Click here for full report and disclosures

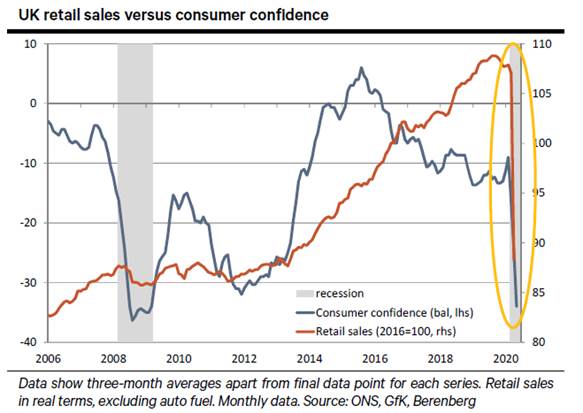

â  UK consumer spending collapse: A record 15.2% mom slump in retail sales in April erased more than seven years of gains (see chart). That in-store retail dropped by 41.7% mom while non-store retail rose by 18.0% and internet sales as a percentage of total sales surged to a record high of 30.0%, from 21.9% in March, suggests that a large part of the fall in spending was involuntary, though. While rising unemployment and a drop in confidence hurt household demand, most of the April plunge is likely due to the fact that non-essential shops were closed as part of the coronavirus lockdown.

â  Rebound begins in June: The UK plans to reopen non-essential retail stores on 1 June; a rebound thus cannot be expected in May. However, after an initial jump once the retail sector is switched back on, the return to the pre-crisis peak for retail sales (January 2020) could be slow and lumpy. Learning to live with coronavirus will involve semi-permanent disruptions to daily life. Even when some restrictions are lifted, people could remain reluctant to go out and spend. Consumers will thus remain nervous further into 2020. Elevated unemployment, a likely modest correction in the housing market and the noisy UK-EU trade negotiations will provide additional headwinds to household confidence and consumption in the second half of 2020.

â  Risks to the economic recovery: While our base case is for a partial snapback in real GDP in H2 followed by a more gradual rebound thereafter, with real GDP returning to its pre-crisis level in 2023, the risks to our call are tilted to the downside. Consumption is 70% of UK GDP. If households remain cautious once the lockdown is lifted, which will show up in a high savings rate and weak spending growth, firms and producers will remain reluctant to hire and invest. If the recovery disappoints, policymakers will need to take further steps to support economic activity.

â  Negative rates will not help: The Bank of England (BoE) has responded aggressively to the coronavirus pandemic by cutting rates to a historic low of 0.1%, buying £200bn in government and corporate bonds, lending directly to corporates on a short-term basis, and flushing credit and interbank markets with liquidity. We expect the BoE to add an extra £200bn to its asset purchases eventually. At least half of that may come at the next Monetary Policy Committee meeting on 18 June. Recently, the debate in the UK has shifted to whether the BoE will cut its policy rate below zero. While Governor Andrew Bailey has not ruled out negative rates, we view them as unlikely â at least in the near term. If the UK falls into a genuine liquidity trap in the coming months, whether the bank rate is 0.1% or marginally below zero will hardly matter.

â  But fiscal policy can help: If private saving remains high even after the lockdowns are eased, even more deficit spending will be much more effective at promoting a recovery than negative interest rates. In such an outcome, Chancellor Rishi Sunak should follow up his aggressive rescue package with a recovery package by offsetting excessing private sector saving with public sector dissaving (ie deficit spending). The risk of not aggressively counteracting such a downside scenario with additional fiscal stimulus would far exceed the risks from adding even more to the public debt.

Chief Economist

+44 20 3207 7889

holger.schmieding@berenberg.com

Senior Economist

+44 20 3465 2672

kallum.pickering@berenberg.com

Florian Hense

European Economist

+4420 3207 7859

Disclosures

This material is intended as commentary on political, economic or market conditions for institutional investors or market professionals only and does not constitute a financial analysis or a research report as defined by applicable regulation. See the "Disclaimers" section of this report.

The commentary included herein was produced by Joh. Berenberg, Gossler & Co. KG (Berenberg). For sales inquiries, please contact:

Phone: +44 (0)20 3207 7800

Email: berenberg.economics@berenberg.com

BERENBERG

Joh. Berenberg, Gossler & Co. KG

Neuer Jungfernstieg 20

20354 Hamburg

Germany

Registered Office: Hamburg, Germany

Local Court Hamburg HRA 42659