|

|

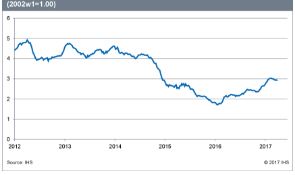

Concerns that Chinese growth will decelerate help pop iron ore bubble

|

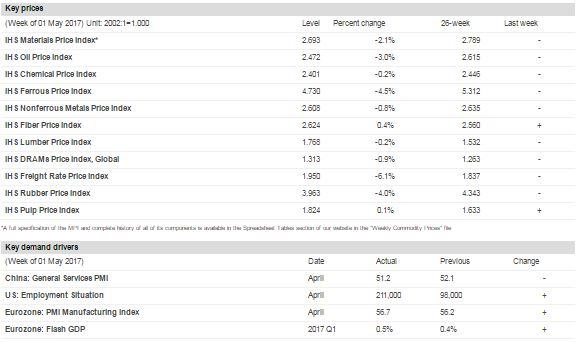

The IHS Materials Price Index (MPI) dropped 2.1% last week, as 8 of the 10 sub-indices fell. The MPI has now declined 11.2% from its mid-February high. Lackluster Chinese manufacturing data, coupled with moves by regulators to crack down on risky investments, are fueling concern that Chinese demand growth is set to decelerate and pushed down commodity prices.

Freight rates experienced the sharpest decline last week, falling 6.1% because of declining fuel prices and jitters about Chinese trade. Oil fell by 3.0%, its third consecutive decline as concerns of oversupply in global markets persist. Meanwhile, the ferrous metals sub-index dropped 4.5% on plunging iron ore prices. Record iron ore port stocks, Chinese steel export markets being closed off by trade actions, and concerns about softening real estate markets have combined to pop the iron ore bubble. Fiber prices came in as the strongest sector last week, rising a mere 0.4%.

Data last week were highlighted by the April purchasing managers' index (PMI) reports and fresh US employment data. April's US employment report was solid, with 211,000 jobs added. The PMI reports, though, did show some softening, with the April global manufacturing composite index inching back to 52.8 from 53 in March. Masked within this slight decline, however, was the retreat in the Caixin Chinese manufacturing index, which moved down to 50.3, close to the breakeven 50 mark. Doubts about Chinese manufacturing activity coupled with ongoing efforts to restrain credit growth are raising concerns about commodity demand in the second half of the year and undermining prices.

|

| | IHS Materials Price Index |  |

|

| |

| Market Insight

For an overview of the IHS Materials Price Index, view this video.

|

|  |

| | |

|

| Industrial Materials: Prices |  |

| Key Prices & Demand Drivers |  |

Construction Costs Rise for Sixth Consecutive Month in April

| | According to IHS Markit and the Procurement Executives Group (PEG), construction costs rose in April on price strength in materials and equipment. |

The headline IHS Markit PEG Engineering and Construction Cost Index registered 57.0 in April, the sixth consecutive month of rising prices, and up from the 53.9 reading in March.

Carbon steel pipe had the largest increase in the materials/equipment index this month when compared to March as higher steel input costs and better demand prospects pushed steel pipe prices higher. “Higher steel input costs and better demand prospects are pushing steel pipe prices higher and will cause prices to escalate further over the next several months. Pipe imports have increased in response to rising demand and they will continue to trend upward and maintain a sizeable share of the market,” said Amanda Eglinton, senior economist at IHS Markit.

| | Learn More |

|

| About IHS Pricing & Purchasing | | The IHS Pricing & Purchasing Service | The IHS Pricing & Purchasing Service enables supply chain cost savings by providing timely, accurate price forecasts and cost analysis. Armed with a better understanding of suppliers' cost structures and market dynamics, organizations can effectively negotiate prices, strategically time buys, and boost the bottom line.

With a database of more than 80,000 historic prices and thousands of price, wage and input cost forecasts, IHS offers more coverage than any other provider in the market. IHS has been providing forecasts of key commodity, labor, and input costs since 1970 -- helping define the purchasing advice industry. | | Learn More |

|

| Commodity Price Forecasts & Supply Chain Cost Benchmarking. Learn More | | |

|

|

|