|

|

Today’s letter is brought to you by Consensus 2024!

Consensus 2024 is happening May 29-31 in Austin, Texas. This year marks the tenth annual Consensus, making it the largest and longest-running event dedicated to all sides of crypto, blockchain and Web3.

Don’t miss Bitcoin: We Are So Back, where Anthony Pompliano will discuss what the next bull market will look like, how it will differ from previous run-ups and the broad macro investment thesis for bitcoin and crypto more broadly.

Consensus has tailored programming for Bitcoin maxis and multi-chain mavericks alike, covering everything from post-halving strategies to mining and more.

Plus, you absolutely won’t want to miss the epic BTC (Nic Carter) vs ETH (David Hoffman) battle at Karate Combat.

That’s just a taste of what's to come at crypto’s only big-tent event. Join Consensus in Austin alongside 15,000+ investors, founders, brands and more to take in all that blockchain has to offer. Get your pass today and use code POMP to save 20%.

Can’t make it to Austin for Consensus 2024? Livestream from wherever you are with the Virtual Pass for $79. Available here.

To investors,

Another public company announced this morning that they are adopting bitcoin as their treasury reserve asset. Here is the opening of their press release:

“Semler Scientific, Inc. (Nasdaq: SMLR), a pioneer in developing and marketing technology products and services to healthcare providers to combat chronic diseases, announced today that its board of directors has adopted bitcoin as its primary treasury reserve asset. In addition, Semler Scientific announced that it has purchased 581 bitcoins for an aggregate amount of $40 million, inclusive of fees and expenses.”

Why would they do this? According to the Chairman of the company:

“Our bitcoin treasury strategy and purchase of bitcoin underscore our belief that bitcoin is a reliable store of value and a compelling investment. Bitcoin is now a major asset class with more than $1 trillion of market value. We believe it has unique characteristics as a scarce and finite asset that can serve as a reasonable inflation hedge and safe haven amid global instability. We also believe its digital, architectural resilience makes it preferable to gold, which has a market value of approximately 10 times that of bitcoin. Given the gap in value between gold and bitcoin, we believe that bitcoin has the potential to generate outsize returns as it gains increasing acceptance as digital gold.

Furthermore, we are energized by the growing global acceptance and 'institutionalization' of bitcoin -- reflected most recently by the Securities and Exchange Commission's January 2024 approval of 11 bitcoin exchange-traded funds. These funds have reported more than $13 billion of net inflows, with investments from nearly 1,000 institutions, including global banks, pensions, endowments and registered investment advisors. It is estimated that more than 10% of all bitcoins are now held by institutions.”

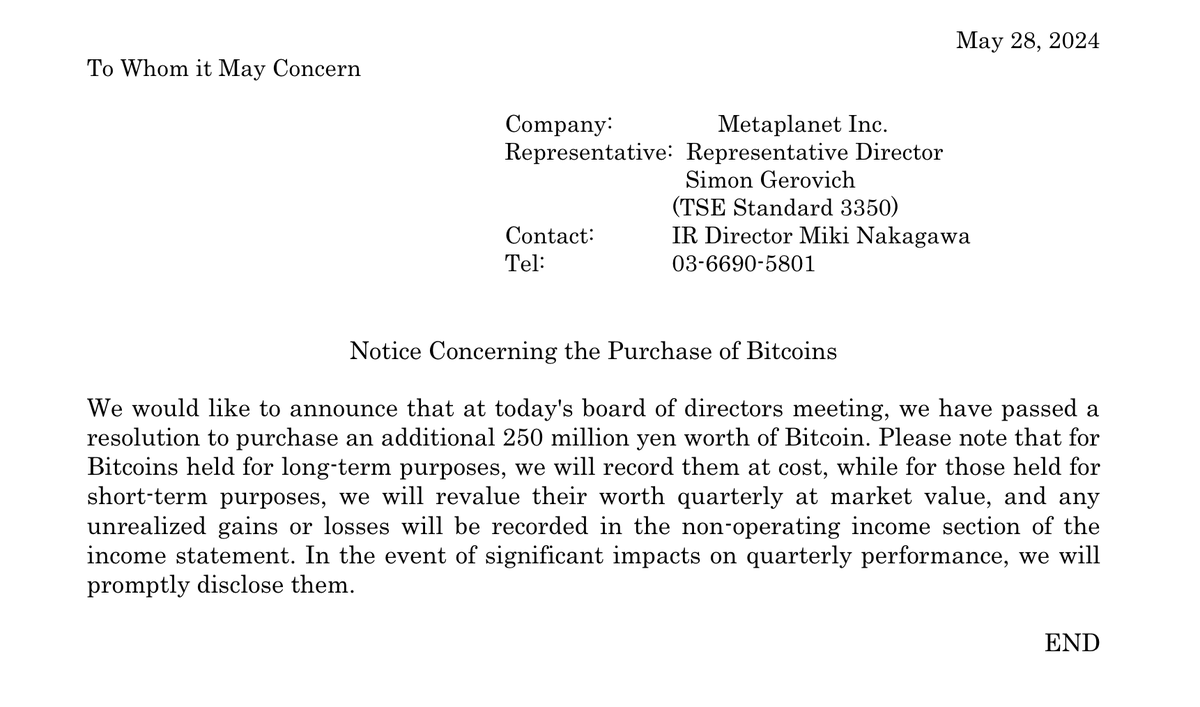

The Semler Scientific announcement comes on the same day that Metaplanet, a Japan-based company pursuing the Microstrategy bitcoin playbook, announced they received board approval to purchase more bitcoin for their balance sheet.

When one company does something, it is a dot. When two do something, it is a line. When three companies do something, it is a trend.

There are at least five publicly-traded non-crypto companies that I know of that are using bitcoin as a treasury asset. This is on top of the many crypto-related companies that are also holding bitcoin on their balance sheet.

I don’t anticipate that every company is going to put bitcoin on their balance sheet. But I do think we will see many more companies pursue the strategy in the coming months. Bitcoin has shown itself to be a superior asset to store value long-term.

The institutional adoption, coupled with the recent regulatory approval, is only going to green light even more executives to consider this option.

Bitcoin is the only asset in the world where retail investors were able to front-run the institutions and corporations. But the corporations are not going to watch this pass them by. Capitalism is an incredible system of incentives, so we know the outcome of actions by simply looking at the incentives that bitcoin provides — protect your hard-earned economic value over the long-term regardless of what the fiat currency debasement rate is.

There may be no greater pitch to corporate America. While everyone thought bitcoin was going to be a high-risk asset, it turned out to be the risk-mitigation tool for the suits.

What a beautiful thing to see. Hope you all have a great start to your week. I’ll talk to everyone tomorrow.

-Anthony Pompliano

Reader Note: Today is a free email available to everyone. If you would like to receive these letters each morning, please subscribe to become a paying member of The Pomp Letter by clicking here.

Jack Mallers is the Founder & CEO of Strike.

In this conversation, we talk about the macro environment, the edge case, use case, investment case for bitcoin, bitcoin vs shitcoins, politics, regulation, and why he believes Wall Street will capitulate and all become bitcoiners.

Listen on iTunes: Click here

Listen on Spotify: Click here

Strike CEO Jack Mallers on Bitcoin, Macro Environment, and Altcoins

Podcast Sponsors

Consensusis the largest event dedicated to all sides of crypto, blockchain and Web3. Use code POMP to get 20% off your pass and join me in Austin this May 29th-31st

Meanwhile is the world’s first licensed and regulated life insurance company built for the Bitcoin economy.

iTrustCapital allows you to buy and sell cryptocurrency in a tax-advantaged crypto IRA.

Supra- Join Supra’s early integration program for zero-cost access to the fastest oracles and dVRF across 50+ blockchains.

Propy - Now, anyone can start their on-chain journey by minting home addresses via PropyKeys and staking them for profit until they are ready to sell their home.

BetOnline - Use crypto to bet on sports, casino games, horse racing, poker and more with promo code POMP100.

Espresso Displays - The world's thinnest touchscreen portable monitor. Expand your workspace and work from anywhere.

ResiClub - Your data-driven gateway to the US housing market.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.