| -- | January 31, 2017 The Energy Rally That Couldn’t By Patrick Watson Energy stocks jumped after the November election because investors thought new management in Washington would be their ticket to wealth. But what if it’s not? On the surface, the stars seem lined up for Big Oil & Gas. President Trump promised to reduce the industry’s regulatory burden and open more federal land and offshore areas to drilling. Furthermore, lower taxes and friendlier regulation will unleash animal spirits, boosting economic growth—and energy demand with it. Maybe it will all work that way, but simple economics tells me it won’t be so easy.  The Bullish Case for Energy So here’s what we know: Energy production is a highly regulated industry, and Trump will make it less so. The president demonstrated this last week when he revived the Keystone and Dakota Access pipeline projects, which had been stalled by his predecessor. Also, Trump’s key appointees should be a boon for the industry: - Scott Pruitt, nominated to lead the Environmental Protection Agency, was the energy industry’s best friend as Oklahoma attorney general.

- Former Texas Governor Rick Perry, Trump’s choice for secretary of energy, once advocated abolishing the very department he will soon lead.

- Trump’s nominee for secretary of state, Rex Tillerson, was the CEO of ExxonMobil (XOM) and negotiated many overseas energy deals. US companies will no doubt gain new opportunities under his watch, maybe even in Russia.

Photo: Getty Images Reducing compliance headaches will make life much easier for oil and gas companies. All other things being equal, it should translate into higher profits. There’s just one problem: All other things aren’t equal. Supply & Demand As the supply of a good or service goes up, the price rises and demand drops. When supplies fall, the opposite happens—demand rises and the price drops. That’s the law of supply and demand we all learned in economics class.

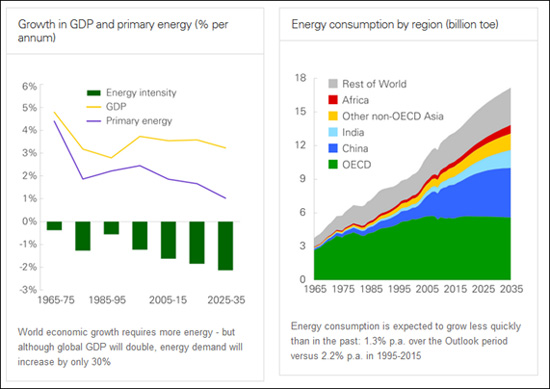

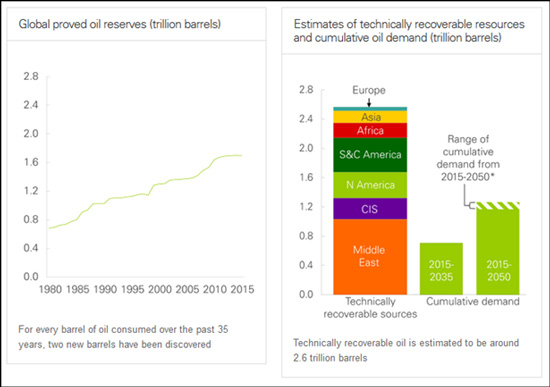

Photo: Wikimedia Commons However, the seller’s cost to acquire the goods isn’t part of this equation. It is an indirect factor. Lower costs let sellers supply more, thereby pushing the unit price lower. This is the oil industry’s present problem. The very same factors that reduce their costs will also lead to higher supply. In the absence of higher demand, lower prices will follow. Energy Intensity So what about that demand growth? Will we use more energy in the coming years? Yes, says the new BP Energy Outlook, an exhaustive report from the former British Petroleum. BP thinks world energy consumption will grow 1.3% per year from 2015 to 2035. That’s impressive until you consider that it grew 2.2% a year from 1995 to 2015. Why? The amount of energy it takes to generate economic growth, or “energy intensity,” is shrinking fast. Today’s vehicles and technology are far more fuel-efficient than those of the past. BP believes world GDP can double in the next 20 years with energy usage growing only 30%. Worse, the demand growth isn’t happening here. It will be flat or even decline in the OECD countries (the US and other developed markets), with most growth happening in China, India, the rest of Asia, and Africa. You can see it in this chart from BP.  The energy mix is changing too. Renewable sources like solar are growing fast in much of the world. Depending on location, in many places solar is now economically on par with fossil fuels, even without government subsidies. And these technologies will only improve. So if demand for oil, gas, and coal is flat or rising slowly, producing more of these energy sources will keep prices steady at best, and more likely push them lower. Supply Glut The left chart below, again from the BP report, shows global proved oil reserves growing steadily since 1980. Now, in reality the oil supply is not growing at all. Whatever is down there is what we have. So when we say supply is rising, we mean we’re finding more thanks to improved technology.  The right chart ought to terrify energy bulls. Even if the entire world stopped exploring for oil right now, the amount we’ve already located is more than twice the cumulative projected demand from 2015 to 2050. So if you own some of those untapped reserves, this tells you to bring your oil to the surface as fast as you possibly can. Sell it to someone while they still have a use for it. Otherwise, you’ll be stuck with a stranded asset nobody wants. That’s what is happening too, despite the oil price falling sharply since 2014. Debt-financed energy producers keep producing even when the oil price is below their production cost, just to cover their debt service. They literally can’t afford to stop—and that’s capping the oil price in the $50–$60 range. Meanwhile, new technologies are pushing production costs even lower by automating the dangerous work formerly done by well-paid humans. - National Oilwell Varco (NOV), for instance, makes an “Iron Roughneck” that does the tedious, repetitive work of connecting drill pipe segments.

- In offshore fields, submersible drones are doing much of the repair and maintenance work once done by human divers.

- Nabors Industries (NBR) says its new automated drill rigs will cut down the number of workers needed at each site from 20 to just five.

Lower production costs mean the supply curve can shift even more, letting producers supply the same quantity at a lower price. If that happens in a declining-demand environment, the price can drop even lower—and almost certainly will. Similar trends are underway in coal and natural gas. All these energy sources face abundant supply, falling production costs, and lower demand. In my book, that doesn’t add up to a sustainable bull market.

Photo: Getty Images Sunset for the Oil Patch? I am not predicting doom for the energy sector by any means. There is still plenty of opportunity to earn good revenue and even boost it. But in the aggregate, the extractive energy sector faces serious headwinds, and there’s nothing President Trump and/or Congress can do to change it. If you’re a nimble trader, you might be able to extract some profits in the next year or two. I’ve recommended natural-gas pipeline plays in both of my publications, the income-focused Yield Shark and its big brother, Macro Growth & Income Alert, a premium alert service for advanced income investing. Opportunities exist—for now. Five or 10 years from now is a different story. If Donald Trump gets a second term as president, the energy industry will be dramatically smaller than it was when he started. See you at the top,  Patrick Watson

@PatrickW

| Subscribe to Connecting the Dots—and Get a Glimpse of the Future

We live in an era of rapid change… and only those who see and understand the shifting market, economic, and political trends can make wise investment decisions. Macroeconomic forecaster Patrick Watson spots the trends and spells what they mean every week in the free e-letter, Connecting the Dots. Subscribe now for his seasoned insight into the surprising forces driving global markets. |

Senior Economic Analyst Patrick Watson is a master in connecting the dots and finding out where budding trends are leading. Patrick is the editor of Mauldin Economics’ high-yield income letter, Yield Shark, and co-editor of the premium alert service, Macro Growth & In come Alert. You can also follow him on Twitter (@PatrickW) to see his commentary on current events. Senior Economic Analyst Patrick Watson is a master in connecting the dots and finding out where budding trends are leading. Patrick is the editor of Mauldin Economics’ high-yield income letter, Yield Shark, and co-editor of the premium alert service, Macro Growth & In come Alert. You can also follow him on Twitter (@PatrickW) to see his commentary on current events.

Share Your Thoughts on This Article

Use of this content, the Mauldin Economics website, and related sites and applications is provided under the Mauldin Economics Terms & Conditions of Use. Unauthorized Disclosure Prohibited The information provided in this publication is private, privileged, and confidential information, licensed for your sole individual use as a subscriber. Mauldin Economics reserves all rights to the content of this publication and related materials. Forwarding, copying, disseminating, or distributing this report in whole or in part, including substantial quotation of any portion the publication or any release of specific investment recommendations, is strictly prohibited.

Participation in such activity is grounds for immediate termination of all subscriptions of registered subscribers deemed to be involved at Mauldin Economics’ sole discretion, may violate the copyright laws of the United States, and may subject the violator to legal prosecution. Mauldin Economics reserves the right to monitor the use of this publication without disclosure by any electronic means it deems necessary and may change those means without notice at any time. If you have received this publication and are not the intended subscriber, please contact service@mauldineconomics.com. Disclaimers The Mauldin Economics website, Yield Shark, Thoughts from the Frontline, Patrick Cox’s Tech Digest, Outside the Box, Over My Shoulder, World Money Analyst, Street Freak, Just One Trade, Transformational Technology Alert, Rational Bear, The 10th Man, Connecting the Dots, This Week in Geopolitics, Stray Reflections, and Conversations are published by Mauldin Economics, LLC. Information contained in such publications is obtained from sources believed to be reliable, but its accuracy cannot be guaranteed. The information contained in such publications is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in such publications are those of the publisher and are subject to change without notice. The information in such publications may become outdated and there is no obligation to update any such information. You are advised to discuss with your financi al advisers your investment options and whether any investment is suitable for your specific needs prior to making any investments.

John Mauldin, Mauldin Economics, LLC and other entities in which he has an interest, employees, officers, family, and associates may from time to time have positions in the securities or commodities covered in these publications or web site. Corporate policies are in effect that attempt to avoid potential conflicts of interest and resolve conflicts of interest that do arise in a timely fashion.

Mauldin Economics, LLC reserves the right to cancel any subscription at any time, and if it does so it will promptly refund to the subscriber the amount of the subscription payment previously received relating to the remaining subscription period. Cancellation of a subscription may result from any unauthorized use or reproduction or rebroadcast of any Mauldin Economics publication or website, any infringement or misappropriation of Mauldin Economics, LLC’s proprietary rights, or any other reason determined in the sole discretion of Mauldin Economics, LLC. Affiliate Notice Mauldin Economics has affiliate agreements in place that may include fee sharing. If you have a website or newsletter and would like to be considered for inclusion in the Mauldin Economics affiliate program, please go to http://affiliates.pubrm.net/signup/me. Likewise, from time to time Mauldin Economics may engage in affiliate programs offered by other companies, though corporate policy firmly dictates that such agreements will have no influence on any product or service recommendations, nor alter the pricing that would otherwise be available in absence of such an agreement. As always, it is important that you do your own due diligence before transacting any business with any firm, for any product or service. © Copyright 2017 Mauldin Economics | -- |