| |

|

| Follow Us | Get the newsletter |

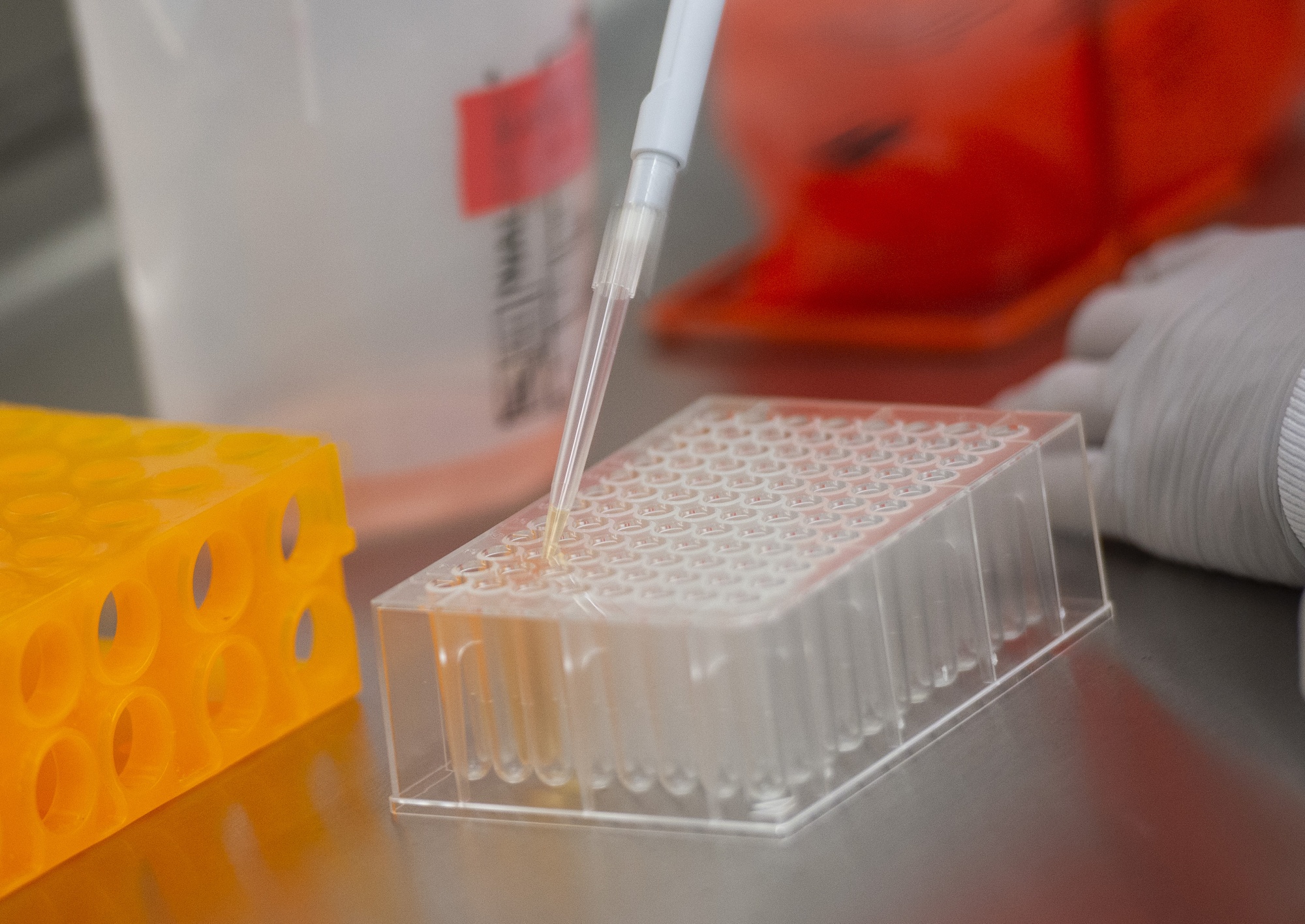

| GameStop turned back toward earth on Thursday, snapping a dizzying six-day rally and wiping out almost $11 billion in market value after brokerages choked off demand for the stock by curbing trading. And Robinhood Markets, the daytrader app that helped make this week’s insanity possible, could end up as collateral damage. The company has drawn down some of its credit lines with banks. Here’s your markets wrap. —David E. Rovella Bloomberg is tracking the progress of coronavirus vaccines while mapping the pandemic globally and across America. Here are today’s top storiesA new Covid-19 vaccine from Novavax was effective in big trials in both the U.K. and South Africa, but that effectiveness appeared to be reduced in South Africa where a worrisome mutation is prevalent. Two cases of that version of the coronavirus have now been found in the U.S. The arrival of the South Africa variant in America follows others spawned in the U.K. and Brazil. The U.K. iteration has been found in more than 20 U.S. states. The Brazil version was identified for the first time in the country this week. The variants are considered more easily transmitted, but not necessarily more deadly. Here is the latest on the pandemic.  Protein samples at Novavax labs in Gaithersburg, Maryland, on March 20, 2020 Photographer: Andrew Caballero-Reynolds/AFP Robinhood lured millions of pajama traders into stocks, inadvertently unleashing havoc in the process. GameStop’s bubble popped on Thursday as Robinhood abruptly sided with Wall Street while also telling users it may close out some of their positions to reduce account risks. Naturally, Robinhood got sued. Oh, and here comes Congress. E*Trade Financial is preventing customers from purchasing shares of GameStop, too, as well as AMC Entertainment Holdings. And here’s something else that won’t make daytraders happy: Everything that was making life miserable for institutional investors this week is reversing itself: Hedge fund trades are working again. U.S. President Joe Biden’s climate blitz has taken Big Oil by surprise. Fossil-fuel giants knew they would face a fight with the new administration, but nobody expected an immediate frontal assault. Biden seems to have a new ally: General Motors. The huge Detroit automaker made a historic pledge to sell only zero-emission vehicles by 2035. Bob Dylan was supposed to spend last summer on tour. Instead, stranded at home because of the pandemic, he lined up the biggest payday of his career, making more than $300 million on his music library. Bloomberg Businessweek reports he wasn’t the only one.  Bob Dylan at The Bitter End in Greenwich Village in 1961. Photographer: Sigmund Goode/Michael Ochs Archives What you’ll need to know tomorrow

What you’ll want to read in Bloomberg GreenThe Secret Planetary Disaster Under Your FeetAs people in cities all over the world go about their daily business, right beneath their feet is a significant contributor to global warming. While oil and coal fade and natural gas rises, leaks from decrepit pipes in underfunded distribution networks are releasing lots methane, which happens to be the high octane version of greenhouse gases.  Photographer: Pomemick/iStockphoto Photographer: Pomemick/iStockphoto Like getting the Evening Briefing? Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and gain expert analysis from exclusive subscriber-only newsletters. The Bloomberg Crypto Summit: With Bitcoin burgeoning and markets jumping as vaccines signal the coming end to the pandemic, the future of digital assets is bright. Join us Feb. 25 as we analyze what it takes to push cryptocurrencies into the portfolios of the world’s largest investors. Sponsored by BitGo and Grayscale Investments. Register here. Download the Bloomberg app: It’s available for iOS and Android. Before it’s here, it’s on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can’t find anywhere else. Learn more. |

| You received this message because you are subscribed to Bloomberg's Evening Briefing newsletter. |

| Unsubscribe | Bloomberg.com | Contact Us |

| Bloomberg L.P. 731 Lexington, New York, NY, 10022 |