| -- | October 10, 2017 How to Work in Retirement and Love It By Patrick Watson Wall Street endlessly gushes about retirement. Its TV commercials show how wonderful life will be in our golden years—when we are old, yet still healthy and wealthy enough to go hang-gliding every day. Meanwhile, out here in the real world, most working-age Americans don’t want to talk or even think about retirement. Often this is because they know they aren’t saving enough and probably will have to work until they drop dead. This is the elephant in the room. 10,000 US Baby Boomers turn 65 every day. For most, life at that milestone won’t look much like the TV commercials. That sounds dire, but it doesn’t have to be. Let’s look at ways this problem could be solved. But first, some more facts.

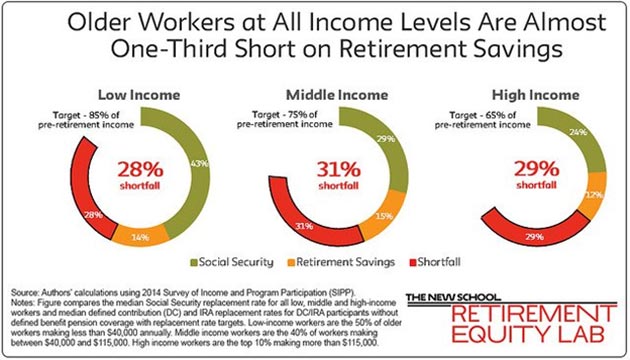

Photo: Julius Diller via Flickr Retirement Shortfall Lately, I’ve been working with John Mauldin to research the huge public pension fund shortfalls. But it’s not just big funds that don’t save enough—most individuals are in the same position, or worse. Judging from the emails and comments I’m getting, Connecting the Dots readers are more financially sophisticated than the general public. You’ve probably prepared for retirement enough to live comfortably. If so, you are a small minority, though. Teresa Ghilarducci is a labor economist at The New School, specializing in retirement security. Here’s what she told the Washington Post last month. “There is no part of the country where the majority of middle-class older workers have adequate retirement savings to maintain their standard of living in their retirement.” Her research shows even high-income workers haven’t saved enough to fund comfortable retirements.  The circles in this chart show how much money people should be saving for retirement. The shortfall (the red part) is around 30% for all income levels. The green part of the circles is what Social Security provides. The program was never meant to be a full pension, and it clearly isn’t delivering one. Yet a majority of the age 65+ population depends on Social Security for at least half of its income.

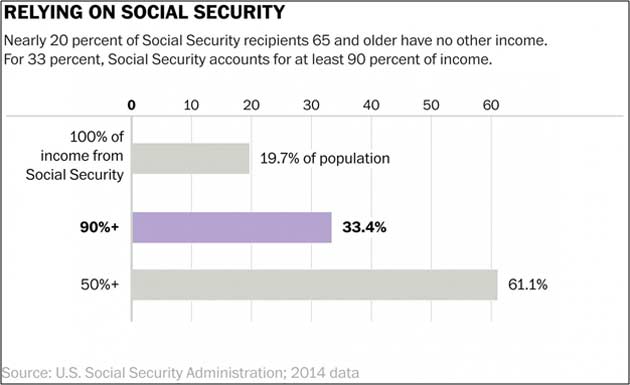

Image: Washington Post These are sobering numbers: - 19.7% of retirees get 100% of their income from Social Security.

- A full third (33.4%) depend on it for 90% of their income.

- And 61.1% get at least half their income from Social Security.

Now, consider what John Mauldin wrote in Thoughts from the Frontline last weekend. The federal government’s unfunded 75-year liability for Social Security and Medicare combined is $46.7 trillion. So Americans aren’t saving enough for themselves, nor is the government saving on their behalf. And the Millennial generation, whose taxes Boomers and Gen-Xers will depend on, is not exactly off to a great career start. It’s hard to see how this story could end well. It certainly won’t end with every older American enjoying a leisurely retirement. “I’m Going to Work Until I Die.” Unprepared retirees are filling the gap the only way they can: by working well into their golden years. In 1986, 10.6% of the population older than 65 was still working. In 2016, it was 18.6%, and I suspect the number will keep rising. The Washington Post story profiles some working senior citizens: Richard Dever had swabbed the campground shower stalls and emptied 20 garbage cans, and now he climbed slowly onto a John Deere mower to cut a couple acres of grass. “I’m going to work until I die, if I can, because I need the money,” said Dever, 74, who drove 1,400 miles to this Maine campground from his home in Indiana to take a temporary job that pays $10 an hour. Dever shifted gently in the tractor seat, a rubber cushion carefully positioned to ease the bursitis in his hip—a snapshot of the new reality of old age in America. Dever’s story isn’t unusual. Many older people sell their homes, buy campers, and move around the country. Some just enjoy sightseeing—but many are making ends meet as seasonal laborers. Amazon even has a formal program for them called CamperForce. Amazon makes it sound fun: “Your next RV adventure is here,” says the website. But it’s not the kind of adventure most camping enthusiasts would prefer. Now, the idea of working past age 65 isn’t necessarily so bad. After all, work isn’t “work” if you enjoy doing it. The problem arises when the work is physically difficult or otherwise unpleasant. I know many people over 65 who are very happily employed. John Mauldin, for one. He’s 68 and keeps a schedule that would exhaust much younger folks. Working past retirement age isn’t always a nightmare—though it can definitely be one if you are forced into it.

Photo: Col Ford via Flickr Encore Career This problem currently affects 76 million Baby Boomers who have already entered, are about to enter, or are approaching their retirement years. At 53, I’m one of them. We know most Americans in that age group don’t have enough savings to simply stop working. If that’s you, here are some tips what to do. 1. Save and invest as much as you can, even if the amount seems small. It will still come in handy. 2. Take care of your health. Lose weight, get exercise, eat healthy. This will both minimize your medical expenses and let you work more comfortably if you need to. 3. Think ahead about what kind of work you can do in retirement. Identify a job you can “retire into.” It should be something you enjoy, that earns real income, and that you’ll be able to continue even as aging slows you down. 4. Don’t look at it as Plan B. Think of retirement as a new stage in your career. As I said, work is only work if you don’t enjoy it. If you plan ahead, it can be a time when you work on your own terms instead of someone else’s. In my case, there’s no reason I can’t keep writing into my seventies. Maybe I’ll take more vacations, but I don’t want to stop writing completely. I’m not sure I could stop even if I wanted to. Meanwhile, those extra working years will allow me to save longer and my savings to compound, which will leave me in a better position when I can’t work anymore and have to tap my savings. Medical breakthroughs extend what my colleague Patrick Cox calls “health spans.” Not only can we live longer, we can be healthier longer. There’s a good chance 80 will be the new 60. In that regard, watch this short video by Gary Vaynerchuk. It has a little profanity at the end, but watch anyway. He has a message that may help. We all have more time than we think… and we can do a lot with it. See you at the top,  Patrick Watson P.S. If you’re reading this because someone shared it with you, click here to get your own free Connecting the Dots subscription. You can also follow me on Twitter: @PatrickW.  | Subscribe to Connecting the Dots—and Get a Glimpse of the Future

We live in an era of rapid change… and only those who see and understand the shifting market, economic, and political trends can make wise investment decisions. Macroeconomic forecaster Patrick Watson spots the trends and spells what they mean every week in the free e-letter, Connecting the Dots. Subscribe now for his seasoned insight into the surprising forces driving global markets. |

Senior Economic Analyst Patrick Watson is a master in connecting the dots and finding out where budding trends are leading. Patrick is the editor of Mauldin Economics’ high-yield income letter, Yield Shark, and co-editor of the premium alert service, Macro Growth & Income Alert. You can also follow him on Twitter (@PatrickW) to see his commentary on current events. Senior Economic Analyst Patrick Watson is a master in connecting the dots and finding out where budding trends are leading. Patrick is the editor of Mauldin Economics’ high-yield income letter, Yield Shark, and co-editor of the premium alert service, Macro Growth & Income Alert. You can also follow him on Twitter (@PatrickW) to see his commentary on current events.

Share Your Thoughts on This Article

Use of this content, the Mauldin Economics website, and related sites and applications is provided under the Mauldin Economics Terms & Conditions of Use. Unauthorized Disclosure Prohibited The information provided in this publication is private, privileged, and confidential information, licensed for your sole individual use as a subscriber. Mauldin Economics reserves all rights to the content of this publication and related materials. Forwarding, copying, disseminating, or distributing this report in whole or in part, including substantial quotation of any portion the publication or any release of specific investment recommendations, is strictly prohibited.

Participation in such activity is grounds for immediate termination of all subscriptions of registered subscribers deemed to be involved at Mauldin Economics’ sole discretion, may violate the copyright laws of the United States, and may subject the violator to legal prosecution. Mauldin Economics reserves the right to monitor the use of this publication without disclosure by any electronic means it deems necessary and may change those means without notice at any time. If you have received this publication and are not the intended subscriber, please contact service@mauldineconomics.com. Disclaimers The Mauldin Economics website, Yield Shark, Thoughts from the Frontline, Patrick Cox’s Tech Digest, Outside the Box, Over My Shoulder, World Money Analyst, Street Freak, Just One Trade, Transformational Technology Alert, Rational Bear, The 10th Man, Connecting the Dots, This Week in Geopolitics, Stray Reflections, and Conversations are published by Mauldin Economics, LLC. Information contained in such publications is obtained from sources believed to be reliable, but its accuracy cannot be guaranteed. The information contained in such publications is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in such publications are those of the publisher and are subject to change without notice. The information in such publications may become outdated and there is no obligation to update any such information. You are advised to discuss with your financial advisers your investment options and whether any investment is suitable for your specific needs prior to making any investments.

John Mauldin, Mauldin Economics, LLC and other entities in which he has an interest, employees, officers, family, and associates may from time to time have positions in the securities or commodities covered in these publications or web site. Corporate policies are in effect that attempt to avoid potential conflicts of interest and resolve conflicts of interest that do arise in a timely fashion.

Mauldin Economics, LLC reserves the right to cancel any subscription at any time, and if it does so it will promptly refund to the subscriber the amount of the subscription payment previously received relating to the remaining subscription period. Cancellation of a subscription may result from any unauthorized use or reproduction or rebroadcast of any Mauldin Economics publication or website, any infringement or misappropriation of Mauldin Economics, LLC’s proprietary rights, or any other reason determined in the sole discretion of Mauldin Economics, LLC. Affiliate Notice Mauldin Economics has affiliate agreements in place that may include fee sharing. If you have a website or newsletter and would like to be considered for inclusion in the Mauldin Economics affiliate program, please go to http://affiliates.ggcpublishing.com/. Likewise, from time to time Mauldin Economics may engage in affiliate programs offered by other companies, though corporate policy firmly dictates that such agreements will have no influence on any product or service recommendations, nor alter the pricing that would otherwise be available in absence of such an agreement. As always, it is important that you do your own due diligence before transacting any business with any firm, for any product or service. © Copyright 2017 Mauldin Economics | -- |