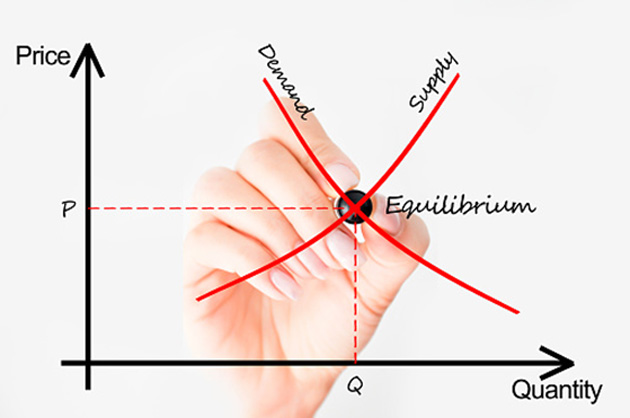

| -- | April 25, 2017 Are Retailers Killing True Free-Market Pricing? By Patrick Watson American stores are dropping like flies. More than 8,600 retail locations could close their doors in 2017, according to a recent Credit Suisse report. On the other hand, people are still shopping, just in different ways. And the shift from brick-and-mortar stores to “online malls” has many consequences we don’t even understand yet. For example, it’s becoming clear that online retailers aren’t shy about using our own data against us. What do you call a market in which the price you pay depends on who you are?  Shopping the Shoppers On the surface, online shopping seems to favor shoppers. It’s easy to compare prices, shipping cost and time, sales tax, and other factors to get the best deal. Retailers have to offer lower prices to make you buy, right? Well, maybe. Last week, I read a fascinating Atlantic Monthly article by Jerry Useem: “How Online Shopping Makes Suckers of Us All.” It’s about the sophisticated ways online merchants adjust and even personalize prices to maximize revenue. A quick excerpt: “I don’t think anyone could have predicted how sophisticated these algorithms have become,” says Robert Dolan, a marketing professor at Harvard. “I certainly didn’t.” The price of a can of soda in a vending machine can now vary with the temperature outside. The price of the headphones Google recommends may depend on how budget-conscious your web history shows you to be, one study found. For shoppers, that means price—not the one offered to you right now, but the one offered to you 20 minutes from now, or the one offered to me, or to your neighbor—may become an increasingly unknowable thing. “Many moons ago, there used to be one price for something,” Dolan notes. Now the simplest of questions—what’s the true price of pumpkin-pie spice?—is subject to a Heisenberg level of uncertainty. Which raises a bigger question: Could the internet, whose transparency was supposed to empower consumers, be doing the opposite? In other words, online retailers are now comparison shopping us. Amazon and others are learning how to dynamically adjust prices based on where you came from, what you bought in the past, where you live, what time of day it is, and even the current weather in your zip code.  Dynamic Pricing If you ever took an economics class, you know about the law of supply and demand. It’s how the market sets prices. Low supply and high demand lead to higher prices. High supply and low demand push prices down. That applies whether the goods are groceries, books, stocks, or anything else. Every product has an equilibrium price. Online retailers are pushing this idea to its limits. They’ve figured out that consumer demand is both individualized and dynamic. Not every person demands a product with equal intensity. Maybe you really want that history textbook because you are enrolled in a class that uses it. You will pay more than someone who just wants to accessorize their living room. Your demand also changes with time. You want the book more now than you did last month, before you enrolled in the class. You won’t want it at all after the semester ends. Since the emergence of online malls, it’s become much easier for retailers to manipulate your demand. They used to do this with limited-time discounts, buy-one-get-one offers, etc. But they all had a common basis in the product’s “list” price, which didn’t change very often.  No More Equilibrium Just like stock prices change by the minute, online shopping is moving toward a similar pattern… but even more chaotic. Stocks still have consolidated tickers—everyone can see the most recent price and decide whether to trade or not. In retail, the concept of a “list price” may lose its meaning entirely. Your price for a widget will be different from my price, and both our prices could change again in a few minutes. Who wins in that environment? A free and open market ought to be a more efficient one, if everyone has access to the same information at the same time. But that isn’t the case now, and it may be even less so in the future. “Equilibrium” in this context may mean we never know what the true value of a given product is. We’ll only know how much we paid. However, I think the “digital malls” connecting online retailers and customers will perform well as the new environment takes shape. Amazon is one such company. Many other retailers use the Amazon web platform and its logistical network to power their online sales. My co-editor Robert Ross and I recently recommended another online retailing technology provider in Macro Growth & Income Alert. We told subscribers how to sell put options for both current income and a chance to buy the shares at a lower price. That’s only the latest in what should be a string of opportunities as consumers and retailers adjusts to a new landscape. It will be a wild but interesting ride. See you at the top,  Patrick Watson P.S. If you’re reading this because someone shared it with you, click here to get your own free Connecting the Dots subscription. You can also follow me on Twitter: @PatrickW.  | Subscribe to Connecting the Dots—and Get a Glimpse of the Future

We live in an era of rapid change… and only those who see and understand the shifting market, economic, and political trends can make wise investment decisions. Macroeconomic forecaster Patrick Watson spots the trends and spells what they mean every week in the free e-letter, Connecting the Dots. Subscribe now for his seasoned insight into the surprising forces driving global markets. |

Senior Economic Analyst Patrick Watson is a master in connecting the dots and finding out where budding trends are leading. Patrick is the editor of Mauldin Economics’ high-yield income letter, Yield Shark, and co-editor of the premium alert service, Macro Growth & In come Alert. You can also follow him on Twitter (@PatrickW) to see his commentary on current events. Senior Economic Analyst Patrick Watson is a master in connecting the dots and finding out where budding trends are leading. Patrick is the editor of Mauldin Economics’ high-yield income letter, Yield Shark, and co-editor of the premium alert service, Macro Growth & In come Alert. You can also follow him on Twitter (@PatrickW) to see his commentary on current events.

Share Your Thoughts on This Article

Use of this content, the Mauldin Economics website, and related sites and applications is provided under the Mauldin Economics Terms & Conditions of Use. Unauthorized Disclosure Prohibited The information provided in this publication is private, privileged, and confidential information, licensed for your sole individual use as a subscriber. Mauldin Economics reserves all rights to the content of this publication and related materials. Forwarding, copying, disseminating, or distributing this report in whole or in part, including substantial quotation of any portion the publication or any release of specific investment recommendations, is strictly prohibited.

Participation in such activity is grounds for immediate termination of all subscriptions of registered subscribers deemed to be involved at Mauldin Economics’ sole discretion, may violate the copyright laws of the United States, and may subject the violator to legal prosecution. Mauldin Economics reserves the right to monitor the use of this publication without disclosure by any electronic means it deems necessary and may change those means without notice at any time. If you have received this publication and are not the intended subscriber, please contact service@mauldineconomics.com. Disclaimers The Mauldin Economics website, Yield Shark, Thoughts from the Frontline, Patrick Cox’s Tech Digest, Outside the Box, Over My Shoulder, World Money Analyst, Street Freak, Just One Trade, Transformational Technology Alert, Rational Bear, The 10th Man, Connecting the Dots, This Week in Geopolitics, Stray Reflections, and Conversations are published by Mauldin Economics, LLC. Information contained in such publications is obtained from sources believed to be reliable, but its accuracy cannot be guaranteed. The information contained in such publications is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in such publications are those of the publisher and are subject to change without notice. The information in such publications may become outdated and there is no obligation to update any such information. You are advised to discuss with your financi al advisers your investment options and whether any investment is suitable for your specific needs prior to making any investments.

John Mauldin, Mauldin Economics, LLC and other entities in which he has an interest, employees, officers, family, and associates may from time to time have positions in the securities or commodities covered in these publications or web site. Corporate policies are in effect that attempt to avoid potential conflicts of interest and resolve conflicts of interest that do arise in a timely fashion.

Mauldin Economics, LLC reserves the right to cancel any subscription at any time, and if it does so it will promptly refund to the subscriber the amount of the subscription payment previously received relating to the remaining subscription period. Cancellation of a subscription may result from any unauthorized use or reproduction or rebroadcast of any Mauldin Economics publication or website, any infringement or misappropriation of Mauldin Economics, LLC’s proprietary rights, or any other reason determined in the sole discretion of Mauldin Economics, LLC. Affiliate Notice Mauldin Economics has affiliate agreements in place that may include fee sharing. If you have a website or newsletter and would like to be considered for inclusion in the Mauldin Economics affiliate program, please go to http://affiliates.pubrm.net/signup/me. Likewise, from time to time Mauldin Economics may engage in affiliate programs offered by other companies, though corporate policy firmly dictates that such agreements will have no influence on any product or service recommendations, nor alter the pricing that would otherwise be available in absence of such an agreement. As always, it is important that you do your own due diligence before transacting any business with any firm, for any product or service. © Copyright 2017 Mauldin Economics | -- |