Click here for full report and disclosures

â A step too far: There are some lines which serious countries simply do not cross. One is to knowingly and openly break an international treaty. But the UK government led by its Brexiteer Prime Minister Boris Johnson apparently intends to do just that. The UKâs draft for a bill to set out the rules for the UK internal market when it leaves the EU single market on 31 December 2020 includes sections which, if ratified by parliament, would violate a key part of the EU Withdrawal Agreement. The deal, which the UK ratified in January, preserves the Good Friday Agreement for peace in Northern Ireland and an open Irish border in any outcome of the ongoing UK-EU negotiations.

â Increased risks: If the UK pushes ahead and breaks its legal commitments to Ireland, it would become almost impossible to still strike a comprehensive deal with the EU on the future relationship. A no-deal outcome would amplify the long-term costs of Brexit. The likely resulting breakdown in UK-EU talks would raise the risk of a disorderly exit from the single market at the year-end. Reacting to the developments, we downgrade our view on the prospects for 1 January 2021. As our base case we now put a 50% probability on a semi-managed hard exit, down from 60% previously. Correspondingly, we raise the risk of a disorderly exit to 20% from 5% and cut the chance of a deal to 30% from 35%.

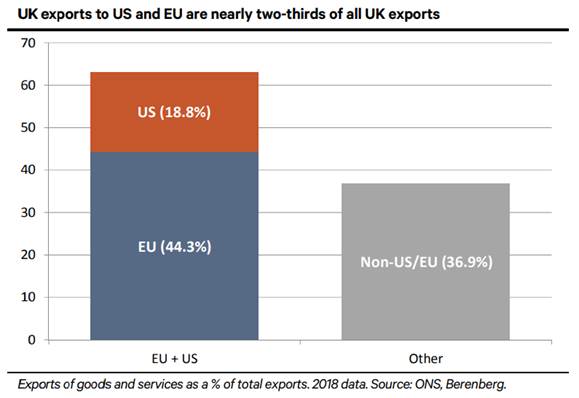

â Hurting future trade prospects: Reacting to the news on the other side of the Atlantic, Nancy Pelosi (Democrat and speaker of the House of Representatives) warned there is âabsolutely no chanceâ that the US Congress would pass a future UK-US trade deal if the UK violates the Good Friday Agreement. As our chart shows, EU and US trade jointly account for nearly two-thirds of all UK trade. Looking at the key partners in the remaining third, including the likes of Canada, Japan and Australia – who may not wish to be opposed to the US in relation to any UK-EU dispute – the realistic damage to future trade is higher than our chart shows. With this in mind, it is hard to take seriously Johnsonâs claim that he is seeking to expand the UKâs trade prospects when he is ready to take steps that could undermine it badly.

â Undermining key industries: In the sensitive areas where the UK is a world leader, such as legal services, finance, information technology, education and military technology, part of the success hinges on the security that comes from dealing with the UK. By violating the rule of law, Johnson risks jeopardising the areas where Britain is still âgreatâ.

â Will the UK parliament intervene? For all Johnsonâs talk of âsovereigntyâ, with luck, he is about to get a lesson in what it actually means. In the UK, parliament is sovereign, not the government. It is the primary job of the House of Commons and the House of Lords to hold the government of the day to account for its actions. Together, they have the power to block the governmentâs intentions. The next few days in parliament could be decisive for the future of the UK.

â Wrong direction, Boris! Johnson and his government are doing far more than damaging the UKâs chance of striking a comprehensive agreement with the EU. They are damaging the UKâs reputation on the world stage, its relations with its closest allies and prospects for its leading industries. Hopefully, enough parliamentarians will see the folly in the governmentâs actions and keep it in check. Otherwise, some of the risks we discuss herein may soon become a reality.

Chief Economist

+44 20 3207 7889

holger.schmieding@berenberg.com

Senior Economist

+44 20 3465 2672

kallum.pickering@berenberg.com

European Economist

+4420 3207 7859

Disclosures

This material is intended as commentary on political, economic or market conditions for institutional investors or market professionals only and does not constitute a financial analysis or a research report as defined by applicable regulation. See the "Disclaimers" section of this report.

The commentary included herein was produced by Joh. Berenberg, Gossler & Co. KG (Berenberg). For sales inquiries, please contact:

Phone: +44 (0)20 3207 7800

Email: berenberg.economics@berenberg.com

BERENBERG

Joh. Berenberg, Gossler & Co. KG

Neuer Jungfernstieg 20

20354 Hamburg

Germany

Registered Office: Hamburg, Germany

Local Court Hamburg HRA 42659