Click here for full report and disclosures

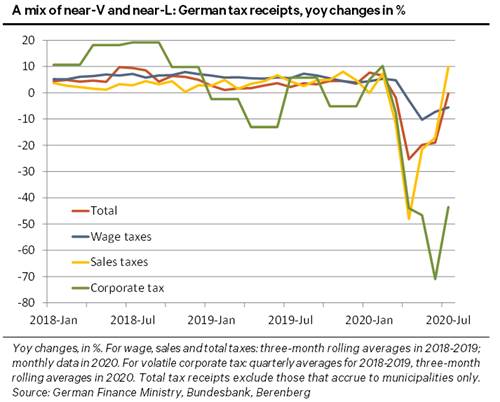

â The tax message: Benjamin Franklin knew it already back in 1789: âIn this world nothing can be said to be certain, except death and taxesâ. Today, those taxes that are collected and reported almost instantly can shed light on the nature of the COVID-19 downturn, the shape of the rebound, and the risks and opportunities ahead. On balance, German tax data up to July suit our call for a tick-shaped recovery. Having started in May with a significant but not quite V-shaped rebound for major parts of the economy, it will likely flatten over time. We expect a similar profile for other European countries. Most of them will probably lag a little behind Germany, though, as they had been hit harder by the pandemic.

â Consumers first: After the shock of March and April, consumers in Germany – and elsewhere – recovered their poise first. Once non-essential shops started to reopen from late April onwards, receipts from sales taxes rebounded almost like a V – see chart. This chimes in with separate data showing that German retail sales, including buoyant online sales, exceeded their year-ago level by 5.2% on average in May and June. After a catch-up effect in these months, we expect retail sales to oscillate around current levels in coming months before embarking again on a gradual uptrend.

â Slow turnaround in the labour market: Wage taxes are collected directly and mostly automatically when companies pay their workers. They are not levied on key income support measures such as furlough schemes (Kurzarbeitergeld). Abstracting from some technicalities, wage tax receipts thus tend to reflect the underlying state of the labour market reasonably well. After a significant drop from March to May, receipts edged up again in June and July. The labour market is recovering, but only gradually. We look for total hours worked and wage tax receipts to increase modestly in coming months. More workers will return from furlough schemes to more regular working hours. However, officially measured unemployment – which does not include furloughed workers – will likely rise nonetheless, at least until late 2020, as some companies will need to shed staff and many new entrants to the labour market will struggle to find a job.

â A serious hit to profits: Corporate profits are a sensitive barometer of the business cycle. When sales fall while costs cannot be cut in a rush, profits tumble. In Q2, corporate tax receipts plunged by c70% yoy. July data point to a potential turning point in profits. However, monthly data can be extremely volatile and distorted by special effects. The tax data cannot yet answer the question whether German corporate profits have indeed bottomed out already.

â With a little help from Berlin: For a good reason, the tax data – especially for sales, corporate and total taxes – overstate the recent gyrations in activity. To enable companies to build up liquidity buffers in a severe crisis, Berlin allowed many of them to postpone payments by three months. Some of the sales and corporate taxes that were due in April, the worst month of the COVID-19 recession, were thus paid in July. This accentuates the April plunge and the rise in July in these categories and the total tax take. We thus have to interpret the data with caution. Still, the July data mostly continued the uptrend that was visible before. As a sign of progress, they also show that fewer companies had to postpone tax payments in July than in April. They were able to pay up again. The economic recovery is not V-shaped. But it is for real.

Chief Economist

+44 20 3207 7889

holger.schmieding@berenberg.com

Senior Economist

+44 20 3465 2672

kallum.pickering@berenberg.com

European Economist

+4420 3207 7859

Disclosures

This material is intended as commentary on political, economic or market conditions for institutional investors or market professionals only and does not constitute a financial analysis or a research report as defined by applicable regulation. See the "Disclaimers" section of this report.

The commentary included herein was produced by Joh. Berenberg, Gossler & Co. KG (Berenberg). For sales inquiries, please contact:

Phone: +44 (0)20 3207 7800

Email: berenberg.economics@berenberg.com

BERENBERG

Joh. Berenberg, Gossler & Co. KG

Neuer Jungfernstieg 20

20354 Hamburg

Germany

Registered Office: Hamburg, Germany

Local Court Hamburg HRA 42659

Any e-mail message (including any attachment) sent by Berenberg, any of its subsidiaries or any of their employees is strictly confidential and may contain information that is privileged or exempt from disclosure under applicable law. If you have received such message(s) by mistake please notify the sender by return e-mail. We ask you to delete that message (including any attachments) thereafter from your system. Any unauthorised use or dissemination of that message in whole or in part (including any attachment) is strictly prohibited. Please also note that any legally binding representation needs to be signed by two authorised signatories. Therefore we do not send legally binding representations via e-mail. Furthermore we do not accept any legally binding representation and/or instruction(s) via e-mail.

In the event of any technical difficulty with any e-mails received from us, please contact the sender or info@berenberg.com.

Click here to unsubscribe from these emails.