Click here for full report and disclosures

â An unprecedented shock: The COVID-19 pandemic and the lockdowns to contain it pushed the advanced world into the worst peacetime recession since the early 1930s. Countries reacted differently to the challenge. This shows up in the economic data. It may well shape the pace of the post-COVID-19 rebound as well.

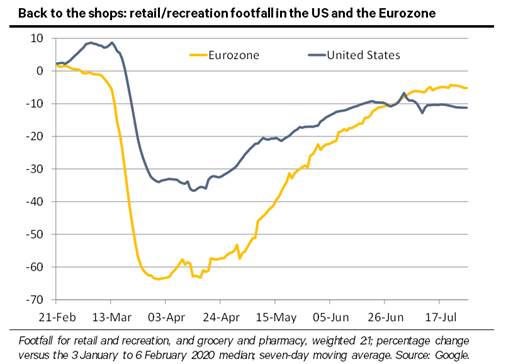

â Eurozone first: After Italy, Spain and France had turned into the new hotspots of the pandemic in late February, Eurozone countries quickly imposed harsh restrictions on daily lives and economic activity. Retail/recreation footfall as measured by Google mobility data dropped like a stone in mid-March. The comparatively rapid response allowed many Eurozone countries, led by Austria and Germany, to gradually re-open shops from mid-April onwards. By the end of June, people were going to the shops and recreation facilities at an almost normal rate again (see Chart).

â The US difference: Much of the US missed the chance to learn from the European experience. Outside Greater New York, lockdowns were mostly less restrictive than in Europe. In parts of the US, people were – and may still be – more reluctant to change behaviour. In economic terms, the US fared less badly in Q2 than Europe, with a 9.5% qoq plunge in GDP in the US versus a 12.1% drop in the Eurozone. In terms of the pandemic, however, the US did much worse. Beyond the toll which the virus has taken so far, the strong surge in new infections in the US since mid-June and the reaction to it have caused a modest decline in retail/recreation footfall over the past four weeks. Judging by these – and some other – high frequency data, the recovery in US consumption seems to be stalling.

â Advantage Europe? For two reasons, the Eurozone will likely rebound faster than the US in H2 2020. First, the virus is currently spreading much more rapidly in the US than in Europe. Second, because the trough in April and May was so much deeper in the Eurozone than in the US, the return to less depressed levels of activity will show up in a stronger rate of change in Europe during the rebound. We look for GDP to recover by a cumulative 7.1% in the US and by 10.8% in the Eurozone in Q3 and Q4 2020. In yoy terms, the US will still remain ahead, though, with a projected -4.3% yoy for the US and -6.1% for the Eurozone in Q4 2020 GDP. The stronger fiscal response, visible for instance in a likely fiscal deficit of 17.5% of GDP in the US versus 11.5% for the Eurozone this year, explains much of this gap. See Forecasts at a Glance for full details of our calls.

â A stark warning: In a still muted echo of the US experience, infection numbers are also edging up in the Eurozone even beyond the serious surge in northern Spain. As a result, retail/recreation footfall started to decline slightly in Europe as well in late July. Fortunately, the rise in infections seems to be going back from exponential to linear in the US. European countries are now reacting early and with little political compunction to the new regional outbreaks. Societies know better how to deal with the virus, treat the disease and protect the most vulnerable than in March. With few strains on European health systems, we expect targeted, modest and regional measures, coupled with some changes in behaviour such as more wearing of face masks, to contain these outbreaks sufficiently so that new harsh and highly disruptive lockdowns will not be required on a grand scale. On both sides of the Atlantic, this is the key risk to watch, however.

Chief Economist

+44 20 3207 7889

holger.schmieding@berenberg.com

Senior Economist

+44 20 3465 2672

kallum.pickering@berenberg.com

European Economist

+4420 3207 7859

Disclosures

This material is intended as commentary on political, economic or market conditions for institutional investors or market professionals only and does not constitute a financial analysis or a research report as defined by applicable regulation. See the "Disclaimers" section of this report.

The commentary included herein was produced by Joh. Berenberg, Gossler & Co. KG (Berenberg). For sales inquiries, please contact:

Phone: +44 (0)20 3207 7800

Email: berenberg.economics@berenberg.com

BERENBERG

Joh. Berenberg, Gossler & Co. KG

Neuer Jungfernstieg 20

20354 Hamburg

Germany

Registered Office: Hamburg, Germany

Local Court Hamburg HRA 42659