Click here for full report and disclosures

Click here to request a call about this note.

â Springtime in Britain: The stream of strong economic data is not abating. The UK economy expanded by 2.3% mom in April after a 2.1% gain in March. Output in April was 4.0% below its pre-pandemic level. A solid rise (3.4% mom) in domestic-oriented services upon the gradual relaxation of restrictions drove the gain while the supply-constrained construction sector pared back (-2.0% mom) some of the recent rapid gains. Driven largely by a 15.0% mom drop in mining and quarrying due to temporary closures for maintenance in oil production sites, industrial production dipped 1.3% mom.

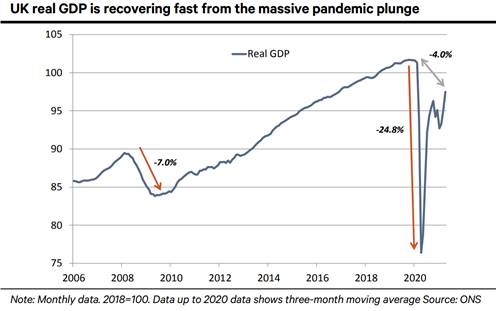

â This time looks different: The massive repair job to fix the foundations and roof of the UK economy after the great financial crisis badly hampered the recovery. After dropping by 7.0% between February 2008 and March 2009, it took until August 2012 for the UK to finally return it is pre-Lehman level of GDP. Despite the damage to trend growth from Brexit, fundamentals are healthier today. Households are ready to spend, banks can supply ample credit and businesses have the confidence to hire and invest. Following the historic collapse in spring 2020, the UK remains on track to return to its pre-pandemic level of GDP by the turn of the year. Judging by recent data trends, that could happen even sooner.

â Impact of a reopening delay: From a very low rate of around 2k new recorded infections per day through most of May, infections in the UK have risen to above 7k per day. To provide more time to assess developments and be sure that vaccines have indeed broken the link between recorded infections and complications – early evidence looks promising – and to make sure that all vulnerable groups have been offered both vaccine shots, a delay to the removal of the last restrictions by probably four weeks beyond 21 June 2021 looks likely. The economic effects would be minor. Any damage from a later easing after most restrictions have been lifted anyway could be offset afterwards by a confidence effect if vaccines prove to be the game-changer.

â Can the good times last? Yes. Every decade is different: roaring economic performance in the 1960s, stagflation of the 1970s, economic renewal in the 1980s, a great moderation in the 1990s, credit-fuelled excess in the 2000s, and then payback in the 2010s. Judging by history, the previous decade is no template for the next one. No one can know what the future holds for sure. But we can judge the fundamentals – healthy banks, cash-flush consumers, confident businesses, and renewed confidence in policymakers – and see the current direction of travel. Together, they clearly suggest that the balance of risks is tilted towards stronger economic performance over the 2020s than during the 2010s.

â Forecast revisions: After the strong monthly gain in April, we raise our call for Q2 GDP to 5.0% qoq from 4.4% previously but reduce our Q3 projection to 2.5% qoq from 3.0%. This lifts our 2021 call from 6.8% to 7.0% but lowers our 2022 call slightly to 5.4% from 5.5%. Since late February, we have raised our already above-consensus 2021 call from 6.1% to 7.0% currently. According to Bloomberg consensus, the market has shifted from 4.6% in late-February to 6.2% currently.

â A critical time for monetary policy: The Bank of Englandâs exceptionally aggressive policy was a necessary and proportionate response to the historic COVID-19 pandemic. After a decade of slow growth and weak inflation, it is tempting to believe that credit and inflation excesses are gone for good. But as a robust recovery is underway, inflation pressures are rising and the housing market is showing early signs of overheating. Monetary policy needs to adjust to avoid an accident. We see a rising chance that the BoE could surprise markets by ending its asset purchases in August – instead of December as planned and as we still project – before preparing markets for the first hike in August 2022.

Chief Economist

+44 20 3207 7889

holger.schmieding@berenberg.com

Senior Economist

+44 20 3465 2672

kallum.pickering@berenberg.com

Disclosures

This material is intended as commentary on political, economic or market conditions for institutional investors or market professionals only and does not constitute a financial analysis or a research report as defined by applicable regulation. See the "Disclaimers" section of this report.

The commentary included herein was produced by Joh. Berenberg, Gossler & Co. KG (Berenberg). For sales inquiries, please contact:

Phone: +44 (0)20 3207 7800

Email: berenberg.economics@berenberg.com

BERENBERG

Joh. Berenberg, Gossler & Co. KG

Neuer Jungfernstieg 20

20354 Hamburg

Germany

Registered Office: Hamburg, Germany

Local Court Hamburg HRA 42659