| | | Today’s Big Stories:

💰 Coinbase Q2 earnings preview

🇺🇸 USA debt downgrade bodes well for BTC | Today's newsletter is 1,219 words, a 5-minute read. |

| |

| | |

|

📌 MUST READS |

| | Here’s What We are Watching For Coinbase’s Q2 2023 Earnings |

|

|

Coinbase (COIN) has been on an absolute tear this year, up more than 180% year to date. |

So with the company expected to release earnings results for Q2, 2023 on Thursday, August 3, we thought it would be helpful to provide some insights into what investors will be watching. |

Trading Volumes

Perhaps the most watched metric of any, Coinbase’s trading volumes are expected to drop dramatically in the quarter. |

While last quarter trading volumes were flat, data is pointing to much lower volumes in Q2 – perhaps 30% or more lower. |

|

That said, Coinbase’s share of trading volume in the U.S. continues to rise, reaching more than 60% in June showing that it is by far the leading exchange in the U.S. |

Regardless, investors will be watching the metric closely. |

Interest Revenue

Coinbase has been a major beneficiary of the Fed’s rate increases, with the company generating more than $240 million in interest income last quarter. |

But while interest rates have continued to increase, it may not be all rosy for Coinbase. That’s because USDC’s market cap has fallen by more than 50% over the last year. |

Due to Coinbase’s revenue share agreement with Circle (USDC’s parent company) in relation to the stablecoin’s market capitalization, the increase in interest rates could be offset by the dropping market cap. |

Adjusted EBITDA

After three straight quarters of Adjusted EBITDA losses, Q1 was a return to “profitability” for Coinbase when they brought the metric to a positive $284 million. |

Although somewhat a vanity metric – as the company still lost millions of dollars of real money in the quarter – the positive Adjusted EBITDA proved that the business can cut expenses while still generating revenue. |

Expect analysts to be keeping a sharp eye on this metric to see if it is sustainable. |

Regulatory Discussion

Two months ago, the SEC launched a lawsuit against Coinbase accusing the company of operating an unauthorized exchange. |

Since then, the positive Ripple ruling has bolstered confidence among investors that Coinbase might have a real chance of beating the SEC. |

Although Coinbase CEO, Brian Armstrong, and Chief Legal Office, Paul Grewal have been vocal on Twitter and in interviews about regulatory concerns, we expect questions from analysts to be heavily centered (as always) on regulatory issues. |

Diversification

When commenting on Coinbase’s Q1, 2023 earnings, we stated: |

Now that [Coinbase is] primarily done in cutting costs, it’s time for the company to begin diversifying revenue more. |

|

|

Although the company has done a good job creating other income through interest revenue, the act doesn't really speak to a transformational, disruptive business. If you want to invest in a company for their interest revenue generation, go buy a bank stock. |

There is a reason that last quarter we stated: |

With interest revenue coming in at such a high percentage of Coinbase’s revenue, the company is becoming more and more dependent on what the Fed does with interest rate policy. Although the recent .25 rate hike should help the company over the next quarter, it also isn't a sustainable revenue stream. |

|

|

Their NFT platform didn’t do it, and we haven’t heard much yet about the take rate on Coinbase One, so unless international expansion and BASE (both covered below) do it, there will be disappointment among investors. |

International Expansion

Coinbase International Exchange, which only initiated its offshore futures exchange operations in May, has already accumulated nearly $2 billion in volume for July. |

Although this only represents a tiny portion of the total futures volume of $550 billion in July, it signifies a substantial amount considering the short time frame since the exchange's inception. |

While U.S. regulators continue to try to stop Coinbase, we will be interested to learn how the exchange currently feels about international expansion. |

BASE

Earlier this year in April, Coinbase announced its latest project dubbed Base – it’s very own L2 blockchain. |

And although the chain hasn’t officially launched, this week it became the talk of the town. That’s because more than $84 million of ETH was bridged to the network as traders pumped up (and dumped) a bunch of worthless meme coins. |

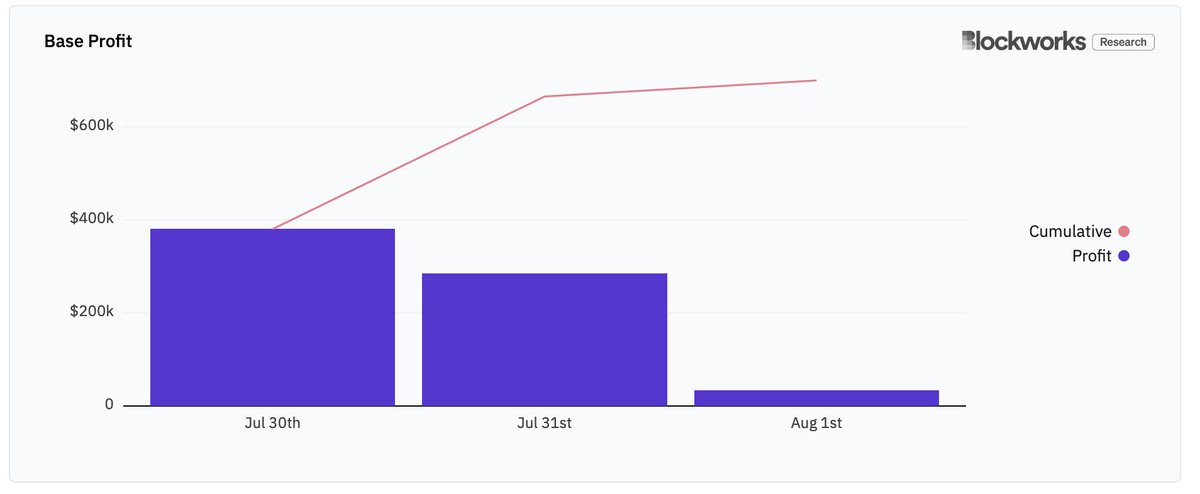

Although Base is an amazing achievement from Coinbase and could drive billions in dollars of revenue to the exchange… |

| Westie 🟪 @WestieCapital |  |

| What people don't know about Coinbase's L2 Base is that it has accrued over $700k profit in just three days. This is ~$85M on an annual basis. Imagine once the Wall Street analysts find this out. |  | | | Aug 1, 2023 | | |  | | | 702 Likes 75 Retweets 60 Replies |

|

|

…Rugpulls, hacks, and frauds aren’t exactly the best thing to be involved in while regulatory scrutiny is on you. |

Don’t be surprised if the Coinbase executive team directly comments on Base and what occurred this week. |

|

SPONSORED | FBI fraud advisor: ‘Sell META immediately’ | As millions of investors pile into AI stocks like Mark Zuckerberg’s Meta… | One highly respected forensic accountant just sounded the alarm – and named three popular stocks it’s crucial you dump today. | It’s all because of a stock market manipulation scheme he’s warning will fool millions of investors this year… | Do these three things today to protect yourself. |

|

|

|

🔎 DEEP DIVES |

|

Yesterday, Fitch Ratings dropped a bomb on Wall Street by announcing that it had downgraded America's long-term foreign currency rating from a picture-perfect AAA to the next level down, AA+. |

This marks the country’s second downgrade ever, following Standard & Poor’s downgrade from AAA to AA+ back in 2011. |

Sparking a bit of controversy, Fitch cited the country’s deteriorating fiscal position, and the frequently chaotic political landscape as the reasoning behinds its bold decision. |

The ratings firm also pointed out that the US debt-to-GDP ratio will likely hit ~120% within the next 3 years as interest payments command more of the budget. |

The Debt-to-GDP Backdrop:

For those keeping track, the U.S. debt-to-GDP ratio had already surpassed the 120% mark in 2021 – the first time since the Second World War. |

Essentially, this means the national debt was 20-25% greater than the entirety of the U.S. economy at the time. Yikes. |

Since then, the debt-to-GDP ratio has scaled back slightly. However, at 112.9% this year, it is still significantly above the pre-pandemic levels of 100.1% back in 2019. |

Nevertheless, Fitch points out that the present debt ratios are more than double the median of 39.3% of GDP for 'AAA' rated countries and 44.7% for 'AA' rated ones. |

To put it simply, the amount of debt the U.S. is facing is quite alarming. According to Fitch, this significantly heightens the risk for the U.S.'s fiscal stability in case of any future economic shocks. |

This Is Why We Crypto

While the Fitch drop temporarily riles those on Wall Street and people like Janet Yellen, it does bode well for us folks betting on crypto. |

For starters, a further drop in confidence in the U.S. might encourage more individuals to turn to digital assets. In other words, a dent in the credit reputation of the central government should increase the allure for a decentralized, borderless currency. |

More US debt + US being a less dependable payor of its debts = more crypto adoption |

But here’s an interesting kicker… |

In the past we’ve seen that negative trends in stocks could bring down Bitcoin as well. However, this time around, when Fitch unexpectedly dropped the news, Bitcoin didn’t go tumbling. Instead, it's showing some spunk and holding its own. |

For context, stock futures fell in after-hours trading on Tuesday, reflecting renewed investor jitters. Today’s stock market opening wasn’t too cheery either. However, the announcement from Fitch seemed to trigger an impulsive pull into Bitcoin. In fact, at the time of writing, Bitcoin is the only player wearing green today. |

While this is just a small example of Bitcoin’s strengthening resilience, it does illustrate a potential break from the historical tendency for cryptos and equities to sink together. |

|

SPONSORED | If you missed the gains of NVIDIA, Microsoft, and other booming AI stocks… | This may be your last chance to get in on the ground floor of today’s AI revolution. | It’s a stock within a niche sector, that’s miraculously still trading for less than a penny and a half. Our friend Nick Black is livestreaming everything you need to know to take advantage of this phenomenon starting now. | Get the full story here » |

|

|

|

TWEET OF THE WEEK |

| Charles Edwards @caprioleio |  |

| What is the most similar asset to Bitcoin? Gold. What happened when the Gold ETF launched? In November 2004, Gold was in a bear market, down -50% (much like Bitcoin is today). When the ETF approval hit, what followed was a massive +350% return, seven-year bull-run. Food for… twitter.com/i/web/status/1… |  | | | Jul 28, 2023 | | |  | | | 560 Likes 123 Retweets 59 Replies |

|

|

|

Other Content You Might Enjoy |

SEC sues crypto influencer for allegedly buying sports cars and a rare black diamond with investor funds MicroStrategy is about to pump another $750,000,000 into BTC Coinbase Mulling Best Ways to Integrate Lightning Network for Bitcoin Worldcoin suspended in Kenya, one of its biggest markets for sign-ups so far Landmark crypto market overhaul bill advances past first committee Tether Reports $3.3B in Excess Reserves in Q2, holds $72.5B worth of US Treasury bills Kyle Samani on reframing RWAs The most profitable NFT projects by royalty earnings Sequoia Capital cuts crypto funds by over 50% as it continues to downsize Introducing Arkham Intel Exchange, a new platform that incentivizes the unmasking of anonymous crypto users SEC asked Coinbase to halt trading in everything except bitcoin, CEO says IRS: Crypto Staking Rewards Taxable Once Investor Gets Hands on Tokens BlackRock, Worldcoin, Ripple: Bitcoin Bull Mike Novogratz Dishes on Crypto

|

|

How did you like today's email? |

|

|

ABOUT COINSNACKS |

Launched in December 2017, CoinSnacks is home to the longest continuously running crypto newsletter. Each week, we publish our cryptoasset musings to an audience of ~30,000 crypto enthusiasts and investors. |

In a space flooded with new projects, research, and narratives, the average investor may feel overwhelmed or confused. CoinSnacks offers a solution by doing the digging for you, so you don't have to spend hundreds of hours sifting through the noise. |

|

REACH OUR AUDIENCE |

If you’re a brand interested in partnering with CoinSnacks to find your next customers, partner, or ally, we’d love to hear from you. Learn more here. |

|

JOIN OUR NEW PUB |

| Stocks & Income Stocks and income investing. | | Subscribe |

|

|