 million jobs), 1.0% in construction (7.3 million jobs) and 0.6% in manufacturing (12.3 million jobs). Average hourly wages have increased 4.4% annualized in the last 6 months, led by increases of 9.1% in leisure and hospitality, 4.9% in transportation and warehousing, and 5.8% in education and health.

â A dominant theme is businesses lack workers, and this is a significant problem. Some workers are reticent to return to work for health reasons, and there are geographic and skill mismatches. Also, the governmentÂfs generous enhanced unemployment compensation may discourage some from taking jobs. This poses a challenge to the Biden Administration and the Federal Reserve that continue to go all-out in pumping up the economy while downplaying the probability that wage increases can persist when the economy is not operating at full employment (Critical issues as the U.S. economy reopens, May 5).

Chief Economist US, Americas and Asia

+1 646 949 9099

Disclosures

This material is intended as commentary on political, economic or market conditions for institutional investors only and should not be construed as a research report as defined by applicable regulation. See the "Disclaimers" section of this report.

The commentary included herein was produced by the Economics Department of Berenberg Capital Markets, LLC (BCM). Joh. Berenberg, Gossler & Co. KG (Berenberg) may distribute this material on a third party basis. For sales inquiries, please contact:

BERENBERG

London Branch

60 Threadneedle Street

London

EC2 8HP

United Kingdom

Phone: +44 (0)20 3207 7800

Email: berenberg.economics@berenberg.com

This email and any files or attachments transmitted with it may contain confidential or privileged information and are intended solely for the use of the intended recipient. If you are not the intended recipient, please do not copy, retain, disclose or use any part of the message or its attachments. Please notify the sender immediately by return email and destroy or delete any copies. Dissemination or use of this information by anyone other than the intended recipient is unauthorised and illegal. Joh. Berenberg, Gossler & Co. KG (Berenberg) does not accept any liability for any errors or omissions in the content of this message or problems in its transmission. No part of this communication or its content may be rewritten, copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of Joh. Berenberg, Gossler & Co. KG (Berenberg).

Click here to unsubscribe from these emails.