Click here for full report and disclosures

Click here to request a call about this note.

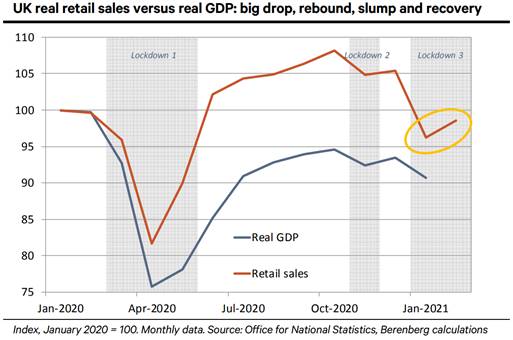

â  Spring comes early: UK retail sales turned up in February, despite the continued closure of non-essential retail stores across the country. A rapid pace of vaccination, a sustained fall in SARS-CoV-2 infections and a plan to lift restrictions through the second quarter have lifted demand a little. In the UKâs consumer- and services-oriented economy, retail sales often provide a reliable early gauge of broader GDP trends â see chart. Albeit from a much lower base, the February rise in retail sales raises the hope that the recent falls in economic activity halted in February or even slightly reversed.

â  Rising mood, rising demand: Although the monthly retail data are volatile, the rise coincides with the sharp improvement in consumer confidence since the start of the year. Consumers are eager to increase spending again once restrictions are eased. The 2.4% mom uptick in retail sales, excluding auto fuel, reverses the downwards trend that started in November and suits our above-consensus call for a 2.5% qoq decline in real GDP in Q1 (Bloomberg consensus: -3.5%).

â  Well below potential: Despite the decent monthly gain, the rise in retail sales barely offsets the big slump during the past winter under a harsh lockdown. In January alone, retail sales collapsed by 8.7% mom. Sales in February were 1.5% below the January 2020 level. For GDP, the gap is much larger. Assuming GDP moved sideways in February, output remained 9.3% below the January 2020 level. Despite growing optimism about the recovery to come, economic conditions remain decidedly weak. At present, real output remains more depressed relative to its potential than even at the worst phase of the financial crisis, when real GDP sank by 7.0% from February 2008 to March 2009.Â

â  Gaining momentum: In the UK and Europe, the economic drag from lockdowns is lessening over time as households and firms better adjust to restrictions, and aggressive fiscal and monetary policy measures continue to support jobs, income and the flow of credit. The sharp rise in the UK composite PMI to 56.6 in March from 49.6 in February suggests that the recovery gained momentum towards the end of Q1. The uptick was driven by a jump in the services index from 49.5 to 56.8, hinting at a domestically driven rebound â we expect retail to recover further in March.

â  Robust fundamentals: The furlough scheme continues to support employment at a high level (75.0% for prime-age workers in January, down a little from the record high of 76.6% in January 2020). Even after adjusting for the compositional effects of job losses at the lower end of the earnings spectrum, real wages are rising at around 2.0-2.5% yoy. In 2020, households accumulated c£160bn in additional savings versus 2019 â equivalent to c11.6% of total 2019 consumption. Some households have used their large liquid balances to pay down consumer credit and/or buy a house. This raises household net worth, which can protect consumers against future income shocks. A partial reduction in excess savings on top of a likely normalisation in the rate of saving tilts the risks to an already positive outlook for consumption to the upside.

â  Heading for a hot summer: Retail sales surged to a record high last summer after the spring virus wave was brought to an end and restrictions were temporarily eased. This time around, households are even more eager to go out and spend â and have even more money to do so. Consumption should recover rapidly as the economy reopens. Starting with the reopening of non-essential retail on 12 April in England, restrictions will be eased every three weeks until all are lifted by 21 June. As the situation returns to normal, the hotel, restaurant, leisure and entertainment industries can enjoy outsized gains after the big hit in 2020.

Berenberg

Chief Economist

+44 20 3207 7889

holger.schmieding@berenberg.com

Berenberg

Senior Economist

+44 20 3465 2672

kallum.pickering@berenberg.com

Disclosures

This material is intended as commentary on political, economic or market conditions for institutional investors or market professionals only and does not constitute a financial analysis or a research report as defined by applicable regulation. See the "Disclaimers" section of this report.

The commentary included herein was produced by Joh. Berenberg, Gossler & Co. KG (Berenberg). For sales inquiries, please contact:

Phone: +44 (0)20 3207 7800

Email: berenberg.economics@berenberg.com

BERENBERG

Joh. Berenberg, Gossler & Co. KG

Neuer Jungfernstieg 20

20354 Hamburg

Germany

Registered Office: Hamburg, Germany

Local Court Hamburg HRA 42659

Joh. Berenberg, Gossler & Co. KG is a Kommanditgesellschaft (a German form of limited partnership) established under the laws of the Federal Republic of Germany registered with the Commercial Register at the Local Court of the City of Hamburg under registration number HRA 42659 with its registered office at Neuer Jungfernstieg 20, 20354 Hamburg, Germany. A list of partners is available for inspection at our London Branch at 60 Threadneedle Street, London, EC2R 8HP, United Kingdom.

Joh. Berenberg, Gossler & Co. KG is authorised by the German Federal Financial Supervisory Authority (BaFin) and deemed authorised and regulated by the Financial Conduct Authority. The nature and extent of consumer protections may differ from those for firms based in the UK. Details of the Temporary Permissions Regime, which allows EEA-based firms to operate in the UK for a limited period while seeking full authorisation, are available on the Financial Conduct Authorityâs website. For further information as well as specific information on Joh. Berenberg, Gossler & Co. KG, its head office and its foreign branches in the European Union please refer to http://www.berenberg.de/en/corporate-disclosures.html.