| -- | March 29, 2016

Old-Fashioned Investment Values Never Go Out of Style According to my children, I’m old enough to have gone to school with George Washington. More than my gray hair or my AARP membership card, their perception comes from my stubborn attachment to old-fashioned values. Sure, the world has changed—a lot—but I still do a lot of things the old-fashioned way. - I use e-mail and instant messaging all the time, but I still send hand-written thank-you letters to express gratitude.

- My father taught me to be the first person to show up for work and to be the last one to leave. That’s how you get ahead in life, and I’ve taught my children (to their chagrin) to do the same.

- I take off my hat when I enter a building, I open doors for women, and I say, “Yes, sir” and “Yes, ma’am” to everyone.

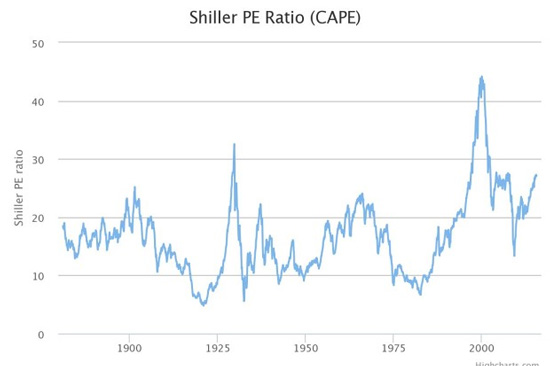

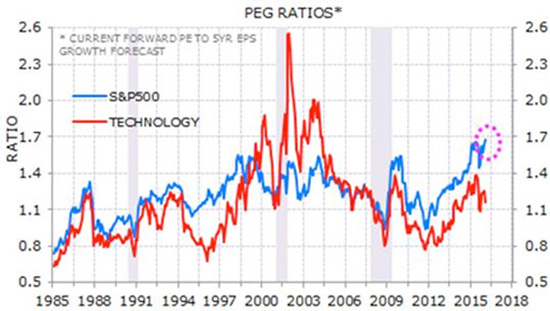

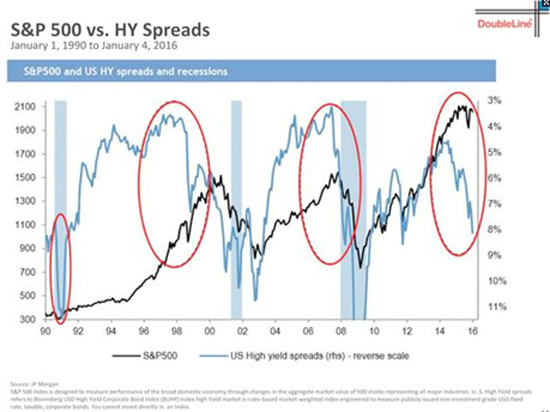

And when it comes to investing, I still believe in the basics of old-fashioned fundamentals like balance sheet and financial statement analysis. The Wall Street youngsters (at least they feel young to me) today are more concerned about the friendly cooperation of the world’s central bankers. In the “good old” days, investment professionals used to focus on boring numbers like days sales outstanding, operating margins, cost of goods sold, accounts payable, and paid in capital.  Today, however, what passes for analysis is the dissection of every syllable that comes out of Janet Yellen and Mario Draghi’s mouth. I never thought I’d see the day on Wall Street when linguistics was more important than things like revenues and profits. However, if you’ve been around long enough, you know that fundamentals do matter and that the current rally based on monetary steroids is doomed to fail. In fact, the warning signs are really starting to pile up. Overvalued Warning #1: This bull market is more than seven years old, and only one rally in history has lasted longer—from December 1987 to March 2000. After that, we had a two-and-a-half-year bear market that chopped the stock market in half. Overvalued Warning #2: One of John Mauldin’s pals is Nobel laureate Robert Shiller, and his cyclically adjusted P/E or CAPE ratio is screaming “Danger” at 24 times earnings compared to the historical average of 16.  Overvalued Warning #3: Even more telling to me is that the US stock market is the most expensive it has ever been as measured by the PEG (price-earnings-to-growth) ratio. The S&P 500’s current PEG ratio is 1.7, an all-time high.  Overvalued Warning #4: Falling junk bond prices have been a very good canary in the stock market coal mine. - Junk bond prices tumbled well in advance of the dot-com implosion.

- Junk bonds peaked shortly before the Financial Crisis slaughtered investors.

Junk bond prices started falling around 18 months ago, and the S&P 500 shouldn’t be far behind.  Overvalued Warning #5: The stock market isn’t the only market that appears overvalued. I’m talking about real estate. My reasoning is simple: home prices are up, but incomes aren’t.  - In 2007, the median household income in the United States was $57,936, but in 2014, it dropped to $53,657.

- In 2007, the average home in the US cost $247,900, but prices increased to $278,800 in January 2016.

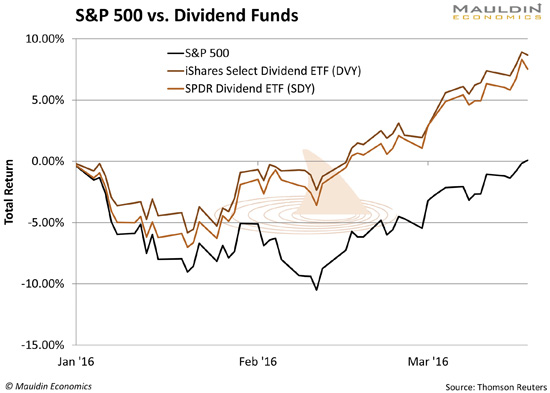

Those two polar opposite forces just cannot go on forever. Either Americans have to start earning more money or real estate prices have to fall. My bet is for lower prices. So What’s an Old-Fashioned Investor Supposed to Do? So what should you do? I think there are just three basic strategies that will protect your portfolio: Survive & Thrive Strategy #1: Load up on generous dividend-paying stocks. In this topsy-turvy world of ZIRP (zero interest rate policy) and NIRP (negative interest rate policy), stocks that pay out generous, sustainable dividends will be one of the few places that will hold their value. Here’s proof: Through the beginning of March, two dividend-focused ETFs—iShares Select Dividend ETF (DVY) and SPDR S&P Dividend ETF (SDY)—outperformed the S&P 500 both going down and going up.  From December 31, 2015 through February 11, 2016, these two dividend ETFs lost significantly less money than the S&P 500 and maintained that outperformance even as the stock market recovered. Survive & Thrive Strategy #2: Raise cash; lots of it. Of course, cash pays almost nothing thanks to our hallucinating central bankers, but zero will be your hero when things turn ugly. Survive & Thrive Strategy #3: If you have some capital you can afford to speculate with, you should consider taking out some portfolio insurance with inverse ETFs and/or put options. In reality, you probably need all three of the above strategies, but more importantly, you need to remember that old-fashioned investment values never go out of style. In the current edition of Yield Shark, I’m talking at length about what dividend stocks can do for you—and recommend a winner whose revenues were up 44% year over year in the last quarter.

Tony Sagami

30-year market expert Tony Sagami leads the Yield Shark and Rational Bear advisories at Mauldin Economics. To learn more about Yield Shark and how it helps you maximize dividend income, click here. To learn more about Rational Bear and how you can use it to benefit from falling stocks and sectors, click here. Share this newsletter

http://www.mauldineconomics.com/members

Use of this content, the Mauldin Economics website, and related sites and applications is provided under the Mauldin Economics Terms & Conditions of Use. Unauthorized Disclosure Prohibited The information provided in this publication is private, privileged, and confidential information, licensed for your sole individual use as a subscriber. Mauldin Economics reserves all rights to the content of this publication and related materials. Forwarding, copying, disseminating, or distributing this report in whole or in part, including substantial quotation of any portion the publication or any release of specific investment recommendations, is strictly prohibited. Participation in such activity is grounds for immediate termination of all subscriptions of registered subscribers deemed to be involved at Mauldin Economics’ sole discretion, may violate the copyright laws of the United States, and may subject the violator to legal prosecution. Mauldin Economics reserves the right to monitor the use of this publication without disclosure by any electronic means it deems necessary and may change those means without notice at any time. If you have received this publication and are not the intended subscriber, please contact service@mauldineconomics.com. Disclaimers The Mauldin Economics web site, Yield Shark, Thoughts from the Frontline, Tony Sagami's Rational Bear, Stray Reflections, Outside the Box, Over My Shoulder, World Money Analyst, Street Freak, Just One Trade, Transformational Technology Alert, and Conversations are published by Mauldin Economics, LLC. Information contained in such publications is obtained from sources believed to be reliable, but its accuracy cannot be guaranteed. The information contained in such publications is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in such publications are those of the publisher and are subject to change without notice. The information in such publications may become outdated and there is no obligation to update any such information. John Mauldin, Mauldin Economics, LLC and other entities in which he has an interest, employees, officers, family, and associates may from time to time have positions in the securities or commodities covered in these publications or web site. Corporate policies are in effect that attempt to avoid potential conflicts of interest and resolve conflicts of interest that do arise in a timely fashion. Mauldin Economics, LLC reserves the right to cancel any subscription at any time, and if it does so it will promptly refund to the subscriber the amount of the subscription payment previously received relating to the remaining subscription period. Cancellation of a subscription may result from any unauthorized use or reproduction or rebroadcast of any Mauldin Economics publication or website, any infringement or misappropriation of Mauldin Economics, LLC’s proprietary rights, or any other reason determined in the sole discretion of Mauldin Economics, LLC. Affiliate Notice Mauldin Economics has affiliate agreements in place that may include fee sharing. If you have a website or newsletter and would like to be considered for inclusion in the Mauldin Economics affiliate program, please go to http://affiliates.pubrm.net/signup/me. Likewise, from time to time Mauldin Economics may engage in affiliate programs offered by other companies, though corporate policy firmly dictates that such agreements will have no influence on any product or service recommendations, nor alter the pricing that would otherwise be available in absence of such an agreement. As always, it is important that you do your own due diligence before transacting any business with any firm, for any product or service. © Copyright 2016 Mauldin Economics | -- |