Click here for full report and disclosures

Click here to request a call about this note.

â  Merkelâs long farewell: As the first of three steps to replace German Chancellor Angela Merkel, her centre-right CDU party will elect a new party chairperson at a digital convention this Saturday. The winner will then need to agree with the leader of the Bavarian centre-right CSU, Markus Söder (54), who will be the CDU/CSUâs joint candidate for chancellor (likely after the 14 March elections in two federal states). Whether the candidate will become chancellor depends on the outcome of the national election on 26 September 2021 at the end of Merkelâs fourth and final term.

â  Three candidates are running to lead the CDU: i) Friedrich Merz (65), an erstwhile Merkel rival with strong grassroots support and a centre-right/pro-business policy tilt; ii) Armin Laschet (59), the centrist state prime minister of populous North Rhine-Westphalia with significant backing from the CDUâs upper echelons and with views close to those of Merkel; and iii) Norbert Röttgen (55), a lesser-known centrist who has raised his profile recently.

â  The race seems open: Merz has long led the pack. However, outspoken support from senior CDU officials has lifted Laschetâs fortunes in recent days. Röttgen could still spring a surprise if Laschet drops out in the first round and Röttgen then scoops up the Laschet votes in a same-day run-off against the more divisive Merz. If Merz prevails on 16 January, he would most likely be the CDU/CSUâs joint candidate to succeed Merkel. If Röttgen wins instead, he would probably offer that role to the more popular Söder or to the CDUâs popular health minister Jens Spahn (40). If Laschet wins the intra-CDU race by just a whisker rather than convincingly, he may also be forced to cede to Söder or Spahn.

â  Similar policies â with some exceptions: Despite their different characters and styles, all potential CDU/CSU successors to Merkel would likely pursue similar policies, which would need to be backed by a centre-left coalition partner anyway. Merz might focus a bit more on deregulation. As a foreign policy expert, Röttgen would take a tougher line against China and Russia than Merkel, aligning Germany more closely with the likely stance of Joe Biden.

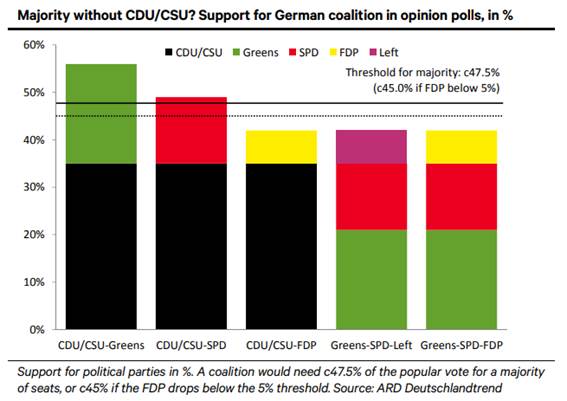

â  The green-red-red risk: The only outcome of the 26 September election that would significantly change the outlook would be a green-red-red coalition between the Greens, the SPD and the Left Party. Such a government without the CDU/CSU may harm the economy through some reform reversals and more regulations. As most major fiscal decisions would need to be approved by the upper house of parliament in which the CDU/CSU would still have a veto, the size of any future stimulus and Germanyâs support for its European partners would only be affected modestly.

â  The Merz paradox: Merz may strengthen the CDU/CSU by taking votes back from the right-wing AfD and the small liberal FDP. But in a more polarised debate, he may also energise the left. Opinion polls show that, taken together, Greens, SPD and Left Party are four points away from the c47.5% needed for a potential majority in parliament â see chart. Merz may raise the tail risk that the CDU/CSU loses power from, say, 20% to 30%. For example, if Merz takes some votes from the FDP, the party may fall below the 5% threshold required to gain seats in parliament. Without the FDP, green-red-red would need only c45% instead of c47.5% to prevail. Laschet and Söder (or Spahn) may appeal more to centrist voters than Merz and contain the tail risk of a green-red-red upset instead of a new CDU-led coalition. Â

Holger Schmieding

Chief Economist

+44 20 3207 7889

holger.schmieding@berenberg.com

Kallum Pickering

Senior Economist

+44 20 3465 2672

kallum.pickering@berenberg.com

Florian Hense

Senior European Economist

+4420 3207 7859

Disclosures

This material is intended as commentary on political, economic or market conditions for institutional investors or market professionals only and does not constitute a financial analysis or a research report as defined by applicable regulation. See the "Disclaimers" section of this report.

The commentary included herein was produced by Joh. Berenberg, Gossler & Co. KG (Berenberg). For sales inquiries, please contact:

Phone: +44 (0)20 3207 7800

Email: berenberg.economics@berenberg.com

BERENBERG

Joh. Berenberg, Gossler & Co. KG

Neuer Jungfernstieg 20

20354 Hamburg

Germany

Registered Office: Hamburg, Germany

Local Court Hamburg HRA 42659