Click here for full report and disclosures

â Retail sales plunge: The nationwide lockdowns from late December onwards hit UK retail spending hard in January. Retail volumes declined by 8.2% mom, the second-biggest monthly contraction on record after the 18.0% mom collapse in April 2020. Is there a silver lining in the news? Yes. Retail sales in January were only 5.5% below the pre-COVID-19 pandemic peak in February 2020 – sales fell by 22.2% during the first lockdown in spring 2020. In addition, consumer confidence improved across the board in February.

â Big decline in durable goods demand: On a smaller scale, the pattern in retail spending during the second wave of lockdowns mirrors the first pandemic wave in spring 2020. While consumers spent more on food (+1.4% mom) as restaurants were closed and shifted some of their spending online (non-store retail: +3.7%), they spent much less on textiles, clothing and footwear (-34.7%) and on household goods (-19.4%) in the shops.

â Bigger hit to Q1 GDP: Retail sales are typically more volatile than broad household consumption, which includes a lot of essential spending that does not fluctuate much on a monthly basis. Still, the sizeable drop in retail spending suggests that total household spending will decline by more than we had initially expected in Q1. We thus cut our real GDP forecast from -1.5% qoq to -2.5%. However, most of the extra drop should be offset by a faster catch-up from Q2 onwards once lockdowns are eased – likely beginning in March with English schools and non-essential retail shortly thereafter. We thus upgrade our Q2 call to a 5.5% qoq rise in real GDP from 5.0%, with slightly faster catch-up growth thereafter in H2 2021. On an annual basis, we now expect real GDP to rise by 6.1% in 2021 and 5.6% in 2022, from 6.5% and 5.1% respectively. We continue to expect the UK to recover to its pre-pandemic real GDP peak by Q2 2022.

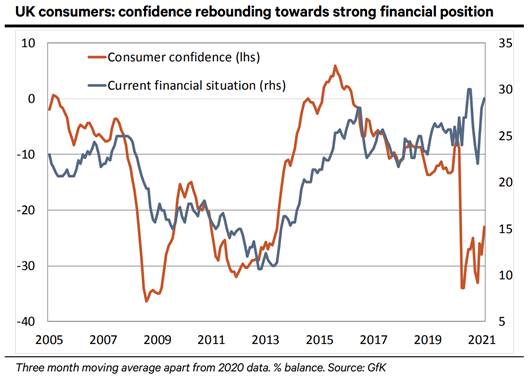

â Growing confidence: Against the bleak retail sales data, UK consumer confidence data for February offer some consolation. Unlike in spring 2020, when spending and confidence caved in simultaneously, this time around confidence has grown during lockdowns, even though the restrictions have taken a mammoth toll on spending. As our chart shows, from a near-record low heading into winter 2020 amid surging SARS-CoV-2 infections and increasing restrictions, the UKâs rapid pace of vaccinations has lifted headline consumer confidence since the start of the year. Although households remain nervous, their financial situation is in good shape thanks to HM Treasuryâs generous furlough scheme, which keeps employment and incomes high and continues to add to a growing pool of excess savings.

â Positive outlook: The UK retail data for January are nothing short of horrific. Despite the growing optimism in financial markets, we are still mired in a historic economic and health crisis with an uncertain outlook. That said, the confidence data also reinforce the case for optimism. Unlike the financial crisis, in which already fragile household balance sheets deteriorated further as house prices collapsed, forcing a long period of repair for almost a decade, household balance sheets in the UK and elsewhere have improved during the crisis. As long as virus risk can be brought further under control, the stage is set for a period of rapid consumer-driven catch-up growth from spring onwards.

Chief Economist

+44 20 3207 7889

holger.schmieding@berenberg.com

Senior Economist

+44 20 3465 2672

kallum.pickering@berenberg.com

Florian Hense

Senior European Economist

+4420 3207 7859

Disclosures

This material is intended as commentary on political, economic or market conditions for institutional investors or market professionals only and does not constitute a financial analysis or a research report as defined by applicable regulation. See the "Disclaimers" section of this report.

The commentary included herein was produced by Joh. Berenberg, Gossler & Co. KG (Berenberg). For sales inquiries, please contact:

Phone: +44 (0)20 3207 7800

Email: berenberg.economics@berenberg.com

BERENBERG

Joh. Berenberg, Gossler & Co. KG

Neuer Jungfernstieg 20

20354 Hamburg

Germany

Registered Office: Hamburg, Germany

Local Court Hamburg HRA 42659