|

|

Correction! Duffy is up 85.99%, not 43.9%

And China allocation is 15% not 13% in Kevin's Coffee Can Model Portfolio

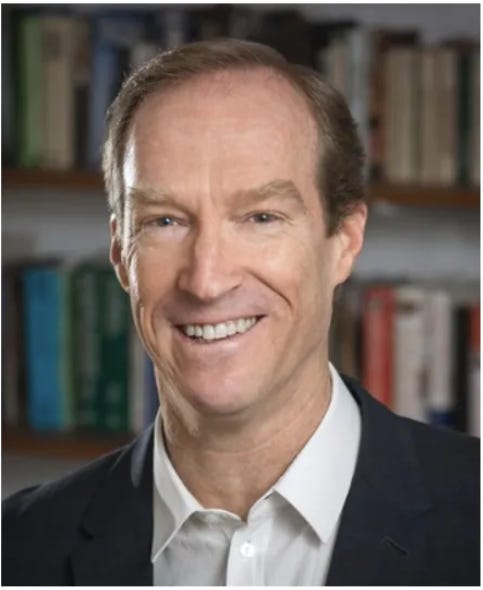

Yesterday in my haste to meet my podcast deadline I hurriedly glanced at the performance chart shown below and erroneously stated that I reported Kevin Duffy’s Coffee Can Portfolio increasing by 43.9%. The actual gain in that portfolio since inception date of Feb. 18, 2020 to December 31, 2024 was 85.99%.

While that’s not quite as good as the 92.89% gain for the S&P 500 during that same time, Duffy’s portfolio was not fueled by the powerful impact passive investing has had on the S&P 500 as it drove the “magnificent seven” shares into nose bleed heights.

Moreover, given the contrarian value added approach applied by Kevin, it is my belief his very diverse portfolio carries far less risk than the S&P 500 which is dominated by a handful massively overvalued stocks.

I also stand corrected on the Coffee Can Portfolio allocation to China. Kevin informed me it s 15% rather than the 13% I incorrectly stated.

Kevin’s unique approach to investing has been remarkably successful. With the Bearing Fund’s success during the 2008 Financial Crisis, now may be a great time to consider subscribing to The Coffee Can newsletter. Kevin provides six issues during the year, each of which are chock full of valuable and very interesting information. The subscription price is a very reasonable US$109 per year. Subscribe here: The Coffee Can Portfolio

My apologies to Kevin for my egregious error but at least that has given me a second chance to plug his excellent service.

Best wishes,

Jay Taylor

You're currently a free subscriber to J Taylor's Gold Energy & Tech Stocks. For the full experience, upgrade your subscription.