| |

| |

Stocks declined, oil retreated and the dollar strengthened after China poured cold water on U.S. President Donald Trump’s declaration Friday that there was a deal to partially settle the trade war. Administration officials say they still expect the deal to happen. —David E. Rovella Here are today’s top storiesAfter clearing the way for Turkey to attack the Kurds in Syria, the Trump administration says it’s imposing sanctions on Turkey for going too far. The attack on the Kurds, who were American allies before Trump ordered a pullback of U.S. forces, has included civilian deaths, executions and fire aimed by Turkey near American soldiers. The Kurds have since struck a deal with the Syrian government, which is allied with Russia. Senator Bernie Sanders is a more dangerous enemy of billionaires than Senator Elizabeth Warren, say two economists. In Ohio, the 2020 presidential race will be a fight for the suburbs, and it may be tougher for Republicans this time around. Get ready for the 20 hour flight. This weekend, Qantas Airways flies direct from New York to Sydney for the first time. No airline has ever completed that route without stopping. America’s shale boom got the world accustomed to soaring production. Now growth has slowed, and a cloud has formed over the industry. There’s an army of women being trained to close the gender pay gap. A nationwide initiative is offering free salary negotiation classes to help women get the money they deserve. What’s Joe Weisenthal thinking about? The Bloomberg news director is thinking about what the bond market has been doing lately. An inability to rally on bad news earlier this month was a marked change from the euphoric bond buying of late August, Joe says. What you’ll need to know tomorrow

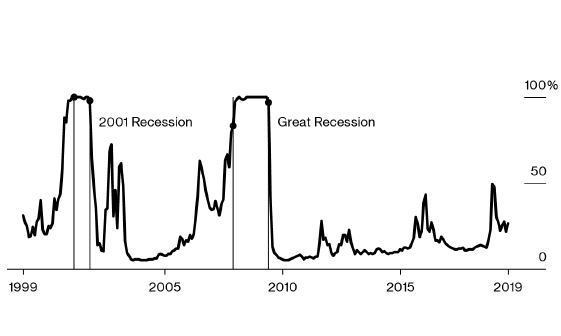

What you’ll want to read in Bloomberg EconomicsU.S. Recession Chances Hit 27% Over Next YearRecession fears have grown in recent months amid a persistent trade war with China, pullbacks in corporate hiring and investment and a manufacturing sector that’s already slipped into contraction. The economy is cooling, but the big question is whether the slowdown will morph into something darker. Bloomberg Economics created a model to determine America’s recession odds. Right now, the indicator estimates the chance of a downturn at some point in the next year is 27%. That’s higher than it was a year ago, but lower than before the last recession. There are reasons to keep a close eye on the economy. But don’t panic yet.  Like Bloomberg’s Evening Briefing? Subscribe to Bloomberg.com. You’ll get our unmatched global news coverage and two premium daily newsletters, The Bloomberg Open and The Bloomberg Close, and much, much more. See our limited-time introductory offer. Sign up for the Bloomberg Recession Tracker: Bloomberg Economics crunches the numbers every month using our proprietary model to reveal the probability of a downturn over the next year. We’ll deliver an updated assessment of all relevant indicators the first week of every month, directly to your inbox. This free newsletter includes analysis showing whether a recession risk is increasing or decreasing, and comparisons to the past month’s performance as well as previous recessions. Sign up here. Download the Bloomberg app: It’s available for iOS and Android. Before it’s here, it’s on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can’t find anywhere else. Learn more. |

| FOLLOW US | SEND TO A FRIEND |

| You received this message because you are subscribed to Bloomberg's Evening Briefing newsletter. |

| Unsubscribe | Bloomberg.com | Contact Us |

| Bloomberg L.P. 731 Lexington, New York, NY, 10022 |