Click here for full report and disclosures

Click here to request a call about this note.

For our 2021 global outlook, see strong rebound ahead.

â  Cannot spend for trying: During a downturn, households prefer to hold more cash as a precaution against an uncertain future and falling incomes. The global coronavirus mega-recession was no different. However, the lockdowns and other such restrictions to contain the virus triggered a sharp rise in additional âinvoluntaryâ savings over and above mere precautionary savings. The closure of shops and restaurants drastically reduced the available opportunities to spend in the first half of 2020, and is doing so again in Europe at the moment. Unlike during normal downturns, when rising unemployment lowers wage incomes, household income has been supported aggressively by direct transfer to households (in the US) or via short-term work and furlough schemes (across Europe). The resulting surge in excess household savings has important implications for the upswing.

â  More savings than in 2008: The rate of household savings on both sides of the Atlantic was off the charts in 2020, even relative to the period after the 2008/09 recession. In the Eurozone, the household savings rate doubled from 12.5% in Q4 2019 to 24.6% in Q2 2020 (versus a peak of 14.2% in Q3 2009). In the US, the savings rate almost tripled from 10.6% to 28.4% over the same period, before falling to 18.9% in Q3 2020 (versus 13% in Q4 2012). In the UK, it almost quadrupled from 7.4% before the pandemic to 26.5% in Q2 before receding to 16.5% in Q3 2020 (versus 12.7% in Q1 2010).

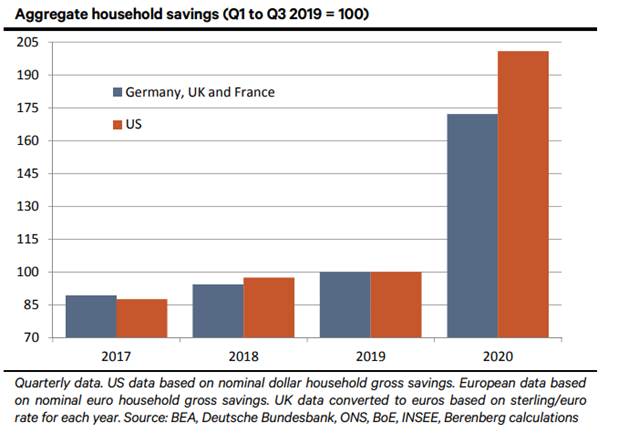

â  How much spare cash? Available data for the first three quarters of 2020 show a 101% increase in aggregate household saving in the US and a 72% total increase for the big three European economies (Germany, the UK and France) â see chart. In the US, the additional $1.4trn in savings in the first three quarters of 2020 compared to the same period a year before is equivalent to 9.6% of 2019 household consumption. For the three big European economies over the same period, the excess saving is â¬290bn, worth 6.2% of 2019 household consumption. Of course, not all the money will be spent. Some will go towards paying down household debt and some may be saved permanently. Still, spending only half of the extra cash as the savings rate normalises would add a very sizeable tailwind to the early stage of the upswing.

â  Solid underlying demand: The risk that households will not unleash their pent-up demand once restrictions are finally eased for good is small, in our view. Current household spending data point to solid underlying demand. Retail spending in the US, Germany and the UK surged above pre-pandemic levels in the summer and autumn of 2020, although it may now dip temporarily while the new lockdowns last in Europe. Thanks to the modern marvel of online shopping, households can continue to spend on retail without visiting a shop. Likewise, housing activity remains firm in the US, the UK and major parts of continental Europe. Despite weaker confidence, underlying fundamentals are positive.

â  Rebalancing: The rise in household cash balances in 2020 is in sharp contrast to the surge in public-sector and corporate debt. Anticipating a severe cash-flow crunch due to a lack of revenue during lockdowns, firms have drawn heavily on their available lending facilities in order to raise their own liquid balances. But a period of strong consumption fuelled by pent-up demand will raise tax yields, as well as business revenues. This partial rebalancing should temper any worries that excesses indebtedness could curtail a near-term recovery once the pandemic is brought under control.

Chief Economist

+44 20 3207 7889

holger.schmieding@berenberg.com

Senior Economist

+44 20 3465 2672

kallum.pickering@berenberg.com

Florian Hense

Senior European Economist

+4420 3207 7859

Disclosures

This material is intended as commentary on political, economic or market conditions for institutional investors or market professionals only and does not constitute a financial analysis or a research report as defined by applicable regulation. See the "Disclaimers" section of this report.

The commentary included herein was produced by Joh. Berenberg, Gossler & Co. KG (Berenberg). For sales inquiries, please contact:

Phone: +44 (0)20 3207 7800

Email: berenberg.economics@berenberg.com

BERENBERG

Joh. Berenberg, Gossler & Co. KG

Neuer Jungfernstieg 20

20354 Hamburg

Germany

Registered Office: Hamburg, Germany

Local Court Hamburg HRA 42659