Click here for full report and disclosures

Click here to request a call about this note.

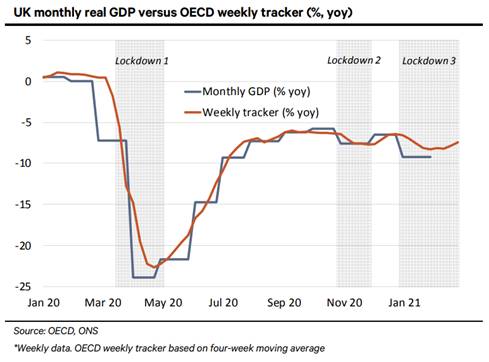

â Lockdowns hurt: Under the economic straitjacket of renewed Covid-19 lockdowns, UK economic activity slumped again at the start of the year. Real GDP contracted by 2.9% mom in January (down 9.2% yoy). However, the hit was well below the consensus estimate of -4.9% mom. The January data suits our above consensus call that real GDP will fall by 2.5% qoq in Q2, with output stagnating in February before staging a recovery in March – Q1 consensus is -3.3% qoq (according to Bloomberg).

â Mixed performance across sectors: Industrial production declined sharply in January, by 1.5% mom, after a tiny 0.2% gain in December. Services output contracted by 3.5% mom after jumping by 1.7% in December. Although the extent of the hit to the big and diverse services sector was mixed in January, unsurprisingly, the three worst hit sub-sectors were those most affected by restrictions: accommodation and food services (-28.1% mom), education (-16.3%) and wholesale and retail trade (-9.0% mom). Construction output edged up by 0.9% mom in January, after shrinking by 2.9% in December.

â 8% empty: After contracting by a historic 24% between February and April 2020, the UK enjoyed a rapid, but partial, recovery during summer 2020. Since the first winter lockdown in November, economic activity has oscillated at around 8.0% below its pre-pandemic level. To put this into some perspective, the total GDP contraction during the financial crisis was 7.0% (from February 2008 to March 2009). The severe and persistent economic shock from the global health crisis places massive strain on huge swatches of the economy. Some of the most hard-hit firms and households may never fully recover. This carries a warning: lasting shocks sometimes lead to scarring, which permanently lowers growth potential.

â 92% full: As our chart shows, the economic hit from the ongoing lockdown is much less severe than the initial shock in Spring 2020. This is the result of significant adaptations by businesses and households, bolstered by aggressive income and credit support by the government and the Bank of England (BoE). Judging by the OECDâs weekly economic tracker for the UK, output may have even picked up a little in February. Critically, data on employment, as well as defaults, looks promising. Despite a historic shock to demand, the UK has not yet suffered mass unemployment or a major wave of bankruptcies. The governmentâs decision to extend its emergency economic measures until after all pandemic restrictions are lifted raises the hope that the UK may suffer little or no major long-term scarring that could further hurt its growth potential after the Brexit hit.

â Light at the end of the tunnel: After a soft start to 2021, we expect a strong consumer-led recovery from spring onwards as savings normalise, face-to-face services re-open and manufacturers step-up production to meet rising demand. We project real GDP gains of 6.2% in 2021 and 5.7% in 2022, with output reaching its pre-pandemic level by Q2 2022. The UK last enjoyed such strong growth during the âLawson boomâ in the late-1980s. Thereafter, a strong global tailwind can keep real GDP growth above the post-Great Recession average of 1.8%. With faster gains in productivity and modestly higher inflation across the advanced world, the longer-run economic outlook can resemble the âold normalââ of the late 1990s and early 2000s, rather than the sluggish post-Great Recession ânew normalâ.

Chief Economist

+44 20 3207 7889

holger.schmieding@berenberg.com

Senior Economist

+44 20 3465 2672

kallum.pickering@berenberg.com

Senior European Economist

+4420 3207 7859

Disclosures

This material is intended as commentary on political, economic or market conditions for institutional investors or market professionals only and does not constitute a financial analysis or a research report as defined by applicable regulation. See the "Disclaimers" section of this report.

The commentary included herein was produced by Joh. Berenberg, Gossler & Co. KG (Berenberg). For sales inquiries, please contact:

Phone: +44 (0)20 3207 7800

Email: berenberg.economics@berenberg.com

BERENBERG

Joh. Berenberg, Gossler & Co. KG

Neuer Jungfernstieg 20

20354 Hamburg

Germany

Registered Office: Hamburg, Germany

Local Court Hamburg HRA 42659

Joh. Berenberg, Gossler & Co. KG is a Kommanditgesellschaft (a German form of limited partnership) established under the laws of the Federal Republic of Germany registered with the Commercial Register at the Local Court of the City of Hamburg under registration number HRA 42659 with its registered office at Neuer Jungfernstieg 20, 20354 Hamburg, Germany. A list of partners is available for inspection at our London Branch at 60 Threadneedle Street, London, EC2R 8HP, United Kingdom.

Joh. Berenberg, Gossler & Co. KG is authorised by the German Federal Financial Supervisory Authority (BaFin) and deemed authorised and regulated by the Financial Conduct Authority. The nature and extent of consumer protections may differ from those for firms based in the UK. Details of the Temporary Permissions Regime, which allows EEA-based firms to operate in the UK for a limited period while seeking full authorisation, are available on the Financial Conduct Authorityâs website. For further information as well as specific information on Joh. Berenberg, Gossler & Co. KG, its head office and its foreign branches in the European Union please refer to http://www.berenberg.de/en/corporate-disclosures.html.