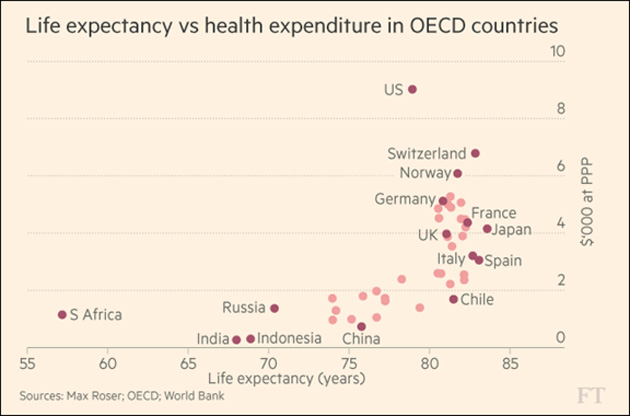

| -- | March 28, 2017 How to Survive the Obamacare Collapse By Patrick Watson Like it or not, Obamacare lives. The question is, for how long? President Trump is right when he says the Affordable Care Act will collapse on its own. Its condition is terminal, and Congress declined treatment last week. Maybe that’s no big deal to you. Maybe you’re on Medicare, or get group health coverage from your employer, or are independently wealthy, or you’re in good health and confident you will remain so. Unfortunately, millions of Americans who don’t fall into any of those categories may soon find themselves in a tough spot. I don’t want that to be you, so today I’m sounding the alarm. You may enter 2018 with no access to health insurance, which means you will be at risk both medically and financially. Now is the time to prepare.  Money for Nothing The first step to solving a problem is admitting you have one. Some of us are in denial, so here’s a hard fact: We Americans spend far more money on healthcare than any other developed nation, but we’re no healthier. We’re even less healthy overall. The chart below shows the bad news. The horizontal axis is years of life expectancy. The vertical axis is per capita healthcare spending. Ideally, you want to be in the lower right quadrant. That means your population has a relatively high life expectancy and relatively low healthcare spending. France, Japan, Spain, Chile, and a bunch of others are clustered in that area. Their money buys more health than ours does.

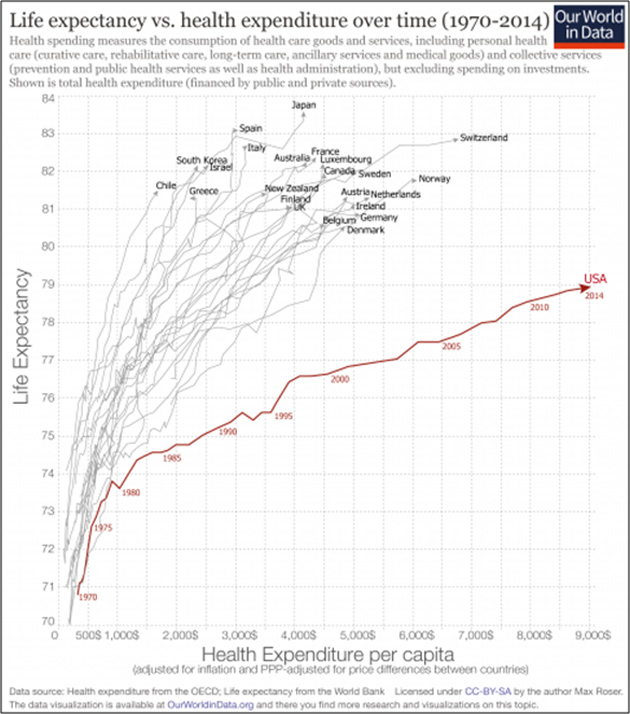

Image: Financial Times The United States is in the upper right, which shows that our per-person healthcare spending is significantly higher than that of the other OECD countries. Switzerland is a distant second place. Our extra spending doesn’t help us live longer. We actually die a little earlier than our peers in Japan and most of Europe. You can quibble over details in this data, but the broad facts are inescapable. We spend too much on healthcare relative to the health it buys us. As long as that is the case, no reform plan will work. Did Obamacare cause this? No. It goes way back. Here’s another graphic showing the changes over time.

Image: Our World in Data You can see that the United States began diverging from other developed countries back in the 1980s. The gap has only grown wider since then. Stranger yet, we spend all this extra money yet still leave millions of low-income citizens with little or no access to healthcare. Kaiser Family Foundation says some 2.5 million working Americans make too much to qualify for Medicaid, but not enough to receive Obamacare tax credits. Death Spiral Approaching I showed you that data to say this: Simply returning to pre-Obamacare conditions won’t solve the problem. Obamacare exists because the system wasn’t working and we needed something better. Before 2014, people with preexisting conditions were simply out of luck. They couldn’t buy health insurance at any price, unless their employers offered group health, which many didn’t. This was hurting both those people and the economy at large. Obamacare, for all its flaws, at least tried to solve the problem. It helped some people but hurt others—and now it’s reached its limits. Insurance works only if the risk pool includes enough low-spending people to offset those with expensive claims. That’s Obamacare’s core problem. The legal mandate to buy insurance hasn’t brought enough young and healthy people into the pool. The private insurers that participate in the Obamacare marketplaces are not in the business of losing money. They can and will back out if they see no profit potential or, worse, a risk of huge losses. Here’s what healthcare policy expert Robert Laszewski said after the GOP proposal failed last week. Note the key point I bolded. Now, the president has threatened to skip fixing Obamacare and let it fail. He will get his wish. The Obamacare insurance exchanges are simply unsustainable in their present form. With only 40 percent of the subsidy eligible signing up after three years, the risk pool is nowhere near the goal of getting 75 percent to sign up to assure enough healthy people are paying into the program to cover the costs of the sick. Health insurers that I have talked to are already working on their contingency plans for 2018 should Obamacare not be repaired. Things are so unsustainable that the shrinking number of health insurance companies left in the Obamacare market are giving serious thought to whether or not they will even participate, and if they do just how much higher—and they will have to be much higher—to set the rates. Already in 2017, one-third of US counties have only one participating marketplace insurer. More of the country will be in that position next year. Some areas may have no insurers at all, or if they do, it will likely be at higher rates for worse coverage. This is the “death spiral” you hear about. People with serious illnesses will buy insurance no matter what it costs. This drives up claim ratios, which then drives premiums yet higher and discourages young and healthy people from buying. That can’t work indefinitely.  What to Do Now If Laszewski is right, at least some of the millions who rely on Obamacare for health insurance will be out of luck next year. Congress and President Trump might buy us another year or two if they put their heads together, but it seems unlikely. They might even make it worse… even though it’s going to get worse without any help. This isn’t just a “tail risk,” as traders might call it. The odds that catastrophe will strike you may not be 100%, but they’re well above zero. We all need to get ready. What can you do? - If you have insurance now and you’ve delayed treating a medical problem, don’t wait any longer. Talk to your doctor and deal with it before 2017 ends.

- Find a good insurance agent in your area. As of now, at least, some companies still sell short-term medical policies with limited coverage. An agent can help you find the best fit. They may not cover preexisting conditions, but may also be better than nothing.

- If you take expensive prescriptions, start refilling them as soon as your insurer allows. Usually, they give you a few days’ leeway before your supply runs out. Do it every time, and over a few months you’ll accumulate an extra supply.

- Take care of your body: Lose weight, eat better, get exercise—you know the drill. It will pay off financially by reducing your risk of expensive problems.

- If you work for a small business that might drop its healthcare plan, or your employment is otherwise unstable, start thinking about possible career changes now.

Another option: the religious healthcare cost-sharing plans. They aren’t “insurance” and don’t cover everything, but they count as meeting the Obamacare mandate. Look here or here to learn more.  Helping Hands Healthcare shouldn’t be this giant problem. The United States is a wealthy nation. We have a long tradition of helping our neighbors when misfortune strikes. But for whatever reasons, it’s turned into a political fight. I believe that next year, millions of Americans will lose access to health insurance. It will be even worse for some—maybe you, maybe me. We don’t know where lightning will strike. There are practical things we can all do to prepare for this. I listed a few ideas above. You may have different or better ones. I’d like to tell other readers about them, so please leave a comment on this article’s web page or send me an e-mail. I’ll share the best ideas in a future letter. If the folks in Washington can’t get their act together, we’ll just have to do it ourselves. See you at the top,  Patrick Watson P.S. If you’re reading this because someone shared it with you, click here to get your own free Connecting the Dots subscription. You can also follow me on Twitter: @PatrickW.  | Subscribe to Connecting the Dots—and Get a Glimpse of the Future

We live in an era of rapid change… and only those who see and understand the shifting market, economic, and political trends can make wise investment decisions. Macroeconomic forecaster Patrick Watson spots the trends and spells what they mean every week in the free e-letter, Connecting the Dots. Subscribe now for his seasoned insight into the surprising forces driving global markets. |

Senior Economic Analyst Patrick Watson is a master in connecting the dots and finding out where budding trends are leading. Patrick is the editor of Mauldin Economics’ high-yield income letter, Yield Shark, and co-editor of the premium alert service, Macro Growth & In come Alert. You can also follow him on Twitter (@PatrickW) to see his commentary on current events. Senior Economic Analyst Patrick Watson is a master in connecting the dots and finding out where budding trends are leading. Patrick is the editor of Mauldin Economics’ high-yield income letter, Yield Shark, and co-editor of the premium alert service, Macro Growth & In come Alert. You can also follow him on Twitter (@PatrickW) to see his commentary on current events.

Share Your Thoughts on This Article

Use of this content, the Mauldin Economics website, and related sites and applications is provided under the Mauldin Economics Terms & Conditions of Use. Unauthorized Disclosure Prohibited The information provided in this publication is private, privileged, and confidential information, licensed for your sole individual use as a subscriber. Mauldin Economics reserves all rights to the content of this publication and related materials. Forwarding, copying, disseminating, or distributing this report in whole or in part, including substantial quotation of any portion the publication or any release of specific investment recommendations, is strictly prohibited.

Participation in such activity is grounds for immediate termination of all subscriptions of registered subscribers deemed to be involved at Mauldin Economics’ sole discretion, may violate the copyright laws of the United States, and may subject the violator to legal prosecution. Mauldin Economics reserves the right to monitor the use of this publication without disclosure by any electronic means it deems necessary and may change those means without notice at any time. If you have received this publication and are not the intended subscriber, please contact service@mauldineconomics.com. Disclaimers The Mauldin Economics website, Yield Shark, Thoughts from the Frontline, Patrick Cox’s Tech Digest, Outside the Box, Over My Shoulder, World Money Analyst, Street Freak, Just One Trade, Transformational Technology Alert, Rational Bear, The 10th Man, Connecting the Dots, This Week in Geopolitics, Stray Reflections, and Conversations are published by Mauldin Economics, LLC. Information contained in such publications is obtained from sources believed to be reliable, but its accuracy cannot be guaranteed. The information contained in such publications is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in such publications are those of the publisher and are subject to change without notice. The information in such publications may become outdated and there is no obligation to update any such information. You are advised to discuss with your financi al advisers your investment options and whether any investment is suitable for your specific needs prior to making any investments.

John Mauldin, Mauldin Economics, LLC and other entities in which he has an interest, employees, officers, family, and associates may from time to time have positions in the securities or commodities covered in these publications or web site. Corporate policies are in effect that attempt to avoid potential conflicts of interest and resolve conflicts of interest that do arise in a timely fashion.

Mauldin Economics, LLC reserves the right to cancel any subscription at any time, and if it does so it will promptly refund to the subscriber the amount of the subscription payment previously received relating to the remaining subscription period. Cancellation of a subscription may result from any unauthorized use or reproduction or rebroadcast of any Mauldin Economics publication or website, any infringement or misappropriation of Mauldin Economics, LLC’s proprietary rights, or any other reason determined in the sole discretion of Mauldin Economics, LLC. Affiliate Notice Mauldin Economics has affiliate agreements in place that may include fee sharing. If you have a website or newsletter and would like to be considered for inclusion in the Mauldin Economics affiliate program, please go to http://affiliates.pubrm.net/signup/me. Likewise, from time to time Mauldin Economics may engage in affiliate programs offered by other companies, though corporate policy firmly dictates that such agreements will have no influence on any product or service recommendations, nor alter the pricing that would otherwise be available in absence of such an agreement. As always, it is important that you do your own due diligence before transacting any business with any firm, for any product or service. © Copyright 2017 Mauldin Economics | -- |