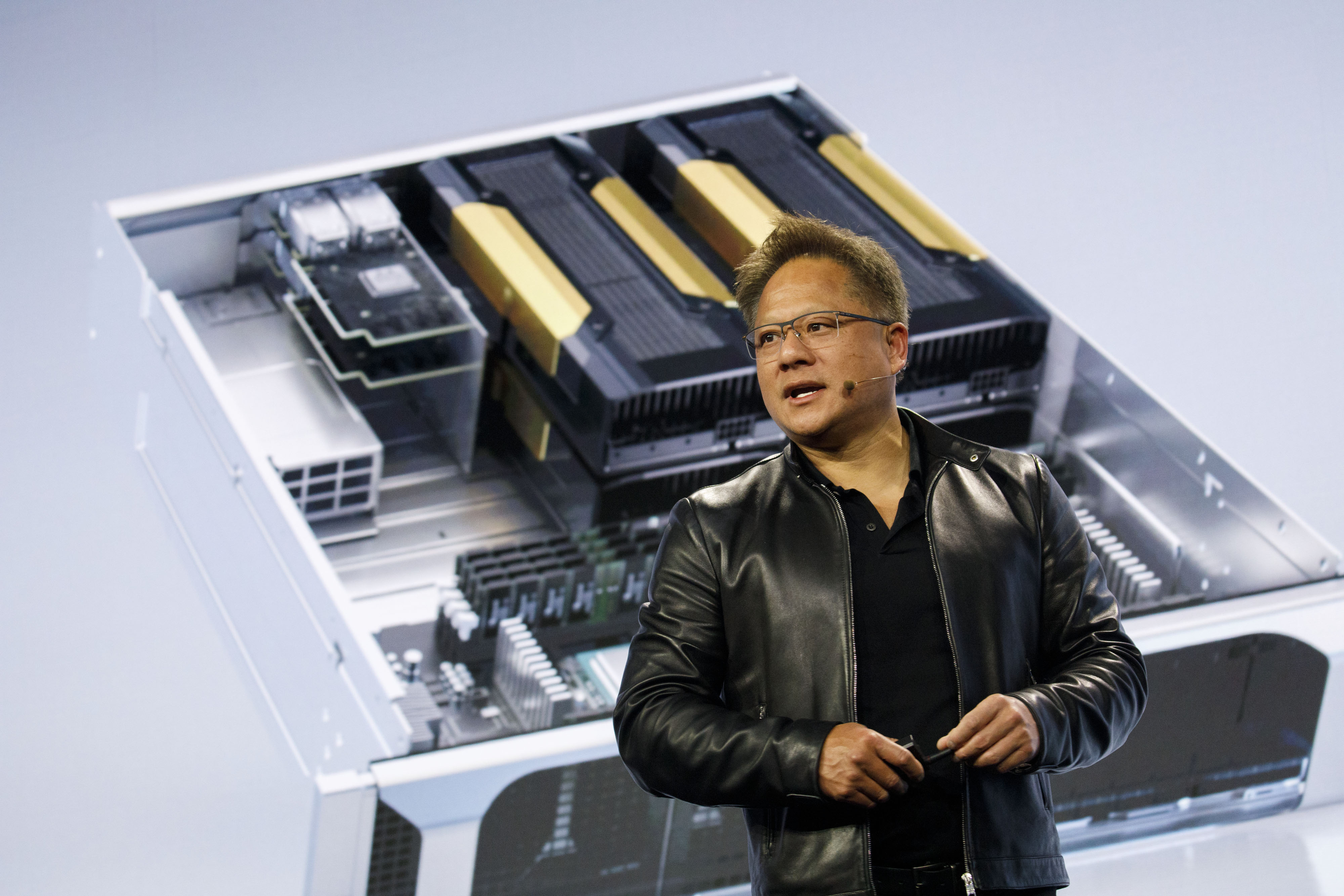

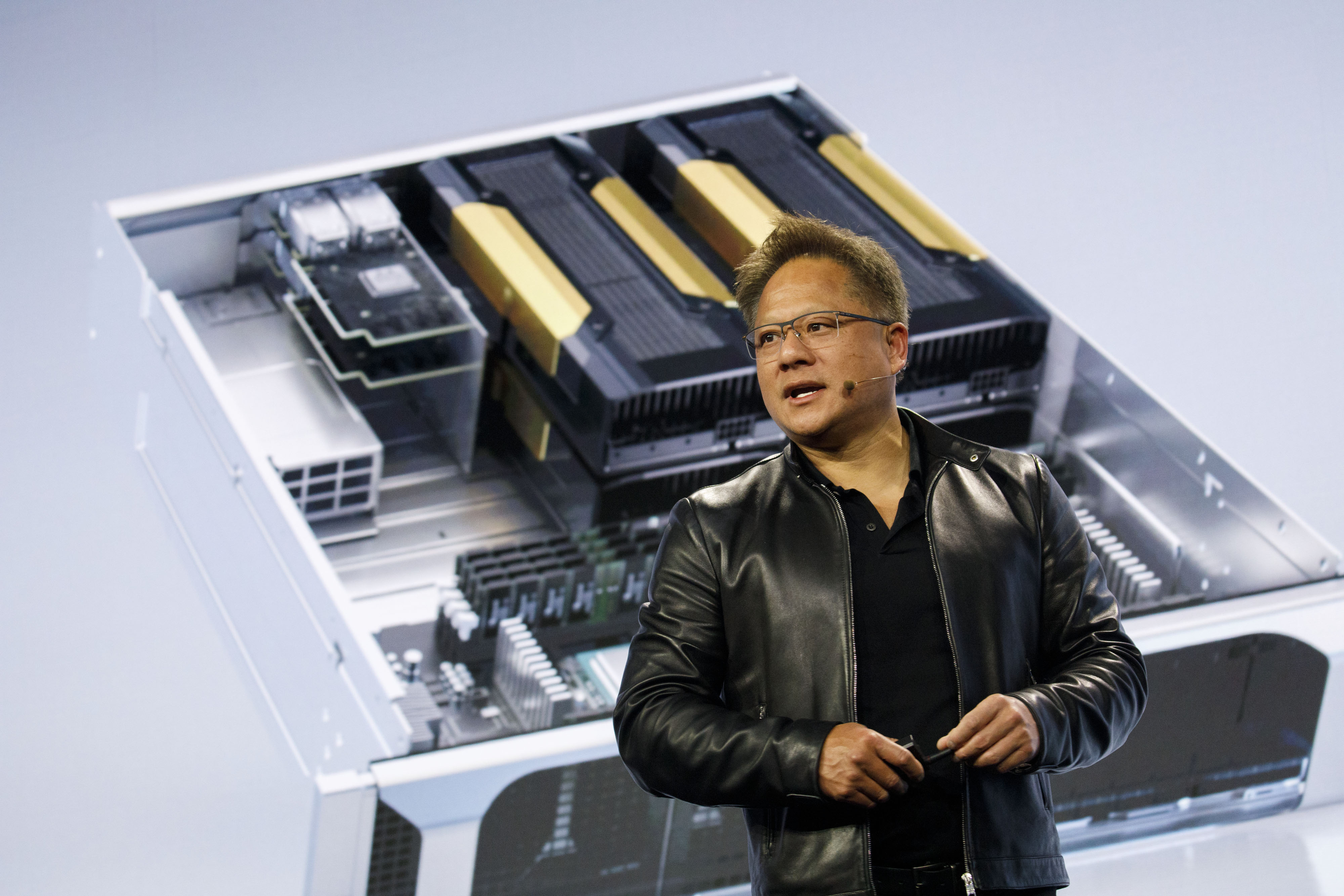

| The US Federal Reserve’s preferred inflation measures eased in December to the slowest annual pace in over a year while consumer spending fell, helping pave the way for policymakers to further scale back interest-rate hikes. The figures added to mounting evidence that the worst bout of inflation in a generation has passed as the Fed’s aggressive tightening campaign works its way through the economy. Officials are widely expected to once again slow the pace of rate hikes, to a quarter point next week, and will discuss how much higher they need to go to ensure prices are cooling for good. —David E. Rovella But as always, there’s bad news, too. Another key gauge of the health of the American economy is showing stress. There’s a growing cohort of Americans facing auto repossessions, often an ominous sign. During the pandemic, a surge in used car prices forced buyers to take out bigger loans for their vehicles. The monthly payments may have been more manageable amid lockdown bailout checks, a tight labor market and surging stocks. But that’s changing for many people as inflation, though cooling, eats into their budgets. Wall Street on Friday brushed off disappointing outlooks from big tech companies, as well as predictions that an earnings recession would overshadow Fed success on the inflation front. Here’s your markets wrap. Trees set ablaze in Brazil’s Amazon rainforest could be directly contributing to melting glaciers in the Himalayas and Antarctica because distant ecosystems that regulate the Earth’s climate are more closely connected than previously thought.  Clouds above mountain glaciers near the Leh district in Jamma and Kashmir, India. Snow cover is shrinking, glaciers are melting, the monsoon season changing and permafrost is at risk, all with drastic consequences for a region whose ice fields hold the largest freshwater reserves outside the poles. Photographer: Prashanth Vishwanathan/Bloomberg The selloff in Gautam Adani’s corporate empire accelerated on Friday, erasing more than $51 billion of market value in two sessions as Asia’s richest man struggles to contain the fallout from a scathing report by US short-seller Hindenburg Research. Peter Oppenheimer, chief global equity strategist at Goldman Sachs, says fears of a recession in Europe are fading. His team sees a “relatively” soft landing for the area’s economy due the decline in natural gas prices. “The recession that people feared six months ago is not happening,” he said. One of the biggest winners from the soaring popularity of the ChatGPT tool is a billionaire Taiwanese immigrant known for his black leather jackets and tattoo resembling the logo of Nvidia, the company he co-founded in 1993.  Jen-Hsun Huang Photographer: Patrick T. Fallon/Bloomberg The possibility that a coronavirus infection could damage your brain is terrifying, Faye Flam writes in Bloomberg Opinion. Scientists have established that long Covid often manifests itself with neurological changes—brain fog, memory problems and fatigue. Some researchers have found changes in the brain after even mild cases of the virus. Bloomberg continues to track the global coronavirus pandemic. Click here for daily updates. At last count, Mercedes-Benz offers 14 electric vehicles. They’re difficult to keep straight. Many of the variants in the EQS, EQE and EQB lines look and behave virtually identically. But after driving a number of them, here’s the one we would consider first: the Mercedes-AMG EQS sedan. With a reserved design that obscures stupefying speed, it presents the forefront of technology without compromising the indulgent standards we expect from the brand with roots back to 1886.  The 2023 Mercedes-AMG EQS electric sedan that starts at $147,500. Source: Mercedes-Benz Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive it in your mailbox daily along with our Weekend Reading edition on Saturdays. |