Click here for full report and disclosures

Click here to request a call about this note.

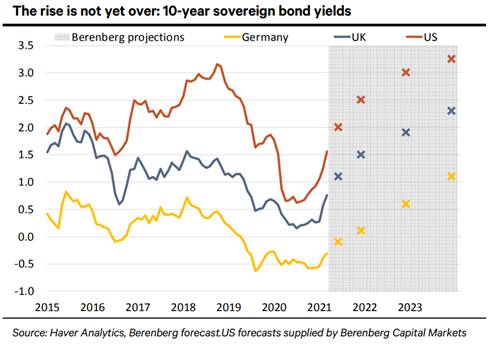

â US bond yields have risen significantly from COVID-19 trough: 10-year Treasury yields hovered around 1.9% before the outbreak of the pandemic. They plummeted to c0.6% in spring 2020 and remained below 0.75% through autumn. Since then, they have rebounded to 1.75%. As the US economy reopens and shifts into a high gear, boosted by a strong fiscal stimulus, pent-up demand for consumer services and excess savings, we expect the return to more normal levels of nominal yields to continue. See our note: US bond yields to rise significantly further.

â On the back of the surge in US yields, rates have also moved up in Europe: Yields have increased from a trough of c0.2% to 0.87% for UK Gilts and from c-0.6% to -0.27% for German Bunds. While yields of different EU national bonds have risen to varying degrees, their spreads to Bunds remain constrained by the European Central Bankâs (ECBâs) monetary policies and the advent of a pro-reform administration in Italy. Japanese 10-yr JGB yields have remained broadly unchanged, rising merely from c-0.1% to 0.10%. Real yields adjusted for inflationary expectations remain markedly negative in the US, the UK and Germany, and close to zero in Japan.

â Real bond yields are still too low: Market-based inflation expectations (breakevens on US TIPs) have risen to 2.3%, implying ex-ante real rates of -0.5%. We expect real rates to eventually turn positive as the US economy rebounds. Inflation expectations are likely to edge up further in anticipation of increasing price pressures. Following the passage of a $1.9trn fiscal stimulus and an improving outlook for nominal and real GDP, we raise our calls for 10-year Treasury yields: to 2.5% from 2.0% for end-2021; to 3.0% from 2.7% for end-2022; and to 3.25% from 2.7% for end-2023.

â Near term, the US is likely to lead the way up: We expect the Treasury-bund spread to widen further this year. But once the market has fully priced in the size of the US fiscal impulse and the strength of the US economic rebound, the somewhat delayed, but still solid, European recovery will likely lead European yields up significantly as well, in the UK more so than in the eurozone. We raise our targets for Gilts: from 1.1% to 1.5% for end-2021; from 1.4% to 1.9% for end-2022; and from 1.9% to 2.3% for end-2023. For German Bunds, we now project 0.6% instead of 0.5% for end-2022, after 0.1% by end-2021. In late 2023, Bund yields could reach 1.1%, up from our previous call of 1.0%.

â Aggressive monetary stimulus to persist: The US Federal Reserve (Fed) is committed to its objectives of prioritising maximum inclusive employment and pushing inflation above 2%, as well as continuing its sizable purchases of Treasuries and mortgage-backed securities (MBS). The ECB will strive to support Europeâs economic recovery, which lags a bit, with an aggressive monetary stance. The Fed, ECB and Bank of England (BoE) share a common concern, which is to avoid any premature policy shift that would jar financial markets or harm economies. For now, higher yields are a reflection of, rather than an obstacle to, stronger nominal and real GDP growth.

â Stock markets are adjusting to higher yields and prospects of higher profits: For markets, higher yields are a double-edged sword. They lower the present value of the expected future stream of earnings. However, a rise in real rates also reflects stronger profits and higher expected rates of return, which favours business valuation – with improved near-term earnings prospects. At least for 2021, markets will continue to receive significant support from central banks. Despite the increase that we project, bond yields remain very low by historical standards.

Berenberg

Chief Economist

+44 20 3207 7889

holger.schmieding@berenberg.com

Berenberg Capital Markets

Chief Economist US, Americas and Asia

+1 646 949 9099

mickey.levy@berenberg-us.com

Berenberg

Senior Economist

+44 20 3465 2672

kallum.pickering@berenberg.com

Disclosures

This material is intended as commentary on political, economic or market conditions for institutional investors or market professionals only and does not constitute a financial analysis or a research report as defined by applicable regulation. See the "Disclaimers" section of this report.

The commentary included herein was produced by Joh. Berenberg, Gossler & Co. KG (Berenberg). For sales inquiries, please contact:

Phone: +44 (0)20 3207 7800

Email: berenberg.economics@berenberg.com

BERENBERG

Joh. Berenberg, Gossler & Co. KG

Neuer Jungfernstieg 20

20354 Hamburg

Germany

Registered Office: Hamburg, Germany

Local Court Hamburg HRA 42659

Joh. Berenberg, Gossler & Co. KG is a Kommanditgesellschaft (a German form of limited partnership) established under the laws of the Federal Republic of Germany registered with the Commercial Register at the Local Court of the City of Hamburg under registration number HRA 42659 with its registered office at Neuer Jungfernstieg 20, 20354 Hamburg, Germany. A list of partners is available for inspection at our London Branch at 60 Threadneedle Street, London, EC2R 8HP, United Kingdom.

Joh. Berenberg, Gossler & Co. KG is authorised by the German Federal Financial Supervisory Authority (BaFin) and deemed authorised and regulated by the Financial Conduct Authority. The nature and extent of consumer protections may differ from those for firms based in the UK. Details of the Temporary Permissions Regime, which allows EEA-based firms to operate in the UK for a limited period while seeking full authorisation, are available on the Financial Conduct Authorityâs website. For further information as well as specific information on Joh. Berenberg, Gossler & Co. KG, its head office and its foreign branches in the European Union please refer to http://www.berenberg.de/en/corporate-disclosures.html.